How Can ISO 27001 Help in the Fintech Sector

Understanding ISO 27001 and Its Significance in Fintech

ISO 27001 is a globally recognised standard for managing information security, providing a systematic approach to managing sensitive company information to ensure it remains secure. This standard is particularly critical for fintech companies due to their handling of vast amounts of sensitive financial data. Compliance with ISO 27001 not only enhances data security but also strengthens compliance with various global financial regulations. By adhering to Clause 6 – Planning and Requirement 6.1.1, we address risks and opportunities crucial for handling sensitive data, ensuring our ISMS can achieve its intended outcomes.

Enhancing Data Security and Compliance in Fintech

Implementing ISO 27001 in fintech operations significantly boosts data security by establishing robust risk management processes and setting a framework for data protection that aligns with international best practices. This standard mandates regular risk assessments, which help fintech companies identify vulnerabilities and implement appropriate security measures to mitigate these risks. By integrating Requirement 6.1.2 and Annex A Control A.5.7, our platform supports the proactive identification and management of information security threats, enhancing risk assessment processes.

Primary Objectives of ISO 27001 in Fintech Operations

The primary objectives of ISO 27001 in fintech include safeguarding data integrity, ensuring data availability, and maintaining confidentiality. By achieving these objectives, fintech companies can protect themselves against data breaches and cyber threats, which are increasingly common in the financial sector. According to IBM’s Cost of a Data Breach Report 2020, the average cost of a data breach in the financial sector is approximately $5.85 million, highlighting the importance of effective risk management strategies provided by ISO 27001. By implementing Annex A Control A.5.12 and A.5.13, our platform ensures that information is classified and labelled to protect data integrity and confidentiality.

Integration with Other Compliance Standards Relevant to Fintech

ISO 27001 not only stands alone as a security standard but also complements other compliance requirements such as GDPR, SOC 2, and PCI DSS. This integration is crucial for fintech companies operating across different jurisdictions, as compliance with ISO 27001 aligns with over 20 global regulations. This harmonisation helps streamline compliance processes, making it easier for companies to meet multiple regulatory requirements simultaneously. By aligning with Clause 4 and Requirement 4.2, our platform helps you consider external and internal issues that affect your ability to achieve the intended outcomes of your ISMS, including compliance with various regulations, essential for fintech companies to align their ISMS with other compliance standards and regulatory requirements.

Book a demoUnderstanding the Scope of ISO 27001 for Fintech

What Does the Scope of ISO 27001 Cover in the Context of Fintech?

ISO 27001 is pivotal for fintech companies as it outlines a comprehensive framework for managing and protecting sensitive financial data. The scope of ISO 27001 in fintech encompasses all aspects of information security management, including:

- Risk assessment (Requirement 6.1.1)

- Data protection

- Incident management

It ensures that fintech companies have robust systems to safeguard customer information and maintain data integrity. This aligns with Clause 4.3, which emphasises the importance of defining the scope of the ISMS to ensure all relevant data and processes are included.

Defining the Boundaries of an ISMS in Fintech Companies

For fintech companies, defining the boundaries of their Information Security Management System (ISMS) is crucial. This involves:

- Identifying the data that needs protection

- The processes that handle this data

- The technologies supporting these processes

Clear boundaries help in focusing security efforts where they are most needed, ensuring comprehensive data protection. This directly relates to Clause 4.3, ensuring all critical elements are covered, and is supported by Annex A Control A.8.1, which aids in the identification of data and assets within the defined ISMS boundaries.

Implications of Not Clearly Defining the ISMS Scope in Fintech

Failing to clearly define the ISMS scope can lead to significant security gaps. Without clear boundaries, certain data assets or processes might be left unprotected, exposing them to cyber threats and compliance risks. This oversight can result in:

- Data breaches

- Financial losses

- Severe reputational damage

This emphasises the necessity for meticulous scope definition. Clause 4.3 highlights the risks of inadequate scope definition, and Annex A Control A.8.1 underscores the importance of comprehensive asset identification to avoid unprotected data assets.

How ISMS.online Assists in Defining and Managing the ISMS Scope Effectively

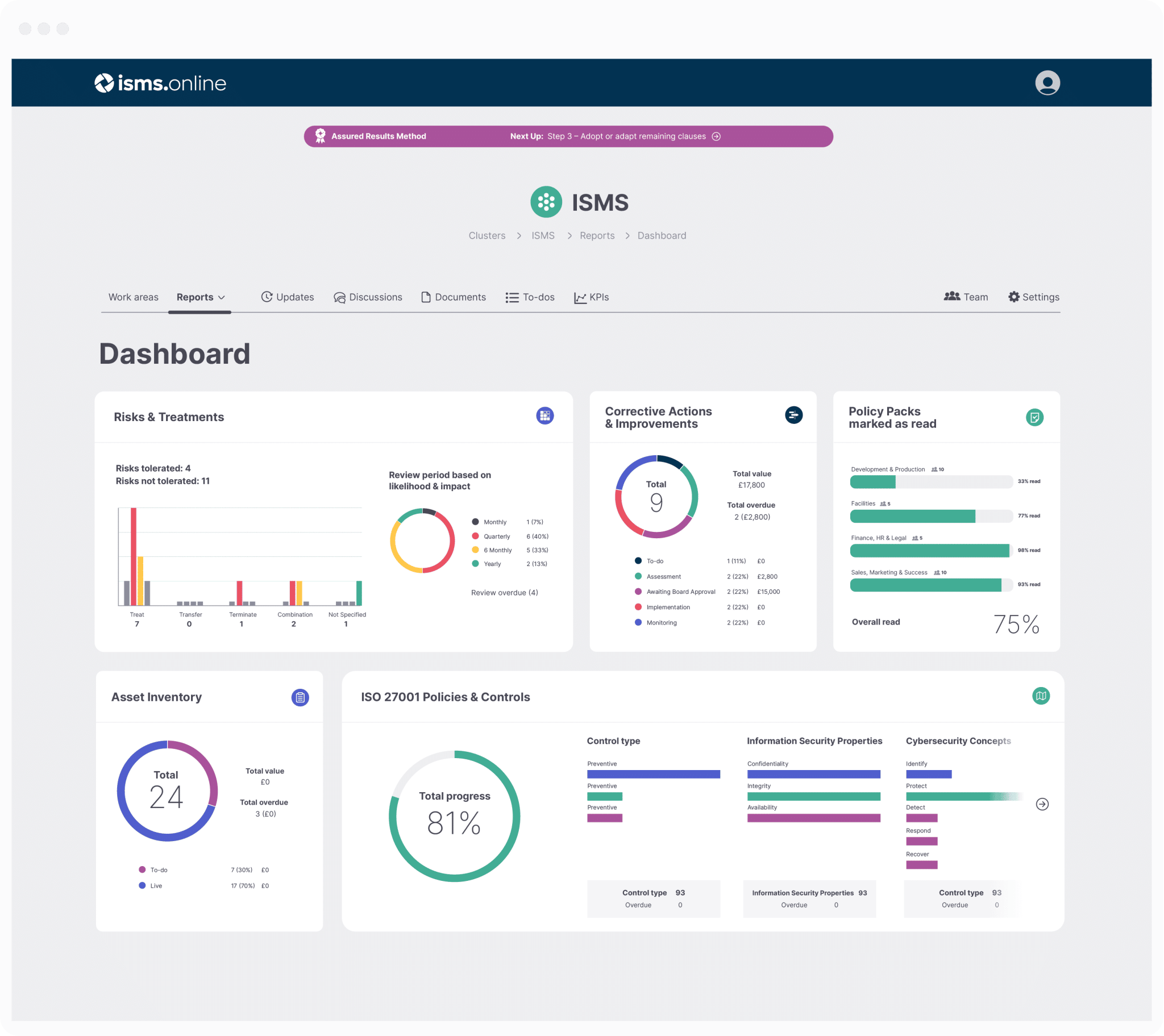

Our platform, ISMS.online, simplifies the process of defining and managing your ISMS scope. By providing tools for risk assessment and compliance management, we help you identify and document the critical elements of your ISMS. Features like automated workflows and centralised documentation reduce the time spent on compliance management by up to 70%, enhancing your efficiency and accuracy in establishing a robust ISMS. These features support the effective definition and management of the ISMS scope as outlined in Clause 4.3, align with the Requirement 6.1.1 to address risks within the ISMS scope, and facilitate the identification and documentation of assets crucial for defining the ISMS scope as per Annex A Control A.8.1.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Risk Assessment and Treatment in Fintech

Guiding Risk Assessment Processes in Fintech Companies

Under ISO 27001:2022, particularly within Clause 6 – Planning, the standards Requirement 6.1.1 – General and Requirement 6.1.2 – Information security risk assessment provide a structured framework essential for fintech companies. This framework mandates the identification, analysis, and evaluation of information security risks, tailored to the specific contexts of fintech operations. It includes assessing threats to digital assets, financial data, and customer information, ensuring comprehensive risk management. Our platform, ISMS.online, enhances this process by:

- Automating and streamlining risk assessments

- Ensuring assessments are consistent and repeatable

Common Cybersecurity Risks in the Fintech Sector

The fintech sector faces unique vulnerabilities to cybersecurity risks such as data breaches, financial fraud, and system outages. These risks are exacerbated by the high volume of transactions and the sensitive nature of financial data. Requirement 6.1.2 emphasises the need for consistent, valid, and comparable risk assessments, highlighting the complexity of managing these risks effectively. Our platform addresses these challenges by providing:

- Clear, structured risk management strategies

- Simplified compliance with ISO 27001:2022 standards

Prioritising and Treating Risks Under ISO 27001

In alignment with Requirement 6.1.3 – Information security risk treatment, fintech companies prioritise risks based on their potential impact and likelihood. This prioritisation assists in applying appropriate controls as outlined in Annex A of ISO 27001:2022. Key controls to mitigate the impact of data breaches include:

- Annex A Control A.5.15 – Access control

- Annex A Control A.5.17 – Authentication information

Our platform facilitates the application of these controls, ensuring robust security measures are in place.

Streamlining Risk Assessment and Treatment with ISMS.online

Our platform, ISMS.online, simplifies the risk assessment and treatment process for fintech companies by providing tools that:

- Automate these assessments, aligning with Requirement 6.1.2

- Facilitate the documentation and management of compliance activities

Fintech companies allocate an average of 7% of their IT budget to compliance-related activities. The integration of tools and resources in our platform helps in maintaining a robust information security management system that aligns with Clause 6 – Planning and Requirement 6.1.3 of ISO 27001:2022, enhancing overall compliance and security posture.

ISO 27001 Requirements and Controls Specific to Fintech

Pertinent ISO 27001 Requirements for Fintech

For fintech companies, adhering to specific ISO 27001:2022 requirements is crucial due to the sensitive nature of financial data. Key requirements include:

- Risk Assessment and Treatment (Clause 6.1): Ensures that fintech firms maintain robust defences against data breaches.

- Information Security Policies (Clause 5.2): Establishes policies that govern the management of information security.

- Incident Management (Clause 8.1): Facilitates efficient incident response and management.

These provisions are essential as data breaches in the fintech sector have surged by 27% in the last year, highlighting the sector’s growing exposure to cyber threats as it expands. Our ISMS.online platform supports these requirements through features like:

- Risk Management: Helps in identifying and treating risks effectively.

- Incident Management: Facilitates efficient incident response and management.

Application of Annex A Controls in Fintech Scenarios

Annex A of ISO 27001:2022 provides a comprehensive set of controls that are particularly applicable to fintech scenarios. Key controls include:

- A.8.2 (Privileged Access Rights): Vital for protecting data integrity and confidentiality in financial transactions.

- A.8.24 (Use of Cryptography): Essential for safeguarding sensitive customer information and complying with stringent regulatory requirements.

Our platform enhances these controls with features like:

- Access Control: Manages and enforces privileged access rights.

- Cryptography Management: Supports the secure use of cryptographic techniques.

Challenges in Implementing ISO 27001 Controls

Fintech companies often face challenges in implementing ISO 27001:2022 controls due to:

- Rapid Technological Changes: The fast pace of innovation in fintech can complicate the integration of new technologies with established security protocols.

- Complexity of Legacy Systems: Integrating modern security protocols with older systems can be challenging.

The dynamic nature of fintech, with its continuous innovation, requires adaptive security measures that can sometimes be at odds with the structured approach of ISO 27001:2022. Our platform addresses these challenges by offering flexible and customizable features that adapt to your evolving security needs, ensuring that you remain compliant with ISO 27001:2022 standards.

Enhancing Operational Security Through Compliance

Compliance with ISO 27001:2022 controls significantly enhances operational security in fintech firms. It not only helps in mitigating risks but also boosts customer confidence and meets regulatory expectations. With the fintech sector projected to reach a market value of $324 billion by 2026, robust information security management is imperative for sustainable growth in this high-stakes industry. By leveraging our ISMS.online platform, you can streamline your compliance processes, enhance your security posture, and build trust with your customers and stakeholders.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Implementing ISO 27001 – A Step-by-Step Guide for Fintech

Initial Steps in Setting Up an ISMS for a Fintech Company

Embarking on the journey to establish an Information Security Management System (ISMS) for your fintech company starts with a thorough understanding of ISO 27001, particularly focusing on Clauses 4 and 5 which delve into the context of the organisation and its leadership. It’s crucial to define the ISMS’s scope, assess existing security measures, and identify all information assets. At ISMS.online, we provide you with structured templates and tools that assist in documenting these essential elements, ensuring a solid foundation for your ISMS.

Key Requirements:

- Requirement 4.1 – Understanding the organisation and its context: This involves identifying both internal and external issues that could influence the achievement of the ISMS’s intended outcomes.

- Requirement 5.1 – Leadership and commitment: This emphasises the need for leadership involvement and the establishment of an information security policy.

Facilitating Employee Involvement in the ISO 27001 Process

The effectiveness of ISO 27001 implementation significantly depends on employee involvement. We suggest starting this process by offering comprehensive training and clear communication about the importance of information security. Our platform enhances this engagement through features like role-based access and task assignments, making it easier for you to involve employees in maintaining the ISMS and ensuring they understand their responsibilities.

Critical Competencies and Awareness:

- Requirement 7.2 – Competence: It’s essential to identify the necessary competencies for personnel involved in ISMS-related tasks and ensure these through education and training.

- Requirement 7.3 – Awareness: Employees must be aware of the information security policy and understand their role in the effectiveness of the ISMS.

Stages of ISO 27001 Implementation from Planning to Execution

Implementing ISO 27001 unfolds through several stages, starting with a comprehensive risk assessment (Requirement 6.1.1) to pinpoint potential security threats and vulnerabilities. Following this, you will need to design and implement controls (Annex A) to mitigate these risks. The process adheres to a cycle of planning, doing, checking, and acting, which is fundamental to the continual improvement principle of ISO 27001. Our platform, ISMS.online, supports each stage with dynamic risk assessment tools and real-time monitoring dashboards.

Implementation Stages:

- Requirement 6.1.1 – General: This stage involves a detailed risk assessment process and planning actions to address these risks.

- Annex A – Reference control objectives and controls: Based on the risk assessment, specific controls are selected to mitigate identified risks.

How ISMS.online Facilitates Each Step of the ISO 27001 Implementation Process

Our platform is meticulously designed to streamline every step of your ISO 27001 implementation. From the initial setup, where you define the scope and policy (Requirement 5.2), to risk management and the application of controls (Annex A), ISMS.online provides an integrated suite of tools. Features such as automated workflows, centralised documentation, and compliance tracking not only facilitate the implementation process but also support ongoing compliance, which is critical in a sector where insider threats account for a significant percentage of breaches.

Platform Features and Benefits:

- Requirement 5.2 – Policy: This establishes that the organisation must have an information security policy that includes a commitment to satisfy applicable requirements and to continual improvement.

- Annex A – Reference control objectives and controls: Our platform aids in effectively applying the appropriate controls from Annex A, ensuring compliance and resilience against threats.

With the financial sector experiencing a notable increase in ransomware attacks, the robust framework provided by ISO 27001 is more crucial than ever. ISMS.online ensures that you are not only compliant but also resilient against evolving cyber threats.

Training and Awareness Programmes for Fintech Staff

Importance of Training and Awareness in ISO 27001 Implementation

Training and awareness are crucial in the successful implementation of ISO 27001, particularly in the fintech sector where sensitive financial data is routinely handled. Educating your staff not only enhances their understanding of compliance requirements but also equips them to effectively handle security threats. Non-compliance with regulations like GDPR can result in fines up to 4% of annual global turnover, highlighting the financial imperative for rigorous training. Our platform, ISMS.online, supports Requirement 7.2 – Competence by ensuring that employees are competent in their roles that affect information security performance. Additionally, Requirement 7.3 – Awareness is addressed as our training programmes are a key method of promoting awareness of the information security policy and their contributions to its effectiveness.

Key Topics for Security Training in Fintech

For fintech employees, training should cover key topics such as:

- Data protection

- Risk management

- Incident response

- Secure handling of customer information

- Legal aspects of fintech operations, including compliance with GDPR and other financial regulations

This comprehensive approach ensures employees are well-prepared to contribute to your organisation’s information security framework. Our platform enhances this training by aligning with Annex A Control A.5.4, supporting the need for regular training on information security, tailored to the roles of the employees within the organisation.

Frequency of Training and Awareness Sessions

To keep pace with the rapidly evolving threat landscape in fintech, we recommend conducting training and awareness sessions at least bi-annually. Regular updates are crucial as they help reinforce security practices and inform staff of the latest cybersecurity threats and mitigation strategies. Cisco’s 2020 Benchmark Study highlights that regular cybersecurity training can reduce compliance-related incidents by up to 70%. By maintaining and improving awareness among employees through regular training sessions, our platform effectively supports Requirement 7.3 – Awareness, which is essential for the effectiveness of the ISMS.

Role of ISMS.online in Facilitating Ongoing Training and Awareness

Our platform, ISMS.online, simplifies the management and delivery of training programmes. With features that allow you to schedule, track, and manage training sessions, you can ensure all employees receive the necessary education on ISO 27001 and its application within the fintech sector. Additionally, our platform provides resources and materials that can be used to enhance the training experience, making it engaging and informative for all participants. We help manage and document training programmes, crucial for demonstrating compliance and the effectiveness of the ISMS, aligning with Requirement 7.5.1 – Documented information – General. Furthermore, our platform’s features ensure that information related to training sessions is controlled and maintained as per Requirement 7.5.3 – Control of documented information, supporting the integrity and availability of training records.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Monitoring and Reviewing the ISMS in Fintech

At ISMS.online, we understand the importance of continuous monitoring and review to maintain a robust Information Security Management System (ISMS) in the dynamic fintech sector. Our platform offers comprehensive tools that track compliance with ISO 27001 standards and assess the effectiveness of implemented controls, aligning with Requirement 9.1. Custom alerts for deviations from set thresholds ensure you are always informed of potential security issues, enabling proactive management of your ISMS.

Key Metrics and Indicators for ISMS Performance Evaluation

Effective Performance Evaluation

For an effective evaluation of ISMS performance, several key metrics are essential:

- Incident Response Times: How quickly your team responds to security incidents.

- User Compliance Rates: The percentage of your users following security policies.

- Audit Findings: The results from periodic ISMS audits.

These indicators are crucial for fintech companies to measure the effectiveness of their security practices and make informed decisions about necessary improvements. A Deloitte survey highlighted that 92% of companies observed an improvement in their security posture after implementing ISO 27001, emphasising the importance of these metrics. Our platform’s alignment with Requirement 9.1 ensures you have the necessary tools to monitor, measure, analyse, and evaluate these key performance indicators effectively.

Ensuring Continual Improvement in Fintech ISMS

Continuous Adaptation and Enhancement

Continual improvement is a fundamental aspect of ISO 27001, as outlined in Requirement 10.1, and is achieved through:

- Regular Audits: Ensuring compliance and identifying areas for improvement.

- Frequent Reviews: Assessing the applicability and effectiveness of the ISMS.

- Updates to Policies and Controls: Adapting to new threats and technologies.

Our platform supports these activities by enabling easy updates to security policies and controls. Continuous reassessment and adaptation to ISO 27001 standards can significantly reduce the time to respond to new threats, fostering a proactive security culture. Our platform ensures that all changes and improvements are documented in compliance with ISO 27001 requirements, making audit processes smoother and more efficient.

Features of ISMS.online That Enhance Monitoring and Continuous Improvement

Tools for Effective ISMS Management

ISMS.online provides several features that are essential for maintaining an up-to-date and effective ISMS:

- Real-Time Dashboards: Offering an at-a-glance view of your ISMS’s current state.

- Comprehensive Reporting Tools: Detailed reports that help in making data-driven decisions.

- Automated Reminders for Review Cycles: Ensuring that reviews are conducted at appropriate intervals.

These tools support fintech companies in their ongoing management review processes as required by Requirement 9.3, ensuring that top management can regularly review the ISMS’s continuing suitability, adequacy, and effectiveness. Our platform’s robust documentation capabilities ensure that all changes and improvements are recorded, streamlining compliance and audit activities.

Further Reading

Handling Security Incidents and Improvements in Fintech

Essential Procedures for Managing Security Incidents in Fintech

Fintech companies must establish robust incident management procedures to swiftly address security breaches. This involves immediate incident identification, classification, and response. The ISO 27001:2022 standard, specifically Clause 8 – Operation and Annex A Control A.5.24 – Information security incident management planning and preparation, guides the establishment of an incident response team, the preparation of response plans, and the communication protocols during and after an incident. Our platform, ISMS.online, streamlines these processes by providing templates and automated workflows that ensure quick and coordinated responses, ensuring compliance with Requirement 8 and A.5.24.

ISO 27001’s Guidance on Post-Incident Improvement Processes

After an incident, ISO 27001:2022 emphasises the need for a thorough investigation to identify the root causes and to prevent recurrence. This includes revising risk assessments and refining the ISMS based on lessons learned, aligning with Clause 10 – Improvement and Annex A Control A.5.27 – Learning from information security incidents. Our platform facilitates this continuous improvement cycle by enabling easy updates to your ISMS documentation and ensuring that all changes are tracked and managed effectively, in line with Requirement 10 and A.5.27.

Common Incidents in Fintech and Remediation Steps

Common security incidents in fintech include data breaches, phishing attacks, and unauthorised access. Remediation steps involve:

- Immediate isolation of affected systems

- Eradication of threats

- Recovery of operations

For instance, if a data breach occurs, the immediate step is to contain the breach and assess the impact, followed by notifying affected customers and regulatory bodies, as mandated by Annex A Control A.5.26 – Response to information security incidents and relevant data protection regulations like GDPR. Our platform supports these actions through features that manage incident response and notifications efficiently, ensuring adherence to A.5.26.

Enhancing Incident Management with ISMS.online

ISMS.online enhances your incident management capabilities by providing a centralised platform where you can manage all aspects of an incident from detection to closure. Features include:

- Real-time alerts

- Detailed incident logs

- Comprehensive reporting tools

These help you maintain an audit trail and ensure compliance with Clause 9 – Performance evaluation and Annex A Control A.5.25 – Assessment and decision on information security events. Additionally, our platform’s collaborative environment allows your team to coordinate effectively, ensuring that incident response and improvements are handled efficiently, in compliance with Requirement 9 and A.5.25.

ISO 27001 Audit Preparation for Fintech Companies

Understanding the ISO 27001 Audit Process for Fintech

An ISO 27001 audit for a fintech company involves a comprehensive review of the Information Security Management System (ISMS) to ensure compliance with the standard’s requirements. This includes Clause 9, which emphasises the need for monitoring, measurement, analysis, and evaluation of the ISMS to ensure its effectiveness. The audit assesses various aspects such as risk management procedures, security policies, and the effectiveness of implemented controls. These align with Annex A Control A.5.1, which mandates the establishment of organisation-wide policies for information security. Given the sensitive nature of financial data, the audit also scrutinises compliance with relevant financial regulations and data protection laws, ensuring that information is classified and labelled correctly as per Annex A Control A.5.13.

Preparing for Compliance Audits in Fintech

To prepare for an ISO 27001 audit, fintech companies should conduct internal reviews and pre-audit assessments. This includes ensuring all documentation is up-to-date and reflects current practices, conducting staff interviews to verify awareness and competence as required by Requirement 7.2, and reviewing past audit findings to address any unresolved issues. Regular internal audits and management reviews, supported by Clause 9.3, are crucial to maintain continual compliance and readiness for external audits. This ensures that top management is actively involved in assessing and improving the ISMS.

Common Pitfalls in ISO 27001 Audits and Avoidance Strategies

Common pitfalls during ISO 27001 audits include inadequate risk assessments, poor documentation, and insufficient evidence of continual improvement. To avoid these, ensure that your risk management process is thorough and includes all relevant assets and vulnerabilities, aligning with Requirement 6.1.2 which calls for consistent and comprehensive risk assessments. Maintain comprehensive documentation of all ISMS activities, and implement a structured process for updating and reviewing the ISMS regularly. This addresses unresolved issues from past audits and documents corrective actions as emphasised by Requirement 10.2.

Streamlining Audit Preparation with ISMS.online

Our platform, ISMS.online, significantly streamlines the audit preparation process by providing integrated tools for risk management, documentation, and compliance tracking. With features like automated workflows, pre-built policy templates, and easy reporting, our platform helps you maintain an audit-ready posture at all times. By centralising all ISMS activities on our platform, you can ensure consistency and completeness in your audit preparations, making the process more efficient and less prone to errors. Utilising pre-built policy templates from ISMS.online helps ensure that security policies are up-to-date and compliant with Annex A Control A.5.1, while the platform’s user management features support Annex A Control A.5.16 by facilitating the management of user identities and access rights, crucial for maintaining information security.

Integrating ISO 27001 with Other Compliance Standards

Benefits of Integrating ISO 27001 with GDPR and PCI DSS

Integrating ISO 27001 with GDPR and PCI DSS offers significant advantages for fintech companies. This strategic alignment enhances data protection frameworks, ensuring comprehensive coverage of both customer data privacy and payment security. By adhering to ISO 27001, which aligns with over 20 global regulations, the complex landscape of regulatory requirements is simplified. This unified approach aids in managing sensitive financial data and reduces the risk of costly data breaches. Our platform leverages specific controls like Requirement 6.1.3 and A.5.32 to ensure comprehensive consideration of all necessary controls, safeguarding data as mandated by GDPR and securing payment processing as required by PCI DSS.

Challenges of Managing Multiple Compliance Standards

Managing multiple compliance standards introduces significant challenges, primarily due to the diverse requirements and frequent updates across different frameworks. Fintech companies often struggle with resource allocation and maintaining up-to-date compliance with all standards. This complexity is magnified in international operations, where local regulations also come into play, necessitating a dynamic approach to compliance management. Our platform addresses these challenges by emphasising Requirement 4.1 and Requirement 6.1.1, which highlight the importance of identifying both external and internal issues that can impact the ability to achieve the intended outcomes of an ISMS, including adherence to multiple standards. This is particularly crucial for fintech companies with international reach.

Leveraging ISO 27001 to Simplify Compliance

ISO 27001 serves as a foundational framework for simplifying compliance with other regulations. Its comprehensive risk management framework and security controls provide a base that can be expanded to meet the specific requirements of GDPR, PCI DSS, and other financial regulations. By establishing a robust ISMS, fintech companies can adopt a proactive stance towards compliance, which facilitates easier adaptation to regulatory changes. Utilising Requirement 6.2 enables fintech companies to set and achieve security objectives that align with GDPR and PCI DSS, ensuring ongoing compliance as regulations evolve. Additionally, A.5.24 supports this proactive approach by ensuring that plans are in place to manage incidents, which is critical for compliance with GDPR’s breach notification requirements.

Tools Provided by ISMS.online to Manage Multiple Compliance Frameworks

At ISMS.online, we offer tools specifically designed to manage multiple compliance frameworks efficiently. Our platform features integrated risk assessments, policy management, and compliance tracking that align with ISO 27001 and can be tailored to support GDPR, PCI DSS, and other standards. These tools enable a streamlined approach to compliance, ensuring that fintech companies can maintain a comprehensive and compliant security posture across all regulatory requirements. Requirement 7.5.1 supports our platform’s role as a centralised repository for all documented information required by the standard and deemed necessary by the organisation. Moreover, A.5.1 enhances our policy management features, helping to establish, review, and communicate security policies that are crucial for maintaining compliance with multiple standards.

Global Trends and Future Directions in Fintech Security

Emerging Trends in Cybersecurity Impacting Fintech

The fintech sector is rapidly advancing its cybersecurity measures to address increasing threats. Notable trends include:

- Adoption of Artificial Intelligence (AI): AI is increasingly used for predictive threat analysis and automated risk management, enhancing the proactive capabilities of cybersecurity frameworks. This aligns with Annex A Control A.5.7 for threat intelligence.

- Integration of Blockchain Technology: Blockchain is being adopted for its decentralised security features, which significantly reduce fraud and enhance transaction security. This supports Annex A Control A.5.8, ensuring that information security is considered in project management processes.

Evolution of ISO 27001 in Addressing Fintech Security Challenges

ISO 27001 is adapting to meet the unique security challenges in the fintech sector by incorporating adaptive risk management approaches suitable for dynamic environments. Key updates include:

- Emphasis on Cloud Security: Reflecting the shift towards digital and mobile banking solutions, the standard now places a greater focus on cloud security and data privacy.

- Mobile Security Enhancements: Updates also prioritise mobile security, acknowledging the growing reliance on mobile platforms.

Our platform, ISMS.online, is designed to support these updates, providing tools that help you maintain compliance with the latest ISO 27001 requirements, particularly under Clause 6 for planning and Annex A Control A.5.23 for managing risks associated with cloud services.

Future Technologies Shaping Fintech Security

Emerging technologies are set to transform fintech security:

- Quantum Computing and Advanced Encryption: These technologies are expected to significantly enhance encryption standards used in financial transactions and data storage, potentially making data breaches obsolete.

- Adoption and Integration: Fintech companies must integrate these technologies to ensure their security measures remain robust.

These advancements are particularly relevant to Annex A Control A.8.24, which focuses on the protection of information through cryptographic means.

Adapting ISMS to Future Trends and Technologies

To stay ahead, fintech companies should focus on flexibility and scalability in their Information Security Management Systems (ISMS):

- Ensuring Scalability: Our platform, ISMS.online, allows you to seamlessly update and scale your ISMS, ensuring robust protection against future challenges.

This approach is in line with Clause 4.4 for the continual improvement of the ISMS and Annex A Control A.5.8 for maintaining security considerations during updates and scaling.

ISMS.online Can Help You Achieve Compliance

Achieving ISO 27001 Certification with ISMS.online

At ISMS.online, we understand the complexities involved in securing ISO 27001 certification, especially within the fintech sector. Our platform is designed to simplify this process by providing comprehensive tools and resources that comply with ISO 27001 standards. From initial risk assessment to continuous enhancement, our system guides you through each phase, ensuring thorough coverage. By enhancing Requirement 6.1 and Requirement 9.1, ISMS.online helps fintech companies identify and address risks and opportunities, ensuring the ISMS achieves its intended outcomes. Additionally, it supports the monitoring, measurement, analysis, and evaluation of the ISMS, confirming its effectiveness and compliance with ISO 27001 standards.

Continuous ISMS Management Support

Maintaining an ISMS requires ongoing monitoring and updates. ISMS.online offers a robust suite of features that support the management of your ISMS beyond the initial certification. Our platform enables:

- Real-time monitoring and scheduled reviews

- Seamless updates to your security practices and policies

This ensures your ISMS adapts alongside your business and emerging security threats. By enabling continuous improvement through real-time monitoring and scheduled reviews as per Requirement 10.1, and aiding in the planning and preparation for information security incidents in line with Annex A Control A.5.24 – A.5.28, our platform ensures your ISMS remains robust and responsive.

Choosing ISMS.online for Fintech Security and Compliance

For fintech companies, selecting ISMS.online means opting for a platform that is finely attuned to the unique challenges and requirements of the financial sector. Our solutions are specifically designed to help you manage sensitive financial data securely and comply with both ISO 27001 and sector-specific regulations like PCI DSS and GDPR. This dual focus on compliance and security positions ISMS.online as an ideal partner for fintech firms. Our platform assists in managing risks associated with suppliers—a critical aspect for fintech companies dealing with multiple financial and data service providers as per Annex A Control A.5.19. It also facilitates the inclusion of information security requirements in supplier agreements, ensuring adherence to ISO 27001 and sector-specific regulations as per Annex A Control A.5.20.

Getting Started with ISMS.online

Initiating your journey with ISMS.online is straightforward. By signing up for a demo, you can see our platform in action and assess how it aligns with your organisation's needs. Our team of experts is ready to guide you through the setup process, ensuring a smooth and beneficial transition to ISMS.online. Join the numerous fintech companies that have enhanced their security posture and streamlined their compliance processes with our comprehensive ISMS solutions. By simplifying the setup process and aligning with Requirement 7.1, ISMS.online provides the necessary resources for establishing, implementing, maintaining, and continually improving an ISMS. Moreover, our platform's operational planning and control features assist in implementing the actions determined in Clause 6, supporting Requirement 8.1 and ensuring effective ISMS operation within fintech environments.

Book a demo