What Sectors Need PCI DSS Compliance?

When considering the Payment Card Industry Data Security Standard (PCI DSS), it’s essential to understand its broad applicability. PCI DSS is a global security standard that mandates all organisations that handle cardholder data must adhere to its strict security measures. This includes entities that store, process, or transmit cardholder information.

Who Must Comply with PCI DSS?

All organisations that deal with payment card transactions are required to comply with PCI DSS. This encompasses a wide range of businesses, from large corporations to small independent vendors, and is not limited to just those within the financial sector.

Business Types and PCI DSS

The type of business you operate influences your specific PCI DSS requirements. For example:

- E-commerce sites must ensure secure online transactions.

- Retail stores need to protect point-of-sale systems.

- Service providers that process payments on behalf of merchants must also maintain compliance.

Merchant vs. Service Provider

In PCI DSS terminology:

- A merchant is an entity that accepts payment cards as payment for goods or services.

- A service provider is a business that directly processes, stores, or transmits cardholder data on behalf of another entity.

Beyond the Financial Sector

PCI DSS is not confined to traditional financial institutions. Any organisation involved in the payment process, such as healthcare providers, educational institutions, and non-profits, must also comply if they handle payment card data.

At ISMS.online, we understand the complexities of PCI DSS compliance. Our platform offers integrated frameworks and tools to help you navigate these requirements, ensuring your organisation adheres to the highest security standards. Whether you're a merchant or a service provider, our solutions are designed to support your compliance journey.

Book a demoUnderstanding Merchant Levels in PCI DSS

Understanding the merchant levels within the Payment Card Industry Data Security Standard (PCI DSS) is crucial for your organisation’s compliance strategy. These levels are primarily determined by transaction volume, which directly influences the rigour of compliance validation required.

Criteria Defining Merchant Levels

PCI DSS categorises merchants into four levels based on the annual number of transactions they process. These levels help determine the extent of assessment and security validation that your organisation must undergo.

Impact of Transaction Volume on Compliance

The transaction volume affects the complexity and frequency of the compliance assessments. Higher transaction volumes typically require more stringent validation efforts to ensure the security of cardholder data.

Obligations for Level 1 Merchants

If you’re a Level 1 merchant, processing over 6 million card transactions annually, you are required to undergo an annual on-site assessment by a Qualified Security Assessor (QSA) and to complete a Report on Compliance (RoC).

Merchant Levels and Compliance Validation Rigour

The merchant level dictates the type of validation required, from self-assessment questionnaires for lower levels to full-scale audits for Level 1 merchants. As the level increases, so does the need for robust security measures and detailed compliance reporting.

By understanding these classifications, you can better prepare for the compliance process and ensure that your organisation meets the necessary PCI DSS requirements. At ISMS.online, we provide the guidance and tools to help you navigate these obligations with confidence.

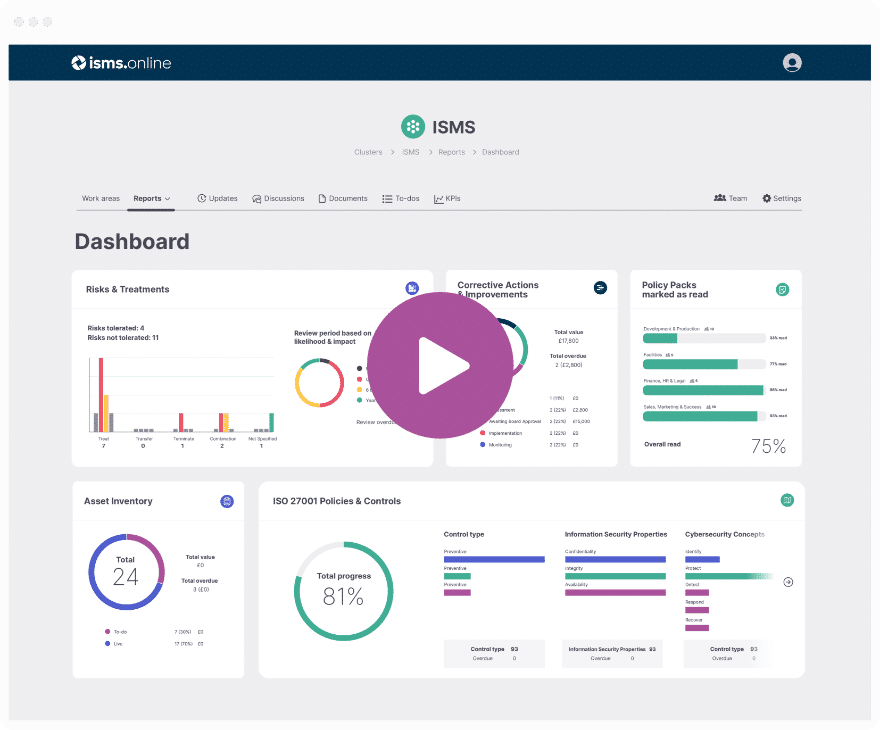

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Service Providers and PCI DSS

Service providers play a pivotal role in the payment card industry, and PCI DSS provides a structured framework to ensure they maintain robust security standards. Understanding the categorisation and compliance challenges for service providers is essential for safeguarding cardholder data.

Categorisation of Service Providers Under PCI DSS

PCI DSS classifies service providers based on the volume of transactions they handle. This categorisation determines the level of scrutiny and the type of compliance validation required.

Transaction Counts and Service Provider Levels

Significant Transaction Counts for Classification:

- Level 1: More than 300,000 transactions annually

- Level 2: Fewer than 300,000 transactions annually

These thresholds are critical as they dictate the compliance verification process, with Level 1 providers undergoing more rigorous assessments.

Unique Compliance Challenges for Service Providers

Service providers face specific challenges, such as managing data across multiple clients and ensuring consistent security practices. They must also adapt to the varying requirements of different payment brands.

Ensuring Security Standards Maintenance

PCI DSS ensures that service providers maintain security standards through:

- Regular Assessments: Annual audits or self-assessments to verify compliance.

- Continuous Monitoring: Implementing processes for ongoing security monitoring.

- Adherence to Updates: Keeping up with the latest PCI DSS versions and requirements.

At ISMS.online, we understand the complexities you face as a service provider. Our platform is designed to support your compliance journey, providing the tools and resources necessary to meet and exceed PCI DSS standards.

The Impact of Transaction Methods

The Payment Card Industry Data Security Standard (PCI DSS) encompasses a variety of transaction methods, each with its own security considerations. Understanding how these methods impact your compliance requirements is essential for protecting cardholder data.

PCI DSS Regulations for Phone Transactions

When you process cardholder data over the phone, PCI DSS requirements still apply. This includes:

- Secure Data Handling: Ensuring that sensitive information is not written down or stored improperly.

- Access Control: Limiting access to data to authorised personnel only.

Third-Party Service Use and PCI DSS

Utilising third-party services for payment processing introduces additional PCI DSS considerations:

- Due Diligence: You’re responsible for ensuring that third-party providers are PCI DSS compliant.

- Shared Responsibility: Contracts should clearly outline the security obligations of each party.

Shopping Carts, Server Security, and PCI DSS

E-commerce platforms must ensure:

- Secure Checkout Processes: Shopping carts must protect data during transactions.

- Robust Server Security: Servers hosting payment pages must adhere to PCI DSS standards.

Addressing Recurring Billing Under PCI DSS

For recurring billing scenarios, PCI DSS mandates:

- Data Storage: Minimise storage of cardholder data and encrypt any data that is stored.

- Authentication: Implement strong authentication methods to prevent unauthorised access.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Legal Implications and PCI DSS Compliance

Understanding the consequences of non-compliance and the intersection with broader data protection laws is essential for maintaining legal and operational integrity.

Consequences of Non-Compliance

Non-compliance with PCI DSS can lead to significant legal repercussions, including:

- Fines and Penalties: Payment brands may impose fines on acquiring banks, which can be passed down to your organisation.

- Breach Liability: You may be held liable for costs associated with a data breach, including forensic investigations and card replacements.

Intersection with GDPR

For organisations operating within or targeting customers in the European Union, PCI DSS compliance intersects with the General Data Protection Regulation (GDPR):

- Data Protection: Both PCI DSS and GDPR require stringent measures to protect personal data.

- Breach Notification: GDPR mandates prompt breach notifications, a principle that aligns with PCI DSS’s incident response requirements.

Understanding Legal Definitions

It’s important to be aware of legal definitions pertaining to cardholder data, such as:

- Cardholder Data Environment (CDE): The processes, technology, and people that handle cardholder data must all comply with PCI DSS.

Quarterly ASV Scans

Quarterly Approved Scanning Vendor (ASV) scans are a legal requirement for certain merchant levels to identify vulnerabilities, ensuring ongoing compliance with PCI DSS:

- Regular Scanning: ASV scans must be conducted every three months to maintain compliance.

At ISMS.online, we provide the framework and support to help you meet these legal requirements, ensuring that your organisation remains compliant and protected.

Demonstrating Compliance With PCI DSS

Demonstrating compliance with PCI DSS is a multi-step process that ensures your organisation securely processes, stores, and transmits cardholder data. We at ISMS.online provide the guidance and tools to help you through each phase of this process.

The Role of Audits and Self-Assessment Questionnaires (SAQs)

Audits and SAQs are fundamental components of the PCI DSS validation process:

- Audits: Conducted by Qualified Security Assessors (QSAs), these are mandatory for merchants and service providers with high transaction volumes.

- SAQs: Self-administered checklists used by organisations with lower transaction volumes to assess their compliance.

Importance of Vulnerability Scans in Compliance Maintenance

Vulnerability scans, performed by Approved Scanning Vendors (ASVs), play a critical role in identifying and mitigating security weaknesses within your systems, ensuring the protection of cardholder data.

Requirements for a Report on Compliance (RoC)

A Report on Compliance is necessary for:

- Level 1 Merchants: Those processing over 6 million transactions per year.

- Certain Service Providers: As dictated by their transaction volume and the requirements of the payment brands they service.

The RoC is a comprehensive document that details your organisation’s adherence to PCI DSS standards, typically completed by a QSA. At ISMS.online, our platform simplifies the process of preparing for and maintaining compliance, supporting you in every step towards achieving and upholding PCI DSS standards.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Cybersecurity Measures and PCI DSS Requirements

To achieve PCI DSS compliance, your organisation must implement a range of cybersecurity practices. These practices are designed to protect cardholder data and maintain a secure transaction environment.

Essential Cybersecurity Practices for Compliance

For PCI DSS compliance, you must establish:

- Firewalls: To protect your network from unauthorised access.

- Encryption: To secure data transmissions.

- Anti-Malware: To defend against malicious software attacks.

Integrating Network Monitoring and Threat Response

Network monitoring and threat response are integral to PCI DSS compliance:

- Continuous Monitoring: To detect and respond to security threats in real-time.

- Incident Management: To have a plan in place for responding to security breaches.

The Role of Ethical Hacking

Ethical hacking, or penetration testing, is a proactive approach to discover vulnerabilities:

- Testing: Regularly test your systems to identify potential security weaknesses.

- Remediation: Address identified vulnerabilities promptly to strengthen your security posture.

Further Reading

Addressing Common Threats to Payment Card Security

PCI DSS serves as a critical standard to mitigate a variety of threats. As part of our commitment to your security, we at ISMS.online aim to equip you with the knowledge to combat these threats effectively.

Mitigating Threats with PCI DSS

PCI DSS is designed to protect against threats including:

- Malware: Malicious software that can compromise cardholder data.

- Phishing: Deceptive attempts to obtain sensitive information.

- Weak Passwords: Inadequate authentication measures that can be easily breached.

- Outdated Software: Systems lacking the latest security patches.

- Skimming: Theft of card information using devices on card readers.

Combating Malware and Phishing

To defend against malware and phishing, PCI DSS recommends:

- Regular Updates: Keeping antivirus software and security protocols up to date.

- Employee Training: Educating staff on recognising and responding to phishing attempts.

Best Practices for Password Management

PCI DSS advocates for strong password management, including:

- Complexity Requirements: Enforcing the creation of complex passwords that are difficult to guess.

- Change Management: Regularly updating passwords to reduce the risk of unauthorised access.

Handling Risks of Outdated Software and Skimming

To address risks associated with outdated software and skimming, PCI DSS advises:

- Timely Patching: Applying security patches promptly to protect against known vulnerabilities.

- Physical Inspections: Regularly inspecting card readers and terminals for skimming devices.

By adhering to these PCI DSS guidelines, you can significantly enhance the security of your payment card operations. Our platform at ISMS.online supports these efforts by providing comprehensive tools and resources to maintain PCI DSS compliance.

The Latest Revision Is PCI DSS 4.0

The introduction of PCI DSS 4.0 brings forth a suite of updates designed to enhance the security of payment card data further. As we transition to this new version, it’s important for your organisation to understand and prepare for the changes that lie ahead.

Key Updates in PCI DSS 4.0

PCI DSS 4.0 introduces several key updates, including:

- Enhanced Flexibility: More options for meeting security objectives.

- Integration of New Technologies: Support for emerging payment environments and technologies.

- Extended Timelines: Additional time for organisations to comply with new requirements.

The Role of Tokenization

Tokenization has gained prominence in PCI DSS 4.0 as a secure method for protecting cardholder data:

- Data Protection: Replacing sensitive card details with unique tokens that are useless to fraudsters if breached.

New Requirements: Ransomware and MFA

With the rise of digital threats, PCI DSS 4.0 addresses:

- Ransomware: New guidelines for preventing and responding to ransomware attacks.

- Multi-Factor Authentication (MFA): Strengthened requirements for authentication to access cardholder data environments.

Spotlight on Threat Awareness

PCI DSS 4.0 emphasises the importance of threat awareness:

- Continuous Monitoring: Encouraging organisations to stay vigilant and proactive in identifying and mitigating threats.

- Security as a Shared Responsibility: Fostering a culture of security across all levels of the organisation.

At ISMS.online, we are committed to helping you navigate these updates. Our platform is equipped to guide you through the transition to PCI DSS 4.0, ensuring that you remain compliant and secure.

The Role of IT Governance in PCI DSS Compliance

Effective IT governance is pivotal in ensuring PCI DSS compliance. It provides a structured framework for aligning IT strategy with business objectives, while ensuring that the necessary security controls are in place to protect cardholder data.

Facilitating PCI DSS Adherence through IT Governance

IT governance supports PCI DSS adherence by:

- Establishing Clear Policies: Defining roles, responsibilities, and processes for maintaining security.

- Regular Review and Improvement: Ensuring that security measures are up-to-date and effective.

Support Services from PCI Qualified Security Assessors (QSAs)

A PCI QSA can offer invaluable services, including:

- Comprehensive Assessments: Evaluating your current compliance status and identifying gaps.

- Expert Guidance: Providing recommendations for security improvements and compliance strategies.

Enhancing Security Posture with Training and Consultancy

Training and consultancy can bolster your security posture by:

- Educating Staff: Increasing awareness of security best practices and compliance requirements.

- Tailored Advice: Offering customised solutions to address your organisation’s unique challenges.

ISMS.online: Your Partner in PCI DSS Compliance

At ISMS.online, we assist with PCI DSS compliance through:

- Integrated Frameworks: Our platform offers a comprehensive suite of tools for managing compliance.

- Guided Certification: We provide step-by-step guidance to help you achieve and maintain compliance.

- Continuous Support: Our experts are available to support you through every step of the compliance journey.

By leveraging our services, you can ensure that your IT governance aligns with PCI DSS requirements, helping you to protect cardholder data and maintain a strong security posture.

Navigating PCI DSS Compliance with ISMS.online

At ISMS.online, we understand that navigating the Payment Card Industry Data Security Standard (PCI DSS) can be complex. Our platform is designed to guide your organisation through the intricacies of compliance with clarity and precision.

Tailored Solutions for Your Compliance Needs

We recognise that each organisation is unique, with specific compliance challenges:

- Customised Frameworks: Our platform adapts to your business size and transaction volume, ensuring relevant compliance measures are in place.

- Integrated Tools: From risk assessments to policy management, we offer a suite of tools tailored to support your PCI DSS journey.

Simplifying the Compliance Journey

Partnering with ISMS.online simplifies your path to compliance:

- Streamlined Processes: Our platform consolidates compliance tasks, making it easier to manage and track progress.

- Expert Support: Our team of experts is on hand to provide guidance and answer your questions, ensuring you’re never alone in the compliance process.

Comprehensive Support with ISMS.online

Choosing ISMS.online means opting for comprehensive support:

- All-in-One Platform: We provide a centralised hub for all your PCI DSS compliance activities, from documentation to staff training.

- Continuous Improvement: Our platform evolves with the PCI DSS standards, offering ongoing updates and resources to maintain your compliance status.

Let ISMS.online be your ally in achieving and maintaining PCI DSS compliance. Contact us to discover how we can assist your organisation in mastering the complexities of PCI DSS.

Book a demo