What Is PCI DSS and Integration With Other Standards

When you’re dealing with credit card transactions, ensuring the security of cardholder data is paramount. This is where the Payment Card Industry Data Security Standard (PCI DSS) comes into play. Our platform, ISMS.online, recognises the critical role PCI DSS plays in safeguarding transaction data, and we’re here to guide you through its core objectives and principles.

Core Objectives of PCI DSS

PCI DSS is designed to protect cardholder data and maintain a secure transaction environment. Its core objectives include:

- Protecting Cardholder Data: Ensuring that all entities that store, process, or transmit credit card information maintain a secure environment.

- Maintaining a Vulnerability Management Programme: Regularly updating antivirus software and developing secure systems and applications.

- Implementing Strong Access Control Measures: Restricting access to cardholder data on a need-to-know basis.

- Regular Monitoring and Testing of Networks: Constantly testing security systems and processes to safeguard against unauthorised access.

The 12 Principles of PCI DSS

To achieve these objectives, PCI DSS sets forth 12 principles that you’re required to implement:

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update antivirus software or programmes.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data by business need to know.

- Assign a unique ID to each person with computer access.

- Restrict physical access to cardholder data.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain a policy that addresses information security for all personnel.

Evolution of PCI DSS

PCI DSS has evolved to address emerging threats and technologies. The transition from version 3.2.1 to 4.0, released in March 2022, maintains the standard’s structure while providing revised wording and expanded applicability from “organisations” to “entities.” This evolution ensures that PCI DSS remains flexible and outcome-driven, capable of addressing unique risks.

Maintaining Structure and Relevance

Despite these changes, PCI DSS has kept its foundational structure intact, ensuring continuity for entities already familiar with the standard. The revisions are crafted to enhance clarity and reflect the changing landscape of data security, ensuring that PCI DSS continues to be a relevant and robust framework for securing credit card transactions.

At ISMS.online, we understand the importance of staying updated with these standards and are committed to helping you navigate the complexities of PCI DSS compliance.

Book a demoISO/IEC 27001 – Framework for Information Security

ISO/IEC 27001 is an international standard that outlines the requirements for an Information Security Management System (ISMS), providing a systematic and proactive approach to managing sensitive company information. This standard is broad in scope and is designed to secure all forms of information, whether digital, paper-based, or in other forms.

Systematic Approach to Information Security

ISO/IEC 27001 employs a risk-based approach to information security. It requires organisations to identify risks and put in place controls that are appropriate to the risks faced. This systematic approach ensures that organisations can secure information assets while maintaining flexibility to adapt as risks evolve.

Voluntary Certification vs. Mandatory Compliance

Unlike PCI DSS, which mandates compliance for entities handling cardholder data, ISO/IEC 27001 certification is voluntary. Organisations choose to certify to demonstrate to stakeholders that they have a robust approach to information security management.

Enhancing Data Security with the PDCA Cycle

The PDCA (Plan-Do-Check-Act) cycle is a core component of ISO/IEC 27001, providing a framework for continuous improvement of the ISMS. By mapping the PDCA cycle to data security practices, organisations can ensure that their security measures remain effective and responsive to changing threats.

Flexibility of Controls

ISO/IEC 27001 is known for its flexibility. The stAndard allows organisations to tailor the 114 controls in Annex A to their specific needs, which contrasts with the more prescriptive requirements of PCI DSS. This flexibility enables organisations to implement controls that are both effective and proportionate to the risks they face.

At ISMS.online, we understand the importance of aligning your organisation’s security practices with recognised standards. Our platform can help you navigate the complexities of ISO/IEC 27001 certification and integrate its practices with other compliance requirements, such as PCI DSS, to enhance your overall security posture.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

GDPR – The Standard for Data Privacy

The General Data Protection Regulation (GDPR) represents a significant shift in data privacy regulation, with a global impact on how personal data is handled. As a compliance officer or someone responsible for your organisation’s data protection strategy, understanding the nuances of GDPR is crucial.

Core Components of GDPR

GDPR is built on principles of transparency, accountability, and individual rights. It mandates that organisations must protect the personal data of EU residents, regardless of where the organisation is located. Key components include the requirement for clear consent from individuals before processing their data, stringent data protection measures, and the appointment of a Data Protection Officer (DPO) in certain cases.

GDPR vs. PCI DSS: A Focus on Personal Data

While PCI DSS is focused on securing cardholder data to prevent credit card fraud, GDPR has a broader scope that encompasses all personal data. This includes any information that can directly or indirectly identify an individual, extending beyond the realm of financial transactions.

Noncompliance Penalties: GDPR’s Stringent Approach

GDPR is known for its heavy penalties for noncompliance, which can reach up to 4% of an organisation’s global annual turnover or 20 million, whichever is higher. This is significantly more severe than the fines typically associated with PCI DSS noncompliance.

Leveraging PCI DSS for GDPR Compliance

Organisations can use their PCI DSS compliance efforts to support GDPR compliance. Many of the security controls required for PCI DSS, such as encryption and access controls, also contribute to the protection of personal data under GDPR. By aligning PCI DSS measures with GDPR requirements, you can create a robust framework for data protection.

At ISMS.online, we provide the tools and guidance to help you navigate the complexities of GDPR and integrate it with other standards like PCI DSS, ensuring your organisation’s compliance and the protection of personal data.

HIPAA – Protecting Personal Health Information

The Health Insurance Portability and Accountability Act (HIPAA) sets the standard for protecting sensitive patient data in the United States. As a healthcare provider or compliance officer, it’s essential to understand how HIPAA safeguards Personal Health Information (PHI) and how it intersects with PCI DSS requirements.

HIPAA’s Privacy and Security Safeguards

HIPAA establishes comprehensive protections for PHI through its Privacy and Security Rules. The Privacy Rule controls how PHI is used and disclosed, while the Security Rule mandates physical, administrative, and technical safeguards to ensure the confidentiality, integrity, and security of electronic PHI.

Aligning HIPAA with PCI DSS Goals

While HIPAA focuses on health information, PCI DSS centres on payment card data. Both require rigorous access controls and risk management practices. However, HIPAA provides a broader scope of protection, covering all aspects of PHI, not just the financial details.

Breach Notification Requirements

Under HIPAA, covered entities must report breaches of PHI to affected individuals, the Secretary of Health and Human Services (HHS), and, in certain circumstances, to the media. This differs from PCI DSS, which has specific breach notification rules focused on cardholder data and reporting to card brands and acquiring banks.

Balancing Compliance with Dual Standards

Healthcare providers that handle PHI and cardholder data must comply with both HIPAA and PCI DSS. This involves implementing a dual-compliance strategy that addresses the unique requirements of each standard without duplicating efforts.

At ISMS.online, we provide solutions that help you manage compliance with both HIPAA and PCI DSS, ensuring that PHI and cardholder data are protected through a unified approach.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Cybersecurity Frameworks and Their Role

As it pertains to IT security management, various cybersecurity frameworks exist to guide organisations in protecting their information assets. These frameworks serve as blueprints for establishing, implementing, maintaining, and continually improving cybersecurity practices.

Complementing PCI DSS with NIST and COBIT

Frameworks such as the NIST Cybersecurity Framework and COBIT provide structured approaches that complement the specific requirements of PCI DSS. NIST, for instance, offers a set of guidelines that can enhance an organisation’s ability to prevent, detect, and respond to cyber incidents. COBIT, on the other hand, focuses on governance and management of enterprise IT, aligning IT goals with business objectives, which is essential for maintaining PCI DSS compliance.

The Importance of Documented Processes and Policies

Documented processes and policies are the backbone of effective compliance. They ensure consistency, accountability, and traceability within an organisation’s cybersecurity efforts. Adherence to these documented practices is often a requirement for compliance with standards like PCI DSS, as they provide evidence of due diligence and operational integrity.

Customising Cybersecurity with Frameworks

Frameworks offer the flexibility to define tasks and customise cybersecurity measures to fit the unique needs of your organisation. By utilising these frameworks, you can tailor your cybersecurity strategy to address specific risks, regulatory requirements, and business goals.

At ISMS.online, we understand the importance of integrating these frameworks into your cybersecurity strategy. Our platform is designed to help you navigate and implement the best practices from various frameworks, ensuring a comprehensive and cohesive approach to securing your organisation’s information assets.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Further Reading

Research and Data Security Compliance

Recent studies provide a critical lens through which we can assess the current state of PCI DSS compliance and its broader implications for data security and privacy. As we delve into these findings, it’s important to consider how they can inform your organisation’s compliance strategies.

Current State of PCI DSS Compliance

Research indicates a varied landscape of PCI DSS compliance among organisations. For instance, the PSR 2022 research highlighted that only 43.4% of organisations were fully compliant in 2020. This suggests a need for increased diligence and resources dedicated to achieving and maintaining compliance.

Impact of Public Awareness and Regulations

In the U.S., state-level data breach notification laws have heightened public awareness of data privacy. This patchwork of regulations underscores the importance of a unified approach to data breach notification and privacy, akin to the comprehensive nature of GDPR.

Global Data Privacy Regulation Benefits

Adopting GDPR-like regulations globally offers clear benefits for businesses, including enhanced consumer trust, improved data management, and a reduction in the risk of data breaches. These regulations set a high standard for privacy and security that can serve as a benchmark for organisations worldwide.

Reinforcing Data Protection with Risk Assessments

Data risk and impact assessments are pivotal in identifying vulnerabilities within your organisation’s data protection measures. By systematically evaluating potential risks, you can reinforce weak spots and ensure a robust defence against data security threats.

At ISMS.online, we provide the tools and expertise to help you navigate the complexities of data security compliance. Our platform supports thorough risk assessments and offers insights into achieving compliance with standards like PCI DSS, helping you safeguard your organisation’s data effectively.

Choosing the Right Standard for Your Organisation

Selecting the appropriate data security standard is a pivotal decision that can significantly impact your organisation’s security posture and compliance status. As you consider your options, it’s essential to weigh various factors to determine the best fit for your operations.

Assessing Applicability of PCI DSS and ISO/IEC 27001

When deciding between PCI DSS and ISO/IEC 27001, consider the nature of your data handling:

- PCI DSS is specifically designed for organisations that handle cardholder data from payment cards.

- ISO/IEC 27001 offers a broader framework suitable for any organisation seeking to protect its information assets.

Transaction volume is a critical factor for PCI DSS, as compliance requirements scale with the number of transactions processed.

Utilising the NIST Cybersecurity Framework as a Guideline

The NIST Cybersecurity Framework can serve as a comprehensive guide for organisations, much like ISO/IEC 27001. It provides a flexible and risk-based approach to cybersecurity, which can be particularly beneficial for organisations not exclusively handling cardholder data.

Realising the Benefits of Selecting the Appropriate Standard

Choosing the right standard can lead to:

- Enhanced Security: Implementing the correct controls for your specific risks.

- Risk Reduction: Minimising the potential for data breaches and associated costs.

- Customer Satisfaction: Building trust through demonstrated commitment to data security.

At ISMS.online, we are committed to helping you navigate these decisions. Our platform supports your journey towards the right standard, ensuring that your data security measures are both effective and aligned with your business needs.

Implementing Integrated Management Systems for Compliance

Navigating the complexities of data security standards can be challenging. An Integrated Management System (IMS) can streamline this process, bringing together various compliance efforts under a single framework.

Streamlining Compliance with an IMS

An IMS integrates multiple management systems and standards, such as PCI DSS and ISO/IEC 27001, into a unified structure. This approach offers several benefits:

- Consolidation of Efforts: Reduces duplication by aligning similar requirements across different standards.

- Efficiency in Management: Provides a clear, organised method for tracking and managing compliance tasks.

- Cost-Effectiveness: Saves time and resources by centralising compliance activities.

The Role of ISMS.online in Simplifying Compliance

At ISMS.online, we understand the importance of an effective IMS. Our platform is designed to:

- Facilitate Integration: Helps you combine various standards into a cohesive system.

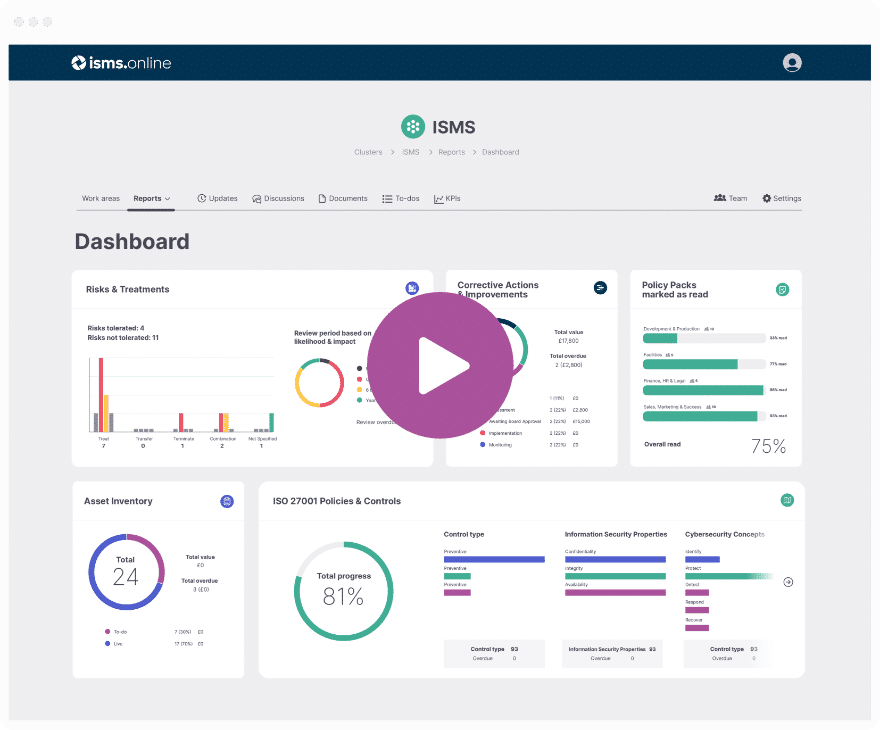

- Enhance Visibility: Offers a dashboard view of your compliance status across different standards.

- Provide Support: Includes templates and tools to assist in meeting compliance requirements.

Achieving Compliance with PCI DSS and ISO/IEC 27001

Using an IMS can make achieving compliance with both PCI DSS and ISO/IEC 27001 more efficient by:

- Mapping Overlapping Requirements: Identifies and merges similar controls from both standards.

- Guiding Through Complexity: Simplifies the process with step-by-step guidance and support.

Addressing Compliance Challenges

Managing compliance with multiple standards presents challenges such as:

- Navigating Different Requirements: Each standard has unique demands that must be met.

- Maintaining Up-to-Date Compliance: Standards evolve, and an IMS helps keep your practices current.

An IMS, supported by ISMS.online, addresses these challenges by providing a structured, adaptable approach to compliance management, ensuring that your organisation remains secure and compliant.

Achieve Data Security Compliance With ISMS.online

Navigating the complexities of data security standards can be daunting. At ISMS.online, we specialise in simplifying this journey for you, ensuring that your organisation’s compliance is both robust and efficient.

How ISMS.online Assists Compliance Officers

Our platform is designed to support compliance officers like you in several ways:

- Comprehensive Tools: We offer a suite of tools that streamline the compliance process, making it easier to manage and maintain.

- Expert Advice: Our team of experts is available to provide guidance on the nuances of various data security standards, including PCI DSS.

Support for Comparing and Implementing Standards

ISMS.online provides:

- Comparative Analysis: We help you understand the differences and similarities between standards such as PCI DSS and ISO/IEC 27001.

- Implementation Strategies: Our platform offers strategies for effectively implementing the necessary controls to meet multiple standards.

Enhancing Your Data Security and Compliance Strategy

By partnering with us, you can:

- Integrate Compliance Efforts: Align your PCI DSS compliance with other standards for a cohesive security strategy.

- Stay Updated: Keep abreast of the latest changes in data security standards and best practices.

Next Steps with ISMS.online

Ready to elevate your data security compliance? Here's how to proceed:

- Reach Out: Contact our team to discuss your specific compliance needs.

- Explore Solutions: Let us demonstrate how our platform can address your challenges.

- Implement: Use our tools and expertise to enhance your compliance strategy.

Embark on your path to comprehensive data security compliance with ISMS.online.

Book a demo