Understanding PCI DSS and Its Importance

When you’re handling card payments, adhering to the Payment Card Industry Data Security Standard (PCI DSS) is not just a recommendation it’s a necessity. PCI DSS is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. This is crucial for protecting cardholder data against unauthorised access and data breaches.

Why Compliance is Critical

For any organisation dealing with card payments, PCI DSS compliance is mandatory. It serves as a robust framework for a secure data environment, helping to prevent security incidents that could lead to fraud or theft of sensitive information. Non-compliance can result in severe penalties, including fines, increased transaction fees, or even the revocation of card processing privileges.

Protecting Cardholder Data

PCI DSS compliance safeguards cardholder data by enforcing strict security controls and measures. These include maintaining a secure network, protecting stored cardholder data, and implementing strong access control measures. By following these guidelines, you’re not only complying with industry standards but also building trust with your customers by demonstrating a commitment to security.

The Impact of Non-Compliance

Failing to comply with PCI DSS can have far-reaching consequences for your organisation. Beyond the immediate financial penalties, non-compliance can damage your reputation, erode customer trust, and potentially lead to legal action. In the digital age, where data breaches are increasingly common, maintaining compliance is integral to your operational integrity and long-term success.

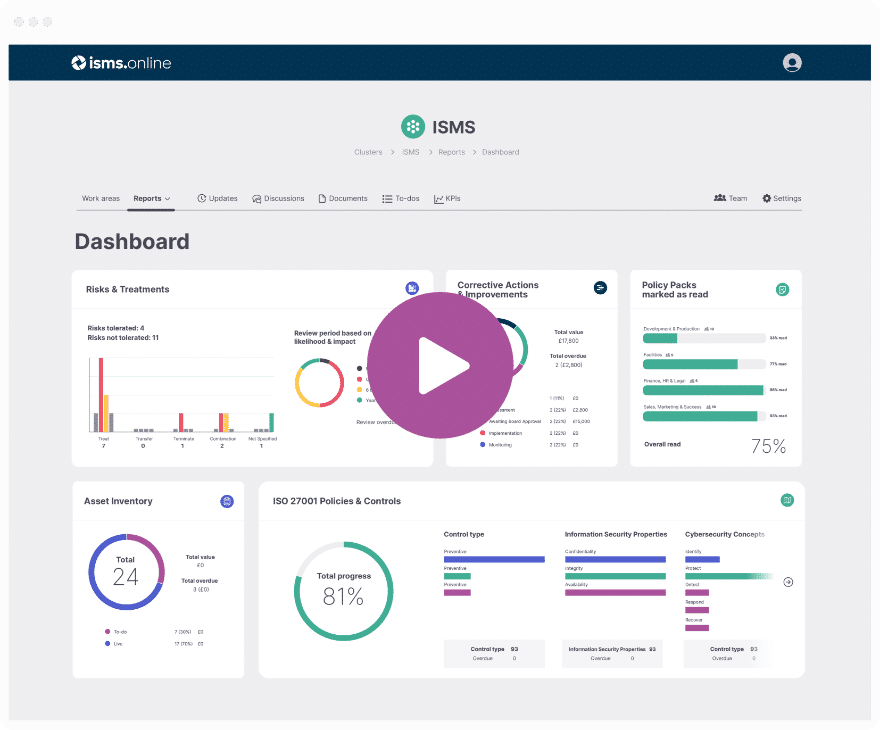

At ISMS.online, we understand the complexities of PCI DSS and offer solutions to streamline your compliance process. Our platform is designed to help you manage and maintain the security controls required by PCI DSS, ensuring that your organisation can confidently handle cardholder data with the highest security standards.

Book a demoThe Challenge of PCI DSS Compliance

Navigating the extensive Payment Card Industry Data Security Standard (PCI DSS) documentation can be daunting. With over 1,800 pages and more than 300 security controls, understanding and implementing the necessary requirements is a significant undertaking for any organisation.

Complexity of Documentation

The sheer volume of PCI DSS guidelines presents a complexity that can be overwhelming. Each page of the documentation is critical, detailing various aspects of security controls and compliance measures. For you, as a compliance officer, this means dedicating substantial time and resources to comprehend and apply these standards.

Impact of Security Controls

The 300+ security controls are designed to protect cardholder data, but they also add layers of complexity to the compliance process. Implementing these controls requires a meticulous approach to ensure that nothing is overlooked and that all aspects of your organisation’s payment processing are secure.

Common Compliance Pitfalls

Organisations often face common pitfalls such as underestimating the scope of compliance, overlooking the need for continuous monitoring, and failing to maintain documentation. These oversights can lead to non-compliance, which may result in penalties and damage to your organisation’s reputation.

Streamlining Compliance

To avoid overwhelm, it’s essential to streamline the compliance process. This can be achieved by leveraging compliance software that simplifies adherence through automation, pre-built controls, and centralised record-keeping. At ISMS.online, we understand these challenges and offer solutions that help you manage compliance effectively, ensuring that your organisation can meet PCI DSS requirements with confidence.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Selecting the Right Compliance Software

Choosing the appropriate compliance software is a pivotal decision for ensuring PCI DSS adherence. It’s crucial to use a systematic approach to evaluate and select the tool that best fits your organisation’s needs.

Criteria for Evaluation

When assessing compliance software, consider these essential criteria:

- Security Controls: Ensure the software encompasses all 300+ PCI DSS security controls.

- User Interface: Look for a user-friendly interface that simplifies complex processes.

- Customisation: The software should be adaptable to your specific compliance processes.

- Reporting: Robust reporting features are necessary for audit preparation and compliance monitoring.

Industry and Company Size Considerations

Your industry and company size significantly influence the selection of compliance tools. Different sectors have unique risks and regulatory requirements, while company size affects the scale and complexity of the compliance solution needed.

Benefits of Selection Tools

Utilising selection tools for side-by-side software comparison can:

- Save Time: Quickly narrow down options based on specific features.

- Increase Accuracy: Ensure that critical compliance features are not overlooked.

- Improve Decision-Making: Provide clear comparisons to inform better choices.

Ensuring Software Meets Specific Needs

To guarantee the chosen software aligns with your requirements:

- Customer Support: Assess the responsiveness and expertise of the software provider’s support team.

- Integration: Confirm that the software integrates seamlessly with your existing systems.

By meticulously considering these factors, you can select a compliance software that not only meets but enhances your PCI DSS compliance efforts.

Automation in Compliance Management

In the intricate landscape of PCI DSS compliance, automation tools stand as a beacon of efficiency, transforming complex requirements into manageable tasks.

Simplifying Adherence with Automation Tools

Automation tools streamline the compliance process by:

- Reducing Manual Effort: They automate repetitive tasks, freeing up your time for strategic compliance planning.

- Ensuring Accuracy: Automated systems minimise human error, ensuring that compliance measures are accurately implemented.

The Role of Pre-Built Controls and Continuous Monitoring

Pre-built controls and continuous monitoring are central to robust compliance management:

- Pre-Built Controls: These are ready-to-use templates that align with PCI DSS requirements, ensuring that you’re always on the right track.

- Continuous Monitoring: This feature keeps a vigilant eye on your systems, providing alerts for any compliance deviations, thus enabling prompt corrective actions.

Policy Library for Efficient Management

A comprehensive policy library offers:

- Centralised Access: All your compliance documents are stored in one place, making it easier to manage and update them.

- Consistency: It ensures that all policies are consistent and up-to-date with the latest PCI DSS standards.

Centralised Record-Keeping System Advantages

Centralised record-keeping enhances compliance management by:

- Streamlining Audits: All necessary documentation is readily available, making audit processes smoother and more efficient.

- Providing Transparency: It offers clear visibility into compliance status, which is essential for both management and external auditors.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Key Features in PCI DSS Compliance Software

Selecting the right compliance software for managing PCI DSS is critical. As you evaluate your options, there are several key features that should be at the forefront of your decision-making process.

Essential Software Features for Effective Management

When considering compliance software, ensure it includes:

- Comprehensive Security Controls: It should cover all the required PCI DSS controls to safeguard cardholder data effectively.

- Real-Time Alerts: For immediate notification of compliance deviations or security breaches, enabling swift action.

Integration with Existing Systems

Integration capabilities are vital for a seamless compliance process:

- Active Directory and Cloud Services: Integration with these services ensures that user management and data security are maintained consistently across all platforms.

- API Access: This allows for custom connections with other tools and systems, enhancing the flexibility and scalability of your compliance efforts.

Enhancing Compliance Officer Efficiency

Features that streamline workflow are invaluable:

- Electronic Signatures: They expedite approval processes and document sign-offs, crucial for maintaining a swift compliance workflow.

- Workflow Simplification: Tools that automate and simplify workflows can significantly reduce the administrative burden on compliance teams.

Identity and Access Management in PCI DSS Compliance

Identity and Access Management (IAM) systems are a cornerstone in safeguarding cardholder data, as mandated by the PCI DSS. By managing user access effectively, IAM ensures that only authorised individuals can interact with sensitive data.

Strengthening Security with Multi-Factor Authentication and Single Sign-On

Implementing Multi-Factor Authentication (MFA) and Single Sign-On (SSO) offers multiple layers of protection:

- MFA: Adds an extra verification step, significantly reducing the risk of unauthorised access.

- SSO: Simplifies the user experience while maintaining security, as users only need to remember one set of credentials.

Critical Importance of User Identity Management

User identity management is essential for:

- Tracking Access: Monitoring who accesses cardholder data and when.

- Enforcing Policies: Ensuring that users adhere to security policies and procedures.

Zero Trust Security Model Alignment with PCI DSS

A Zero Trust security model complements PCI DSS by:

- Never Assuming Trust: Every access request is fully authenticated, authorised, and encrypted before granting access.

- Minimising Breach Impact: By limiting access, even if a breach occurs, the damage is contained.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Compliance Software Integration and Support

Integrating your PCI DSS compliance software with other IT and security tools is not just a convenienceit’s a necessity for maintaining a robust compliance posture.

Essential Integrations for Streamlined Compliance

The right compliance software should seamlessly integrate with tools that are integral to your operations, such as:

- Project Management Tools: Like Jira, to track compliance-related tasks and workflows.

- Communication Platforms: Such as Slack, to facilitate real-time discussions on compliance issues and updates.

These integrations are crucial because they:

- Enhance Collaboration: Allowing your team to work together efficiently on compliance tasks.

- Improve Visibility: Providing a centralised view of compliance activities across different platforms.

The Importance of 24/7 Support

Around-the-clock support is vital for addressing any compliance questions or issues that arise, ensuring:

- Immediate Assistance: Whenever you encounter a challenge, help is just a call or click away.

- Continuous Compliance: Minimising downtime and maintaining a consistent compliance stance.

Supporting a Variety of IT and Security Tools

Compliance software should be versatile, offering support for a wide range of IT and security tools to:

- Ensure Compatibility: With your existing technology stack.

- Facilitate Comprehensive Compliance: By covering all aspects of PCI DSS across various systems and applications.

Further Reading

Ensuring Comprehensive Data Protection

In terms of PCI DSS compliance, the role of compliance tools in safeguarding data cannot be overstated. These tools are instrumental in reducing the risk of data breaches, a critical concern for any organisation handling sensitive payment information.

Reducing Data Breach Risks with Compliance Tools

Compliance tools aid in data protection by:

- Automating Security Protocols: Implementing and managing security measures consistently across the board.

- Monitoring for Vulnerabilities: Continuously scanning for and addressing potential security gaps.

Secure Payment Credential Generation

A key component of PCI DSS compliance is the secure generation of payment credentials:

- Tokenization: Replacing sensitive data with unique identification symbols that retain all the essential information without compromising security.

- Encryption: Ensuring that payment information is unreadable to unauthorised parties.

Cryptographic Key Management’s Contribution

Effective cryptographic key management is essential for:

- Protecting Data: Keys are used to encrypt and decrypt sensitive information, keeping it secure.

- Maintaining Integrity: Proper key management prevents unauthorised access and manipulation of data.

Consequences of Inadequate Data Protection

Failing to protect data adequately can lead to:

- Financial Losses: Significant fines and costs associated with breach mitigation.

- Reputational Damage: Loss of customer trust, which can be devastating for business longevity.

At ISMS.online, we understand the importance of comprehensive data protection. Our platform is designed to support your compliance efforts, ensuring that your organisation’s data security measures are robust and effective.

Preparing for Audits and Evidence Collection

As you approach the critical phase of PCI DSS audits, the role of compliance tools in evidence collection becomes increasingly significant. At ISMS.online, we provide features that support a robust audit trail, ensuring your organisation’s preparation is aligned with PCI DSS requirements.

Compliance Tools for Evidence Collection

Our compliance tools assist in evidence collection by:

- Automating Data Capture: Systematically recording all relevant data transactions and changes.

- Organising Documentation: Centrally storing policies, procedures, and records for easy retrieval during audits.

Features Supporting Audit Trail Implementation

Key features of ISMS.online that support audit trails include:

- Time-Stamped Records: Providing a chronological record of activities for accountability and traceability.

- Access Logs: Monitoring and recording who accessed what information and when, crucial for security audits.

Aligning Audit Preparation with PCI DSS Requirements

To ensure your audit preparation meets PCI DSS standards, we recommend:

- Regular Reviews: Periodically assess your compliance status using our platform’s reporting features.

- Policy Alignment: Utilise our policy templates to ensure your practices are in line with PCI DSS guidelines.

Strategies for a Smooth Audit Process

For a successful audit, consider employing strategies such as:

- Pre-Audit Checklists: Use our platform to create and complete checklists that cover all PCI DSS audit points.

- Mock Audits: Conduct practice audits to identify and address any potential issues before the actual audit.

By leveraging the capabilities of ISMS.online, you can navigate the audit process with confidence, knowing that your evidence collection and audit trail are thorough and compliant with PCI DSS standards.

PCI DSS Compliance Support at ISMS.online

At ISMS.online, we understand the complexities of PCI DSS compliance and the unique challenges it presents to organisations like yours. Our platform is designed to simplify the compliance journey, providing tailored solutions that cater to your specific needs.

Tailored Solutions for Your Compliance Challenges

We offer a range of services to assist with PCI DSS compliance:

- Customisable Frameworks: Adapt our pre-built controls to fit your organisation’s specific requirements.

- Policy Management: Utilise our comprehensive policy library to develop and maintain PCI DSS-compliant policies.

Streamlining Your Compliance Management

Partnering with ISMS.online streamlines your compliance management by:

- Centralising Documentation: Keep all your compliance records in one secure, accessible location.

Comprehensive Support Throughout Your Compliance Journey

Choosing ISMS.online means you'll benefit from:

- Expert Guidance: Our team of compliance experts is available to support you every step of the way.

- Continuous Improvement: We provide tools and insights to help you maintain and improve your compliance stance over time.

By leveraging the power of ISMS.online, you can navigate the PCI DSS compliance landscape with confidence, backed by a team dedicated to your success. Contact us to learn more about how we can support your compliance journey.

Book a demo