What Is PCI DSS and the Risk Management Approach

The Payment Card Industry Data Security Standard (PCI DSS) has undergone a significant transformation with the introduction of version 4.0. As we at ISMS.online reflect on the evolution of PCI DSS, it’s clear that the latest iteration marks a pivotal shift towards a more dynamic and responsive approach to payment security.

Key Changes in PCI DSS 4.0

PCI DSS 4.0 introduces a host of changes, emphasising flexibility and adaptability. The standard now supports an objective-based framework, allowing you to tailor security controls to your organisation’s unique environment. This version departs from the prescriptive requirements of v3.2.1, offering a pathway to innovate while maintaining robust security measures.

Impact on Risk Management Strategies

Your risk management strategies will need to evolve to align with the new PCI DSS 4.0. The standard’s flexible nature means that you’re encouraged to develop customised controls that address specific risks pertinent to your operations. This shift necessitates a deeper understanding of your organisation’s risk landscape to effectively leverage the new framework.

Transition Timeline and Compliance Deadline

The transition from PCI DSS v3.2.1 to 4.0 is not just a procedural update; it's a strategic overhaul with a generous timeline to ensure readiness. The 2022 inception of PCI DSS 4.0 sets the stage for a gradual implementation, with a hard deadline for full compliance by 2025. This timeline underscores the importance of proactive planning and phased adoption to meet the new standards without disruption.

At ISMS.online, we understand the complexities involved in this transition and are committed to guiding you through each step. Our platform is designed to streamline your compliance journey, ensuring that you're well-prepared to meet the 2025 full compliance deadline with confidence.

Book a demoThe Zero Trust Security Model

In the context of digital finance, the security of cardholder data is paramount. PCI DSS 4.0 introduces the Zero Trust model as a cornerstone of its framework, recognising the need for rigorous verification in every transaction and system access. As we at ISMS.online understand, this model is not just a set of technologies but a holistic approach to security.

Understanding Zero Trust Principles

Zero Trust is a security concept centred on the belief that organisations should not automatically trust anything inside or outside their perimeters. Instead, they must verify anything and everything trying to connect to their systems before granting access. This principle is integral to PCI DSS 4.0 as it aligns with the standard’s move towards more dynamic and robust security measures.

Implementing Zero Trust in Your Risk Management

For compliance officers, implementing Zero Trust means adopting a mindset where security is not a one-time checkbox but a continuous process. You’re encouraged to apply strict access controls and not to assume trust based on network location. This includes enforcing Multi-Factor Authentication (MFA), least privilege, and micro-segmentation.

Challenges in Transitioning to Zero Trust

Transitioning to a Zero Trust framework can be challenging, as it requires a shift in traditional security models that may have been in place for years. It involves comprehensive changes in how access rights are granted and monitored, which can be resource-intensive.

Enhancing Cardholder Data Security

By adopting Zero Trust, you ensure that each access request is critically evaluated, reducing the attack surface and enhancing the security of cardholder data. This proactive stance is a key component of PCI DSS 4.0, aiming to adapt to the evolving threats in the payment security landscape.

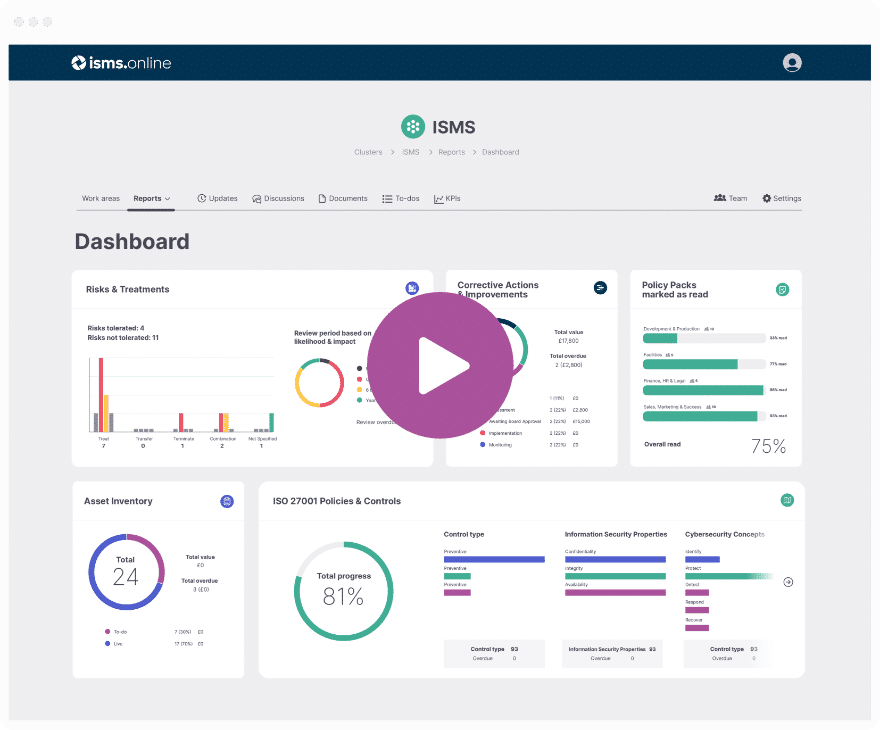

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Controls to Meet PCI DSS Requirements

The advent of PCI DSS 4.0 ushers in a new era of payment security, where customised controls become a pivotal aspect of compliance. This flexibility is designed to accommodate the diverse operational landscapes of organisations while maintaining rigorous security standards.

Benefits of Customised Controls

Customised controls under PCI DSS 4.0 offer you the ability to align security measures with your organisation’s specific risks, business models, and technological environments. This tailored approach not only enhances security but also ensures that the controls are relevant and effective for your unique operational needs.

Tailoring Security Controls for Compliance

To tailor your security controls, begin with a comprehensive risk assessment to identify your organisation’s specific threats and vulnerabilities. This assessment forms the foundation for developing controls that are both compliant with PCI DSS 4.0 and customised to your environment. Consider factors such as the types of data you process and the technologies you employ.

The Role of Risk Assessment

Risk assessment is critical in customising controls. It helps you prioritise resources and apply security measures where they are most needed, ensuring that the controls are not just compliant but also cost-effective and efficient.

How ISMS.online Supports Customisation

At ISMS.online, we provide tools and frameworks that streamline the customisation of controls for PCI DSS 4.0 compliance. Our platform facilitates the documentation, management, and monitoring of tailored controls, making it easier for you to achieve and maintain compliance.

Authentication Protocols for Enhanced Security

With the introduction of PCI DSS 4.0, the Payment Card Industry Security Standards Council (PCI SSC) has placed a renewed emphasis on authentication protocols. This is a critical step in safeguarding payment transactions and protecting cardholder data against unauthorised access.

New Authentication Requirements in PCI DSS 4.0

PCI DSS 4.0 introduces stringent authentication requirements, including mandatory Multi-Factor Authentication (MFA) for accessing the Cardholder Data Environment (CDE). This requirement is designed to ensure that the verification process is robust and that a single point of failure in authentication cannot lead to a security breach.

Alignment with NIST MFA Guidance

The mandatory MFA for the CDE is in alignment with the National Institute of Standards and Technology (NIST) MFA guidance. This alignment underscores our commitment at ISMS.online to adhere to globally recognised standards, ensuring that you’re equipped with the most effective security measures.

Adoption of Stronger Protocols

Organisations are now required to adopt stronger authentication protocols. This includes the use of adaptive and context-aware authentication mechanisms that can assess the risk level of access requests and adjust authentication strength accordingly.

Contribution to Payment Security

Enhanced authentication protocols contribute significantly to the overall security of payment systems. By requiring multiple forms of verification, organisations can better protect against unauthorised access, reducing the risk of data breaches and fraud.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Advanced Encryption for Data Transmission

Encryption serves as the bedrock of data security within the PCI DSS 4.0 framework, ensuring that cardholder data remains inaccessible to unauthorised entities during transmission over networks.

The Critical Role of Encryption in PCI DSS 4.0

Under PCI DSS 4.0, encryption is not just recommended; it is a requirement for protecting network transmissions. This safeguard is essential because it acts as a last line of defence, rendering data unreadable to those without the proper cryptographic keys, should other security measures fail.

Navigating the TLS v1.2+ Mandate

The mandate for TLS v1.2 or higher signifies a commitment to using strong encryption standards. For your organisation, this means:

- Ensuring that all systems capable of transmitting cardholder data are updated to support TLS v1.2+.

- Phasing out older encryption protocols that are susceptible to vulnerabilities.

Tailoring Encryption to Your Organisation’s Needs

While the mandate specifies a minimum standard, we at ISMS.online advocate for a tailored approach to encryption that considers:

- The types of data you handle.

- Your specific network architecture.

- The potential impact on system performance.

Best Practices for Robust Encryption

To ensure robust encryption of cardholder data, we recommend:

- Regularly updating cryptographic keys and certificates.

- Conducting periodic reviews of encryption protocols to ensure compliance with the latest standards.

- Training staff on the importance of encryption and secure handling of cryptographic keys.

Monitoring for Real-Time Threat Identification

The Payment Card Industry Data Security Standard (PCI DSS) 4.0 sets a new benchmark for monitoring payment networks, emphasising the importance of real-time threat identification to safeguard sensitive cardholder data.

Elevated Monitoring Standards in PCI DSS 4.0

PCI DSS 4.0 enhances the requirements for monitoring, moving beyond traditional methods to incorporate advanced technologies that enable real-time detection and response. This proactive stance is crucial in today’s fast-paced digital environment, where threats can evolve rapidly and impact your systems within moments.

Recommended Technologies for Real-Time Monitoring

To meet these elevated standards, we at ISMS.online recommend implementing risk-based monitoring solutions that utilise:

- Intrusion detection systems (IDS) and intrusion prevention systems (IPS) for network traffic analysis.

- Security information and event management (SIEM) systems for log aggregation and event correlation.

- Advanced threat protection tools that leverage artificial intelligence (AI) and machine learning for predictive threat modelling.

Effective Implementation of Monitoring Technologies

For effective implementation, it’s essential to integrate these technologies into your existing security architecture seamlessly. This includes configuring alerts to flag suspicious activities and establishing protocols for immediate response to potential threats.

The Role of Continuous Monitoring

Continuous monitoring plays a pivotal role in maintaining PCI DSS compliance. It ensures that any anomalies are detected and addressed promptly, minimising the window of opportunity for attackers. By integrating continuous monitoring into your security strategy, you’re not only complying with PCI DSS 4.0 but also fortifying your defences against the ever-present threat of cyber attacks.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Control Testing Frequency and Methodology

With the release of PCI DSS 4.0, the frequency and methodology of control testing have undergone significant enhancements. These changes are designed to ensure that security controls remain effective and responsive to the evolving threat landscape.

Rationale Behind Increased Control Testing Frequency

PCI DSS 4.0 mandates increased control testing frequency to:

- Ensure continuous security posture assessment.

- Identify and remediate vulnerabilities in a timely manner.

- Adapt to new threats that emerge rapidly in the digital environment.

Understanding DESV and Its Impact on Risk Decision-Making

Designated Entities Supplemental Validation (DESV) is a set of additional criteria for entities that require a higher level of assurance. DESV:

- Provides a structured approach to validate the effectiveness of security controls.

- Enhances visibility into the risk decision-making process.

- Ensures that critical data environments are protected against advanced threats.

Adapting to New Control Testing Requirements

To adapt to the new requirements, your organisation should:

- Schedule regular control tests in alignment with PCI DSS 4.0 guidelines.

- Utilise automated testing tools to increase efficiency and coverage.

- Integrate control testing results into your overall risk management framework.

The Benefits of Frequent Control Testing

Frequent control testing fortifies your organisation’s security posture by:

- Providing ongoing assurance of control effectiveness.

- Enabling proactive identification and mitigation of security gaps.

- Supporting a culture of continuous improvement in security practices.

Further Reading

Conducting Thorough Threat and Vulnerability Risk Assessments

Under PCI DSS 4.0, conducting a comprehensive Threat and Vulnerability Risk Assessment (TRA) is a critical step in safeguarding your payment card data. This process involves a systematic examination of potential threats and vulnerabilities that could impact your Cardholder Data Environment (CDE).

The TRA Process Under PCI DSS 4.0

To conduct a TRA, you should:

- Identify and catalogue assets within the CDE, noting their importance to your business operations.

- Assess potential threats and vulnerabilities for each asset, considering both internal and external factors.

- Evaluate the likelihood and impact of these threats materialising, which will inform your risk prioritisation.

Benefits of Annual and Risk-Based TRA Reviews

Regular TRA reviews allow you to:

- Stay ahead of evolving threats by updating your risk assessments frequently.

- Make informed decisions about where to allocate resources for maximum risk mitigation.

- Ensure that your risk management practices are aligned with the current threat landscape.

Required Documentation for TRA

Your TRA documentation should include:

- A detailed inventory of assets within the CDE.

- Records of identified threats and vulnerabilities.

- An analysis of the likelihood and impact of potential security incidents.

Streamlining TRA with ISMS.online

At ISMS.online, our platform simplifies the TRA process by providing:

- Tools to document and manage your asset inventory efficiently.

- Templates for recording and assessing threats and vulnerabilities.

Aligning Cybersecurity Solutions with PCI DSS

As we navigate the complexities of PCI DSS 4.0, it’s clear that cybersecurity solutions must evolve to align with the standard’s elevated requirements. At ISMS.online, we understand the importance of integrating robust cybersecurity measures to protect your digital finance operations.

Cybersecurity Solutions for PCI DSS 4.0 Compliance

The types of cybersecurity solutions that align with PCI DSS 4.0 include:

- Automated Detection and Response (ADR) systems that provide real-time threat detection and automated incident response.

- Identity and Access Management (IAM) platforms that enforce strict access controls and authentication protocols.

- Data Protection Tools that ensure the confidentiality and integrity of cardholder data through encryption and tokenization.

- Application Security (AppSec) measures that secure your applications from vulnerabilities and attacks.

Contributions of ADR and IAM to Risk Management

ADR and IAM systems are pivotal in managing risks within digital finance by:

- Automating threat detection to reduce the time between breach and response.

- Strengthening authentication processes to prevent unauthorised access.

- Streamlining user access management to ensure that only authorised personnel can access sensitive data.

Data Protection and AppSec Considerations

For data protection and AppSec under PCI DSS 4.0, you should consider:

- Implementing end-to-end encryption for data at rest and in transit.

- Adopting a secure software development lifecycle (SDLC) to integrate security into every phase of development.

- Conducting regular security assessments and code reviews to identify and remediate vulnerabilities.

Gaining a Competitive Edge through Optimised Threat Management

To optimise threat management and gain a competitive edge, organisations should:

- Leverage advanced analytics and machine learning to predict and prevent potential security incidents.

- Foster a security-centric culture within the organisation to ensure that all employees are aware of and adhere to security best practices.

- Utilise threat intelligence platforms to stay informed about the latest cybersecurity threats and trends.

By aligning your cybersecurity solutions with PCI DSS 4.0 standards, you’re not only ensuring compliance but also fortifying your defences against the ever-evolving threat landscape.

Compliance with a Phased Implementation Roadmap

Preparing for PCI DSS 4.0 compliance is a structured journey that requires careful planning and execution. At ISMS.online, we advocate for a phased implementation roadmap that enables a smooth transition, ensuring that you meet all the necessary milestones by the 2025 full compliance deadline.

Key Steps in PCI DSS 4.0 Compliance Preparation

To prepare for PCI DSS 4.0 compliance, consider the following steps:

- Conduct a Gap Analysis: Assess your current security posture against PCI DSS 4.0 requirements to identify areas needing attention.

- Prioritise Actions: Based on the gap analysis, prioritise the actions that address the most critical gaps first.

- Develop an Implementation Plan: Create a detailed plan with timelines and responsibilities for addressing each requirement.

Facilitating a Smooth Transition with a Phased Roadmap

A phased implementation roadmap facilitates a smooth transition by:

- Allowing for incremental progress, making the process more manageable.

- Enabling you to address the most critical security needs first, enhancing your risk posture early in the transition.

- Providing clear milestones and checkpoints to measure progress and make necessary adjustments.

Critical Milestones for the Roadmap to 2025 Compliance

Critical milestones to consider in your roadmap include:

- 2022: Complete initial gap analysis and begin addressing high-priority gaps.

- 2023: Continue implementing new controls and processes, begin training programmes.

- 2024: Finalise implementation of all required controls, conduct thorough testing.

- 2025: Achieve full compliance, with all controls operational and effective.

ISMS.online’s Support in Developing a Compliance Evaluation Plan

Our platform supports your organisation in developing a compliance evaluation plan by:

- Providing tools to document and track progress against each PCI DSS 4.0 requirement.

- Offering guidance and resources to understand and implement the standard’s requirements.

- Enabling collaboration across your team to ensure a cohesive and coordinated effort.

By following these steps and leveraging the support of ISMS.online, you can confidently navigate the path to PCI DSS 4.0 compliance.

Addressing New and Emerging Risks in Digital Payment Ecosystems

The introduction of PCI DSS 4.0 has brought to light new risks in the digital payment ecosystem, necessitating a forward-thinking approach to risk management. As compliance officers, it’s imperative to understand these risks and implement strategies to mitigate them effectively.

Emerging Risks with PCI DSS 4.0

With PCI DSS 4.0, new risks include:

- Advanced cyber threats targeting payment data.

- IoT vulnerabilities due to the proliferation of connected devices.

- Mobile payment security challenges as transactions shift to smartphones.

- Cloud security concerns as more data is stored off-premises.

Strategies for IoT, Mobile, and Cloud Security

To address these risks, we recommend:

- Conducting regular security assessments to identify and address vulnerabilities.

- Implementing strong encryption and access controls for IoT devices.

- Ensuring robust authentication for mobile payment applications.

- Adopting comprehensive cloud security measures that align with PCI DSS 4.0 standards.

Managing Supply Chain Risks in Payment Security

Supply chain risks can be managed by:

- Performing due diligence on all third-party service providers.

- Establishing clear security requirements for vendors.

- Monitoring third-party compliance with PCI DSS 4.0.

Mitigating Risks from Advanced Technologies

PCI DSS 4.0 provides guidance on mitigating risks from emerging technologies like quantum computing and blockchain by:

- Staying informed about the latest developments in these technologies.

- Participating in industry forums to share best practices.

- Preparing for future standards that address these specific technologies.

At ISMS.online, we are committed to helping you navigate these new challenges and ensure that your risk management strategies are robust and compliant with the latest PCI DSS standards.

Tailoring Your Risk Management with ISMS.online

At ISMS.online, we understand the complexities of aligning with PCI DSS 4.0. Our platform is designed to assist you in tailoring your risk management processes to meet the new standards effectively.

Integrating Compliance Frameworks

Our platform offers:

- Integrated Compliance Frameworks: Align your risk management with PCI DSS 4.0 using our comprehensive tools that facilitate a holistic security approach.

- Guided Certification: Navigate the PCI DSS certification process with our step-by-step guidance, ensuring nothing is overlooked.

Expertise in Policy and Control Management

We provide:

- Policy Management Tools: Develop, document, and manage your security policies with ease, ensuring they are up-to-date and PCI DSS 4.0 compliant.

- Control Management: Our platform helps you to implement, monitor, and review controls, making continuous compliance achievable.

Benefits of Choosing ISMS.online

By partnering with us, you gain:

- Pre-configured IMS: Quickly deploy an Information Security Management System that is pre-configured for PCI DSS compliance.

- Adapt, Adopt, Add Strategy: Customise the platform to fit your organisation’s specific needs while focusing on information security.

Why ISMS.online for PCI DSS 4.0 Compliance

Choose ISMS.online for:

- Streamlined Compliance: Our platform simplifies the path to PCI DSS 4.0 compliance, saving you time and resources.

- Expert Support: Benefit from our expertise in risk management and compliance, ensuring you're well-prepared for the 2025 full compliance deadline.

For tailored risk management solutions that align with PCI DSS 4.0, contact us at ISMS.online. We're here to support your journey to secure greatness.

Book a demo