PCI DSS and How a Risk Assessment Aids Compliance

As we approach the March 2024 deadline, understanding the transition from PCI DSS v3.2.1 to v4.0 is crucial for your organisation’s compliance journey. Here’s what you need to know:

Key Changes from PCI DSS v3.2.1 to v4.0

PCI DSS v4.0 introduces significant updates to better align with evolving technologies and threats. The changes emphasise a customised approach to compliance, allowing for more flexibility in how requirements are met. This version also enhances validation methods and supports a range of security methodologies.

Preparing for the Transition

To prepare for the transition, you should start by familiarising yourself with the new requirements and assessing how they impact your current security measures. It’s essential to plan early, considering the surge in contactless card usage and its implications on your security infrastructure. ISMS.online can assist in this process with our integrated compliance framework and dynamic risk management tools.

Contactless Card Usage and PCI DSS Compliance

The rise in contactless transactions calls for heightened security measures. PCI DSS v4.0 addresses this by requiring robust encryption and authentication methods to secure cardholder data during these quick and convenient transactions.

Enhancing Security of Card Transactions

PCI DSS v4.0 places a strong emphasis on continuous security processes and enhanced validation. This proactive approach ensures that security measures keep pace with technological advancements, providing a more resilient defence against data breaches and fraud.

By leveraging our expertise and tools at ISMS.online, you can navigate these changes confidently and ensure that your organisation remains compliant and secure.

Book a demoCustomised Approach in PCI DSS

As compliance officers, you’re likely aware that PCI DSS v4.0 introduces a more flexible, customised approach to compliance. This shift allows for alternative methods to meet security objectives, tailored to your organisation’s specific needs and the types of data you handle.

Understanding the Customised Approach

The customised approach in PCI DSS v4.0 empowers you to design and implement security measures that align with your unique operational environment. It moves away from the one-size-fits-all model, acknowledging that the same controls may not be equally effective across different organisations.

Impact of No Compensating Controls

With the absence of compensating controls, your risk assessment process becomes even more critical. You must ensure that the alternative methods you employ provide security that is equal to or greater than the standard controls.

Documentation for Alternative Compliance Methods

To support your customised approach, robust documentation is essential. You will need to detail how your chosen methods meet the intended outcomes of the standard controls. This documentation should be clear, comprehensive, and readily available for assessment.

Leveraging ISMS.online for Documentation and Risk Assessment

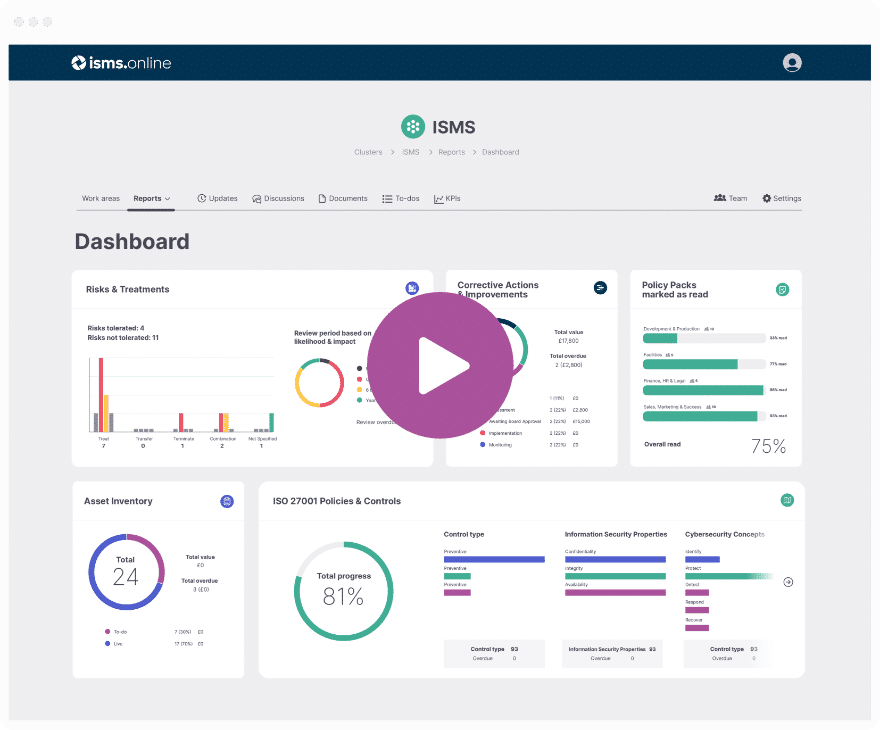

At ISMS.online, we provide a platform that simplifies the documentation and risk assessment process. Our tools help you maintain a clear record of your compliance journey, ensuring that all necessary information is organised and accessible for both internal governance and external assessment.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Threat and Risk Analysis in PCI DSS

With the advent of PCI DSS v4.0, the Threat and Risk Analysis (TRA) has undergone a significant transformation. Previously a stringent requirement, TRA now adopts a more advisory role, emphasising its importance as a recommendation. This evolution reflects a strategic shift towards a risk-based approach, allowing for a more dynamic and responsive security posture.

Understanding Risks and Customised Controls

In PCI DSS v4.0, you’re encouraged to identify and categorise risks into two main types: those that can be addressed with predefined controls and those that require customised controls. This distinction is crucial for tailoring your security measures to the specific threats your organisation faces.

Frequency of TRA for Proactive Security

Proactive security is a cornerstone of PCI DSS v4.0, and conducting regular frequency analysis is key. While the standard does not prescribe a specific interval, we at ISMS.online recommend that you perform TRA at least annually or whenever significant changes occur within your cardholder data environment.

Adapting to the Evolving Threat Landscape

The threat landscape is ever-changing, and your TRA processes must evolve accordingly. By staying informed about new threats and vulnerabilities, you can ensure that your risk analysis remains relevant and effective, providing robust protection for cardholder data in a world of shifting cyber risks.

Steps for Conducting a PCI DSS Risk Assessment

Conducting a risk assessment is a foundational element of PCI DSS v4.0 compliance. As you embark on this process, it’s essential to follow a structured approach that aligns with the standard’s goals.

Identifying Assets, Threats, and Outcomes

Begin by pinpointing the assets that are involved in storing, processing, or transmitting cardholder data. For each asset, identify potential threats and the undesirable outcomes if those threats were to materialise. This step is critical in setting the stage for a thorough risk assessment.

Defining Context and Scope

Next, define the context and scope of your risk assessment. This involves understanding your organisation’s specific environment and the cardholder data ecosystem. By doing so, you ensure that the risk assessment is relevant and focused on the areas of highest impact.

The Role of Annual Media Inventories Review

An annual review of media inventories is vital. It ensures that all media containing cardholder data are accounted for and adequately protected. This review is a key component of a comprehensive risk assessment, helping to prevent data breaches and ensuring compliance.

Aligning Risk Assessment with PCI DSS v4.0 Goals

To align your risk assessment with PCI DSS v4.0, ensure that it addresses the standard’s 12 fundamental requirements. This comprehensive approach not only meets compliance mandates but also strengthens your overall security posture. At ISMS.online, we provide the tools and guidance to help you achieve this alignment effectively.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Addressing Security Needs with PCI DSS

PCI DSS v4.0 is designed to meet the evolving security needs of organisations by emphasising a continuous security process. This approach ensures that security measures are not just a one-time setup but are actively maintained and updated in response to new threats.

Continuous Security Process

A continuous security process under PCI DSS v4.0 involves regular monitoring, testing, and improvement of security controls. It requires you to stay vigilant and responsive to the changing threat landscape, ensuring that your security measures remain effective over time.

Enhanced Validation Mechanisms

Enhanced validation in PCI DSS v4.0 is achieved through more rigorous testing procedures and increased transparency in the reporting of security controls. This ensures that the implemented measures are not only in place but are functioning as intended to protect cardholder data.

Flexibility in Security Methodologies

PCI DSS v4.0 supports a range of methodologies for achieving compliance, recognising that different organisations may have varied environments and risk profiles. This flexibility allows you to adopt security practices that are most suitable for your specific circumstances while still adhering to the core objectives of the standard.

Adapting to Technological Advancements with PCI DSS

PCI DSS v4.0 recognises the rapid pace of technological evolution and provides a framework that accommodates these changes. This version introduces flexibility, allowing your organisation to adapt to new technologies while maintaining a strong security posture.

Implementing New Validation Methods

To ensure ongoing security, PCI DSS v4.0 introduces new validation methods that focus on the effectiveness of security controls. These methods include:

- Enhanced Testing Procedures: More rigorous and frequent testing to verify the integrity of security measures.

- Automated Monitoring Tools: Utilisation of advanced tools for continuous monitoring of security controls.

Achieving Flexibility in Security

PCI DSS v4.0 allows for a customised approach to security, enabling you to:

- Tailor Security Controls: Adapt standard controls to better fit your unique operational environment.

- Innovate Securely: Implement new technologies with the assurance that compliance can be maintained.

Planning for Future-Dated Requirements

The standard includes future-dated requirements, providing a roadmap for security planning. These requirements ensure that you are prepared for upcoming changes and can plan accordingly. At ISMS.online, we offer tools and services to help you stay ahead of these requirements and ensure that your security and compliance efforts are proactive rather than reactive.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Scoping and Security Awareness in PCI DSS

Annual scoping is a critical component of PCI DSS v4.0, ensuring that all processes and systems that affect the security of cardholder data are identified and properly managed.

The Significance of Annual Scoping

Annual scoping allows your organisation to review and confirm the accuracy of the cardholder data environment (CDE). This process is vital for maintaining compliance as it helps to identify any changes that might affect the security of cardholder data.

Emphasising Information Security Policies

Requirement 12 of PCI DSS v4.0 underscores the importance of robust information security policies. These policies form the backbone of your security programme, guiding the implementation of protective measures and ensuring that all personnel are aware of their roles in maintaining security.

Supporting Organisational Security Awareness

Our platform, ISMS.online, can assist in developing and disseminating organisational programmes that bolster security awareness. These programmes are designed to educate your staff on the risks to cardholder data and the best practices for mitigating those risks.

Updating Incident Response Plans for PAN Detection

Incident response plans must be regularly updated to address the detection of the Primary Account Number (PAN) and other sensitive authentication data. This ensures that in the event of a breach, your team is prepared to act swiftly and effectively to minimise damage and restore security.

Further Reading

Understanding the Role of Advanced Cybersecurity Tools

In the framework of cybersecurity, tools such as Endpoint Detection and Response (EDR), Extended Detection and Response (XDR), Security Information and Event Management (SIEM), and Managed Detection and Response (MDR) play pivotal roles in safeguarding your organisation’s data.

The Function of EDR, XDR, SIEM, and MDR

- EDR provides real-time monitoring and response to threats at the endpoint level.

- XDR extends these capabilities across networks and cloud services for a more comprehensive security posture.

- SIEM systems aggregate and analyse data from various sources to identify anomalies.

- MDR offers outsourced monitoring and management of security technologies and systems.

Adapting IT Internal Audits for PCI DSS v4.0

With the introduction of PCI DSS v4.0, IT internal audits must evolve to assess the effectiveness of these advanced tools. Audits should verify that these systems are correctly configured to meet the new standard’s requirements and that they effectively identify and mitigate risks.

The Importance of Penetration Testing in 2023

Penetration testing remains a critical component of incident response, especially as cyber threats become more sophisticated. Regular testing ensures that vulnerabilities are discovered and addressed before they can be exploited.

Preparing for Peak Shopping Periods

To prepare for increased security risks during peak shopping periods, organisations should:

- Enhance monitoring with SIEM and MDR services.

- Conduct thorough penetration tests to identify potential weaknesses.

- Review and update incident response plans to ensure rapid action in the event of a breach.

Structured Risk Assessments in PCI DSS

Structured risk assessments are paramount in the context of PCI DSS v4.0, as they provide a systematic approach to identifying, evaluating, and addressing potential security threats. Significant changes in technology or business processes can introduce new vulnerabilities, making it essential to assess their impact methodically.

Formal Necessities in Risk Assessments

A formal risk assessment process is necessary to ensure comprehensive coverage of all potential risks. This process typically includes:

- Identification of Assets: Recognising all components that store, process, or transmit cardholder data.

- Threat and Vulnerability Analysis: Determining potential threats to these assets and their vulnerabilities.

- Impact Assessment: Evaluating the potential consequences of these threats being realised.

ISMS.online’s Support for Structured Risk Assessments

At ISMS.online, we provide a platform that facilitates structured risk assessments by offering:

- Dynamic Risk Management Tools: To help you identify and prioritise risks based on their potential impact.

- Documentation Management: For maintaining clear and organised records of your risk assessment activities.

- Guided Compliance Process: Offering step-by-step guidance to ensure that nothing is overlooked.

Notable Updates in PCI DSS v4.0 Requirements

It’s important to note the updates in PCI DSS v4.0 that affect risk assessments, including:

- Enhanced Documentation: Requirements for more detailed documentation of risk assessment processes and outcomes.

- Customised Controls: The introduction of customised controls based on the outcomes of your risk assessments.

- Ongoing Monitoring: The need for continuous monitoring and reassessment as part of the risk management process.

By adhering to these structured processes and utilising the tools provided by ISMS.online, you can ensure that your risk assessments are effective and compliant with the latest PCI DSS standards.

Aligning PCI DSS with Information Security Frameworks

Integrating PCI DSS v4.0 with established information security frameworks like NIST and ISO 27001 is essential for creating a robust security posture. These frameworks complement PCI DSS by providing a comprehensive set of guidelines for managing and protecting information assets.

Best Practices for Security Audits and Testing

To ensure thorough compliance and security, consider the following best practices:

- Regular Security Audits: Conduct audits periodically to assess the effectiveness of security controls.

- Comprehensive Testing Techniques: Implement a variety of testing methods, including penetration testing and vulnerability scanning, to uncover potential weaknesses.

Ensuring Compliance with Security Threat Intelligence

Staying compliant involves a proactive approach to security threat intelligence:

- Continuous Monitoring: Keep abreast of emerging threats and adjust your security measures accordingly.

- Incident Response Planning: Develop and regularly update an incident response plan to quickly address any security breaches.

Roles and Responsibilities in Security Maintenance

Maintaining a secure environment is a collective effort:

- Clear Role Definition: Assign specific security responsibilities to team members.

- Staff Training: Ensure that all employees are trained on security best practices and understand their role in protecting sensitive data.

At ISMS.online, we provide the tools and expertise to help you integrate these frameworks into your PCI DSS compliance efforts, ensuring a comprehensive approach to data security.

ISMS.online Support Your PCI DSS Compliance Journey

At ISMS.online, we understand that navigating the complexities of PCI DSS v4.0 can be challenging. Our platform is designed to simplify your compliance journey, providing you with the tools and support needed to meet the standard’s requirements effectively.

How ISMS.online Can Assist You

Our comprehensive suite of tools enables you to:

- Conduct Thorough Risk Assessments: Utilise our dynamic risk management tools to identify, analyse, and prioritise risks.

- Maintain Up-to-Date Documentation: Easily manage and update your compliance documentation through our integrated document management system.

- Implement Robust Security Controls: Develop and enforce security policies and controls that align with PCI DSS v4.0 requirements.

Navigating Risk Assessment Complexities

We offer expert guidance to help you:

- Understand the Standard’s Nuances: Our knowledgeable team can clarify the intricacies of PCI DSS v4.0, ensuring you have a clear understanding of the requirements.

- Develop a Tailored Risk Management Strategy: Work with our specialists to create a risk management plan that fits your organisation’s specific needs.

Ensuring an Up-to-Date Risk Management Strategy

To keep your risk management strategy current, we provide:

- Regular Updates and Insights: Stay informed about the latest security threats and compliance changes with our up-to-date resources.

- Continuous Improvement Tools: Leverage our platform’s features to regularly review and enhance your security measures.

Choosing ISMS.online for Integrated Management System Needs

Selecting ISMS.online means opting for:

- A Unified Compliance Framework: Align your PCI DSS compliance efforts with other standards like ISO 27001 for a holistic approach.

- Streamlined Compliance Processes: Benefit from our pre-configured solutions and guided certification process to accelerate your compliance journey.

We are committed to supporting you every step of the way. Contact us to learn more about how we can assist with your PCI DSS v4.0 compliance needs.

Book a demo