What Is PCI DSS, Requirement 9?

The Payment Card Industry Data Security Standard (PCI DSS) has undergone significant evolution to bolster the security of payment environments. As threats have become more sophisticated, PCI DSS has adapted to provide robust defences against security breaches and fraud.

Foundational Principles of PCI DSS

At its core, PCI DSS is built upon principles designed to secure sensitive cardholder data. These principles include maintaining a secure network, protecting stored cardholder data, and implementing strong access control measures. By adhering to these principles, organisations can create a secure payment ecosystem that protects both their interests and those of their customers.

Staying Current with PCI DSS Versions

For organisations handling cardholder data, staying updated with the latest PCI DSS versions is not just a compliance requirement it’s a critical component of their security posture. Each iteration of the standard incorporates new insights and addresses emerging threats, ensuring that security measures remain effective against the evolving landscape of cyber risks.

Transitioning to PCI DSS Version 4.0

The release of PCI DSS version 4.0 in March 2022 marks a significant update, with a transition period extending until March 2024. This transition allows entities to adapt to the new requirements gradually. For you as a compliance officer, understanding these changes is vital. The updated standard emphasises flexibility and performance-based objectives, allowing for customised implementation strategies that align with your organisation's specific needs and technological advancements.

At ISMS.online, we recognise the importance of this transition and offer services to help you navigate the complexities of updating your compliance strategies. Our platform provides tools and resources to ensure that your organisation remains ahead of the curve in payment security.

Book a demoThe Role of PCI SSC in PCI DSS

The Payment Card Industry Security Standards Council (PCI SSC) is pivotal for the purpose of payment security. As the administering body for the Payment Card Industry Data Security Standard (PCI DSS), the PCI SSC’s authoritative functions extend beyond mere standard setting. They are instrumental in fostering a secure payment ecosystem by continuously updating and improving the standards to address evolving security threats.

Continuous Improvement of Payment Security Standards

PCI SSC’s commitment to enhancing payment security is evident in their rigorous approach to updating the PCI DSS. By engaging with a global forum of industry stakeholders, they ensure that the standards reflect the latest in security practices and technological advancements. This collaborative effort results in a robust set of requirements that protect cardholder data against current and emerging threats.

Guidance Beyond Standard Setting

In addition to standard setting, the PCI SSC provides extensive guidance to support organisations in their compliance journey. For instance, they offer resources on Skimming Prevention for Point-of-Interaction (POI) devices, which are crucial in thwarting one of the most common attack vectors in payment fraud.

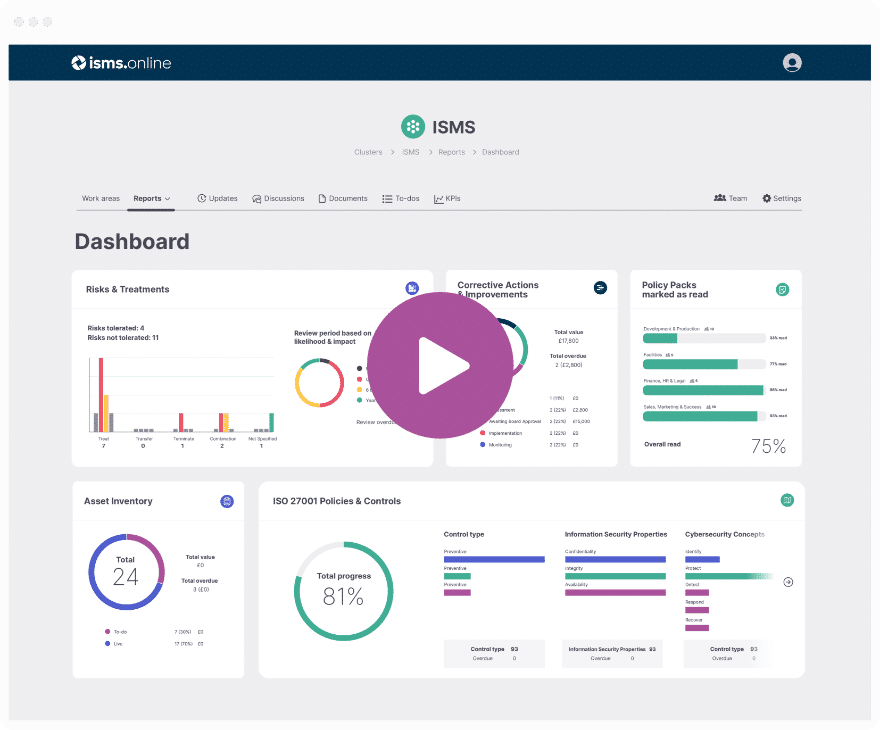

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Compliance as a Strategic Goal

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) transcends the realm of mandatory requirements; it serves as a strategic asset for organisations. Adherence to PCI DSS is not merely about fulfilling a checklist; it’s about embedding a culture of security that significantly reduces the risk of card fraud and data breaches.

Reducing Card Fraud Risks

By aligning with PCI DSS, you’re implementing a robust security framework that safeguards sensitive cardholder data. This proactive stance not only minimises the likelihood of financial fraud but also strengthens your overall security posture, making your organisation a less attractive target for cybercriminals.

GDPR Implications on PCI DSS Compliance

For entities handling cardholder data within the scope of the General Data Protection Regulation (GDPR), PCI DSS compliance is doubly crucial. GDPR’s stringent data protection requirements dovetail with PCI DSS’s security measures, ensuring that you’re not only compliant but also demonstrating due diligence in protecting personal data.

Enforcing Compliance Through Audits and Penalties

Regular audits are a cornerstone of PCI DSS compliance, serving as both a checkpoint and a deterrent. Non-compliance can result in severe penalties, including hefty fines and, in extreme cases, the revocation of card payment processing privileges. These consequences underscore the importance of maintaining a vigilant and compliant stance in your data security practices.

Merchant and Service Provider Compliance Levels

Understanding the compliance levels for merchants and service providers is essential for adhering to the Payment Card Industry Data Security Standard (PCI DSS). These levels are determined by transaction volume and dictate the rigour of compliance verification required.

Determining Compliance Levels

The PCI DSS categorises merchants and service providers into different levels based on the annual volume of card transactions they process. This tiered approach ensures that the most stringent security measures are applied where the risk is greatest.

- Level 1: Applies to merchants processing over 6 million transactions per year and service providers handling over 300,000 transactions.

- Level 2 to 4: Categorised by decreasing transaction volumes, with Level 4 applying to merchants processing fewer than 20,000 e-commerce transactions annually.

Compliance Requirements by Level

Each level has specific compliance requirements:

- Level 1: Requires an annual external audit by a Qualified Security Assessor (QSA) and submission of a Report on Compliance (RoC).

- Levels 2 to 4: Can often self-assess using Self-Assessment Questionnaires (SAQs), which simplifies the compliance process.

The Role of QSAs and SAQs

For Level-1 entities, the QSA’s role is critical as they provide an independent validation of security measures, ensuring that the most robust controls are in place. For Levels 2 to 4, SAQs offer a streamlined method to demonstrate compliance, allowing smaller entities to efficiently manage and report their security posture. At ISMS.online, we understand the nuances of these requirements and offer guidance to help you navigate the compliance landscape effectively.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Restricting Physical Access

At ISMS.online, we recognise the fundamental role of PCI DSS Requirement 9 in safeguarding cardholder data. This requirement is dedicated to the protection of sensitive information by controlling physical access to the data environment.

Core Objectives of PCI DSS Requirement 9

The primary goal of Requirement 9 is to prevent unauthorised individuals from gaining physical access to systems where cardholder data is processed, stored, or transmitted. It is designed to:

- Ensure that only authorised personnel have physical access to sensitive data.

- Protect against the physical manipulation of data systems that could compromise cardholder information.

Contribution to Data Integrity and Security

Physical access control is a cornerstone of data security for several reasons:

- It mitigates the risk of data theft or damage from internal and external threats.

- It serves as a deterrent against unauthorised access, thereby maintaining the integrity of the cardholder data environment.

Risks of Inadequate Physical Access Control

Failing to restrict physical access can lead to severe consequences, including:

- Data breaches that result in financial loss and reputational damage.

- Non-compliance penalties that may include fines or loss of payment processing capabilities.

Alignment with PCI DSS Goals

Requirement 9 is integral to the broader objectives of PCI DSS, which aim to establish a secure payment processing ecosystem. By adhering to this requirement, you’re not only complying with a mandate but also reinforcing the trust of your customers and stakeholders in your commitment to data security.

Implementing Sub-Requirements of Requirement 9

To effectively restrict physical access to cardholder data, PCI DSS Requirement 9 mandates a series of sub-requirements. At ISMS.online, we guide you through the implementation of these critical controls to ensure the protection of sensitive information.

Defining Access Restriction Processes

Organisations must establish clear processes to control physical access to cardholder data. This includes:

- Identifying and authenticating access: Ensuring that only authorised personnel can enter sensitive areas.

- Documenting access protocols: Keeping records of who has access, when, and to which areas.

Managing Personnel and Visitor Access

Effective management of access to secure areas is crucial:

- Access control systems: Implement badge readers or biometric scanners to manage entry.

- Visitor logs: Maintain a record of all visitors, their purpose of visit, and monitor their access.

Best Practices for Media Security

Protecting media containing cardholder data involves:

- Secure storage: Locking away physical media in a secure location.

- Controlled access and distribution: Limiting access to media based on job roles and responsibilities.

- Documented destruction procedures: Ensuring media is destroyed in a manner that prevents data reconstruction.

Ensuring POS Device Security and Data Disposal

Point-of-Interaction (POI) devices require special attention:

- Regular inspections: Checking devices for tampering or unauthorised substitution.

- Secure disposal: Implementing procedures for the safe disposal of devices to prevent data leaks.

By adhering to these sub-requirements, you’re taking a significant step towards securing your cardholder data environment and maintaining PCI DSS compliance.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Synergy with Other PCI DSS Controls

PCI DSS Requirement 9 does not operate in isolation; it is part of a comprehensive framework designed to secure cardholder data. Understanding how this requirement interacts with other PCI DSS controls is crucial for creating a cohesive security strategy.

Synergy with User Identification and Authentication

Requirement 9’s effectiveness is closely linked to Requirement 8, which mandates unique user identification and authentication. Here’s why:

- Access Control: Requirement 8 ensures that only authenticated users gain access to systems, complementing the physical access controls of Requirement 9.

- Accountability: By tying access to individual user IDs, organisations can trace actions back to specific users, reinforcing the physical security measures.

Essential Role of Monitoring and Logging Access

Requirement 10’s call for monitoring and logging access is vital for several reasons:

- Audit Trails: It creates a record of who accessed cardholder data, providing an audit trail that is essential for investigating security incidents.

- Detection and Response: Continuous monitoring allows for the timely detection of unauthorised access, enabling swift response to potential breaches.

Complementing Network and System Security Measures

The controls in Requirement 9 enhance network and system security by:

- Preventing Physical Threats: Restricting physical access helps prevent direct attacks on network systems and devices.

- Supporting Cybersecurity: Physical security measures support cybersecurity efforts, creating a multi-layered defence against data breaches.

By integrating Requirement 9 with other PCI DSS controls, you’re not just checking a box for compliance; you’re building a robust security environment that protects both the physical and digital realms of cardholder data.

Further Reading

Addressing the Challenges of E-Commerce

The surge in e-commerce has magnified the significance of PCI DSS Requirement 9, which focuses on restricting physical access to cardholder data. As online transactions become more prevalent, the need to secure data not just digitally, but also physically, becomes increasingly critical.

E-Commerce and the Amplified Importance of Requirement 9

For e-commerce businesses, the physical security of data centres, servers, and backup media is as vital as cybersecurity measures. With the expansion of e-commerce:

- Data Centres: The locations where transactions are processed and data is stored must be rigorously protected.

- Backup Media: Physical copies of cardholder data require secure storage to prevent unauthorised access.

Mitigating Non-Compliance Risks in E-Commerce

To mitigate the risks of non-compliance, e-commerce businesses should:

- Assess Risks: Regularly evaluate physical security measures to ensure they are adequate for protecting cardholder data.

- Update Policies: Keep physical security policies up-to-date with the changing e-commerce landscape.

Strategies for Continuous Compliance

Organisations can employ several strategies to maintain compliance:

- Regular Training: Ensure staff are trained on the latest physical security protocols.

- Continuous Monitoring: Implement systems to monitor physical access points to sensitive areas around the clock.

By adopting these strategies, you’re not only complying with PCI DSS Requirement 9 but also fortifying your defences against the unique challenges posed by the e-commerce sector.

Essential Physical Security Measures for PCI DSS Compliance

When it comes to protecting cardholder data, PCI DSS Requirement 9 mandates a set of essential physical security measures. These measures are designed to prevent unauthorised access and protect the integrity of the cardholder data environment (CDE).

Implementing Access Control Systems

Effective access control is a critical component of physical security:

- Entry Management: Instal systems like badge readers or biometric scanners to manage both authorised and unauthorised entry.

- Access Authorisation: Ensure that access rights are granted based on job role and necessity, minimising the risk of internal threats.

The Role of Surveillance in Data Protection

Surveillance systems serve as both a deterrent and a means of detection:

- Monitoring: Use video cameras to monitor sensitive areas, keeping an eye on entry points and the CDE.

- Data Retention: Maintain surveillance records for a minimum of three months to aid in investigations should a breach occur.

Ensuring Ongoing Compliance Through Training

Staff training and awareness are key to maintaining security:

- Regular Training Programmes: Conduct training sessions to keep staff informed about security protocols and their role in protecting cardholder data.

- Awareness Campaigns: Implement ongoing awareness campaigns to ensure that security remains at the forefront of staff consciousness.

By following these best practices, you’re taking proactive steps to secure your organisation’s cardholder data and maintain compliance with PCI DSS Requirement 9. At ISMS.online, we provide the tools and guidance to help you implement these measures effectively.

Identifying Gaps and PCI DSS Requirement 9 Compliance

Organisations must actively monitor and improve their adherence to PCI DSS Requirement 9 to ensure the ongoing security of cardholder data. At ISMS.online, we advocate for a systematic approach to compliance monitoring.

Identifying and Addressing Control Gaps

Regular assessments are crucial for identifying control gaps in physical access restrictions:

- Conduct Audits: Perform periodic internal and external audits to uncover any deficiencies in physical security controls.

- Review Access Logs: Analyse access logs to ensure only authorised personnel are accessing sensitive areas.

Establishing Compensating Controls

When gaps are identified, compensating controls become necessary:

- Implement Additional Measures: If certain requirements cannot be met, introduce compensating controls to maintain security levels.

- Document Changes: Keep a detailed record of any compensating controls for audit purposes.

Ongoing Compliance Responsibilities

Maintaining compliance with Requirement 9 is an ongoing duty:

- Continuous Review: Regularly review physical security measures to ensure they remain effective and compliant.

- Update Security Protocols: As threats evolve, so should your security protocols to address new challenges.

By staying vigilant and responsive to the dynamic nature of security threats, you can ensure that your organisation remains compliant with PCI DSS Requirement 9 and protects cardholder data effectively.

PCI DSS Requirement 9 and ISO 27001:2022

In the pursuit of robust security, aligning PCI DSS Requirement 9 with ISO 27001:2022 controls is a strategic approach that we at ISMS.online advocate for. This alignment ensures that your organisation’s physical security measures are comprehensive and adhere to internationally recognised best practices.

PCI DSS Requirement 9.1 and ISO 27001:2022 Mapping

For Requirement 9.1, which focuses on defining and understanding processes for restricting physical access:

- A.7.1 Physical Security Perimeters: Establish secure perimeters to protect areas where cardholder data is processed or stored.

- 5.3 Organisational Roles, Responsibilities, and Authorities: Clearly define roles and responsibilities related to physical security to ensure accountability.

PCI DSS Requirement 9.2 and ISO 27001:2022 Mapping

Requirement 9.2 emphasises managing entry into facilities and systems:

- A.7.2 Physical Entry Controls: Implement measures to prevent unauthorised physical access to information and information processing facilities.

- A5.15 Access Control: Control access to information and systems based on business and security requirements.

- A.7.4 Physical Security Monitoring: Monitor and detect unauthorised physical access.

PCI DSS Requirement 9.3 and ISO 27001:2022 Mapping

Requirement 9.3 deals with the authorisation and management of access for personnel and visitors:

- A.7.2 Physical Entry Controls: Ensure secure entry to facilities.

- A.7.3 Securing Offices, Rooms, and Facilities: Protect information in offices, rooms, and facilities against unauthorised access.

PCI DSS Requirement 9.4 and ISO 27001:2022 Mapping

For Requirement 9.4, which covers the secure handling of media:

- Requirement 7.6 Working in Secure Areas: Take precautions when working in secure areas to avoid unauthorised access.

- Annex A Controls A.7.10 Storage Media: Protect media containing data from unauthorised access, misuse, or corruption.

- A.5.9 Inventory of Assets: Maintain an inventory of assets associated with information and information processing facilities.

PCI DSS Requirement 9.5 and ISO 27001:2022 Mapping

Requirement 9.5 focuses on protecting Point-of-Interaction (POI) devices:

- A.7.8 Equipment Siting and Protection: Prevent physical damage or loss of information and interference with organisation operations.

- A.5.9 Inventory of Assets: Control inventory to protect assets.

- A.6.3 Information Security Awareness, Education, and Training: Educate and train employees about security procedures and the correct use of information processing facilities.

By mapping PCI DSS Requirement 9 to ISO 27001:2022 controls, you’re ensuring that your physical security controls are not only compliant but also resilient against a spectrum of physical threats.

Navigating PCI DSS Requirement 9 with ISMS.online

Navigating the complexities of PCI DSS Requirement 9 can be daunting. At ISMS.online, we understand the intricacies involved in restricting physical access to cardholder data. Our platform is designed to support your organisation through this process with a suite of tailored solutions.

Tailored Solutions for Your Compliance Challenges

We offer a range of services to address your specific compliance needs:

- Pre-configured Templates: Simplify the documentation process with our ready-to-use policy and control templates that align with PCI DSS requirements.

- Risk Management Tools: Identify and assess risks associated with physical access to cardholder data using our comprehensive risk management module.

Strategic Partnership for Comprehensive Compliance

Partnering with us means you’re choosing a strategic approach to PCI DSS compliance:

- Expert Guidance: Our team of experts is available to provide advice and support, ensuring you understand and meet all aspects of Requirement 9.

- Integrated Management System: Our platform aligns with Annex L of ISO standards, offering a cohesive approach to managing your security controls.

Smoothing the Transition to PCI DSS Version 4.0

As PCI DSS evolves, so do our services:

- Stay Informed: We keep you updated on the latest changes, including the transition to PCI DSS version 4.0.

- Seamless Updates: Our platform evolves with the standards, ensuring you have the most current tools at your disposal.

For expert guidance on achieving and maintaining compliance with PCI DSS Requirement 9, reach out to us at ISMS.online. We're here to help you protect cardholder data and navigate the compliance landscape with confidence.

Book a demo