Understanding the ‘Business Need to Know’ Principle

When we discuss PCI DSS Requirement 7, we’re delving into the critical concept of limiting access to your system components and cardholder data strictly to individuals whose job roles necessitate it. This ‘business need to know’ principle is a cornerstone of maintaining a secure payment environment. It ensures that sensitive information is only accessible to authorised personnel, thereby reducing the risk of data breaches and unauthorised access.

Defining System Components and Cardholder Data

Under PCI DSS Requirement 7, system components are defined as any network devices, servers, computing devices, and applications that are part of your cardholder data environment (CDE). Cardholder data encompasses any information printed, processed, transmitted, or stored on a payment card. As a compliance officer, you’re tasked with safeguarding this data, which is fundamental to the integrity of the payment card industry.

Impact on Security Posture

By enforcing the ‘business need to know’ principle, Requirement 7 directly enhances your organisation’s security posture. It ensures that access to sensitive data is controlled and monitored, thereby mitigating potential internal and external threats to your CDE.

Aligning with PCI DSS Objectives

Requirement 7 is not an isolated directive; it's an integral part of the broader PCI DSS framework aimed at protecting cardholder data. This requirement intersects with other PCI DSS mandates, such as maintaining a vulnerability management programme and implementing strong access control measures. At ISMS.online, we understand the complexities of these interconnections and provide the tools and guidance necessary to navigate them effectively.

Book a demoWhat Is PCI DSS, Requirement 7?

When addressing PCI DSS Requirement 7, you’re tasked with establishing processes that restrict access to system components and cardholder data based on the ‘business need to know.’ This principle is fundamental to maintaining a secure payment environment. Let’s delve into the specifics of these processes and how they contribute to safeguarding sensitive information.

Mandated Processes for Access Restriction

PCI DSS Requirement 7 mandates that you define and implement processes that limit access rights to network resources and cardholder data to only those individuals whose job requires such access. These processes typically involve:

- Identifying and documenting the roles that require access to sensitive data.

- Assigning unique IDs to each person with computer access to trace actions to individuals.

- Establishing a system for access request and approval to ensure that access rights are granted according to the defined roles.

Ensuring Protection of Cardholder Data

To ensure the protection of cardholder data, the processes you implement must:

- Enforce least privilege by providing the minimum level of access necessary for individuals to perform their job functions.

- Incorporate periodic reviews of access rights to confirm they remain aligned with job requirements.

Documentation for Compliance

Compliance with PCI DSS Requirement 7 requires maintaining documentation that includes:

- Access control policies that specify how access is controlled and who approves it.

- Records of access granted or revoked, demonstrating adherence to the ‘business need to know’ principle.

ISMS.online’s Role in Process Management

At ISMS.online, we provide a platform that simplifies the management of these processes. Our tools enable you to:

- Streamline the documentation of access control policies and procedures.

- Monitor and review access rights efficiently, ensuring ongoing compliance.

By leveraging our platform, you can ensure that your access control processes are robust, compliant, and effectively protect cardholder data.

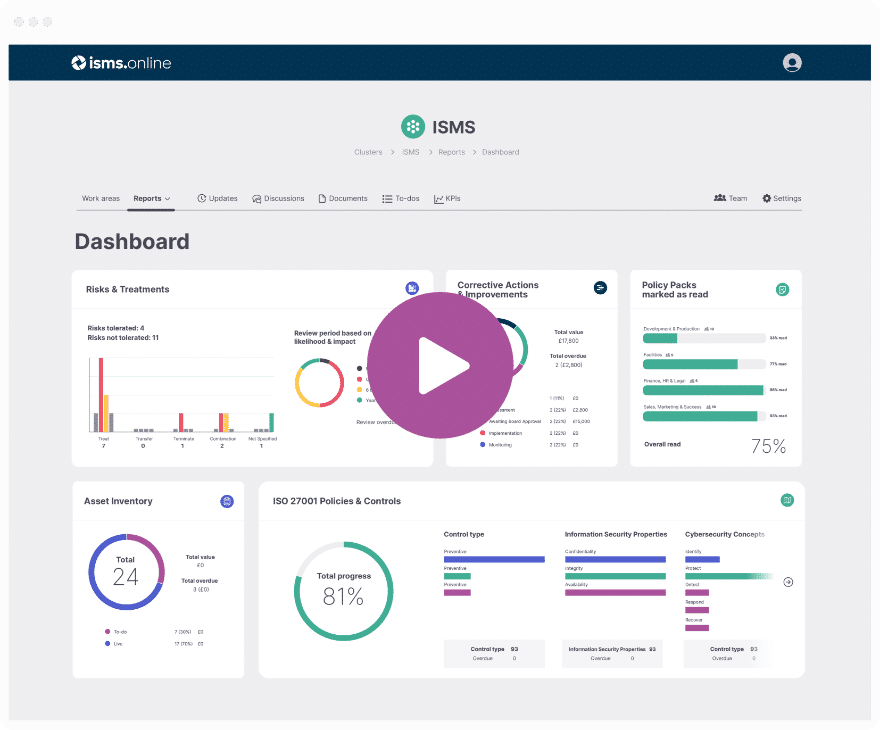

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Enforcing ‘Need to Know’ Access

Effective access control is a cornerstone of PCI DSS Requirement 7, ensuring that only authorised individuals have access to sensitive cardholder data. Let’s explore the mechanisms that enforce this ‘need to know’ principle and how they integrate with your security systems.

Effective Access Restriction Mechanisms

To enforce access restrictions, you should consider implementing:

- Role-Based Access Control (RBAC): Assign access based on individual roles within your organisation.

- Access Control Lists (ACLs): Specify which users or system processes are granted access to objects, as well as what operations are allowed on given objects.

- Multi-Factor Authentication (MFA): Enhance security by requiring multiple forms of verification before granting access.

Integration with Security Systems

These mechanisms should seamlessly integrate with your existing security infrastructure, enhancing your ability to monitor and control access without disrupting user productivity. Integration also facilitates:

- Centralised management of access controls.

- Real-time monitoring and alerts for unauthorised access attempts.

- Automated provisioning and deprovisioning of user access.

Challenges in Implementation

Organisations may encounter challenges such as:

- Complexity in role definitions: Ensuring that access levels are appropriately tailored to each role.

- User resistance to change: Educating users on new security measures and their importance.

Streamlining Access Control with ISMS.online

At ISMS.online, we simplify the enforcement of access control. Our platform offers:

- Pre-configured templates for access control policies.

- Automated workflows for managing user access.

- Comprehensive tracking of access changes for audit purposes.

By utilising our services, you can ensure that your access control mechanisms are not only effective but also compliant with PCI DSS Requirement 7.

Role-Based Access Control and Compliance

Role-Based Access Control (RBAC) is a strategic approach that supports the fulfilment of PCI DSS Requirement 7 by aligning access permissions with the roles within your organisation. Let’s examine how RBAC facilitates compliance and the best practices for its implementation.

Best Practices for Defining Roles and Access Levels

To effectively implement RBAC, you should:

- Identify specific job functions and the data access necessary for each role.

- Establish clear role definitions to ensure that access rights are consistent and aligned with job responsibilities.

- Apply the principle of least privilege, granting only the access necessary to perform a job.

Regular Review and Update of Access Privileges

It’s essential to review and update roles and access privileges regularly. We recommend doing this:

- At least every six months, or more frequently if there are significant changes in job functions or the risk environment.

- Following any major organisational change, such as mergers, acquisitions, or restructuring.

ISMS.online’s Assistance in Role Definition and Access Control

At ISMS.online, we provide tools and services to assist you in:

- Creating and managing role definitions with our pre-built templates and frameworks.

- Automating the review process for access privileges, ensuring they remain up-to-date and compliant.

- Documenting all changes in roles and access rights, which is crucial for audit trails and compliance verification.

By leveraging our platform, you can ensure that your RBAC strategy not only meets PCI DSS requirements but also enhances your overall security posture.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Compliance and Audit Preparedness

Annual compliance validation is a critical component of PCI DSS Requirement 7, ensuring that access to system components and cardholder data is restricted appropriately. This process is vital for maintaining the integrity of your secure payment environment.

Understanding the Compliance Validation Process

The annual compliance validation process involves:

- Self-Assessment Questionnaires (SAQs): These are tools provided by the PCI SSC for merchants and service providers to self-evaluate their compliance with PCI DSS requirements.

- Qualified Security Assessors (QSAs): QSAs are organisations certified by the PCI SSC to conduct external validation of compliance with all PCI DSS requirements.

Preparing for QSAs and SAQs

To prepare for QSAs and SAQs, organisations should:

- Conduct regular internal reviews to ensure ongoing adherence to PCI DSS requirements.

- Gather necessary documentation that evidences compliance, such as access control policies and procedures.

- Perform gap analyses to identify and address any areas of non-compliance before the QSA review.

The Role of Audit Readiness

Audit readiness plays a crucial role in compliance validation by:

- Ensuring that all PCI DSS requirements are met and documented systematically.

- Facilitating a smoother audit process with fewer surprises or areas of non-compliance.

ISMS.online’s Support for Audit Preparedness

At ISMS.online, we support your audit preparedness and compliance validation by providing:

- Guided certification processes to navigate the complexities of PCI DSS compliance.

- Dynamic risk management tools to identify and mitigate potential compliance risks.

- Efficient document management to organise and present evidence of compliance during audits.

By utilising our platform, you can approach your annual compliance validation with confidence, knowing that you have a robust system in place to demonstrate your adherence to PCI DSS Requirement 7.

Addressing Merchant and Service Provider Level Requirements

Understanding how transaction volumes influence merchant and service provider levels is crucial for PCI DSS compliance. These levels dictate the rigour of the validation process required to demonstrate compliance.

Impact of Transaction Volumes on Compliance Levels

Transaction volumes directly affect your classification level:

- Level 1: Applies to merchants processing over 6 million transactions annually, requiring an annual Report on Compliance (RoC) by a Qualified Security Assessor (QSA).

- Level 2-4: Applies to merchants with lower transaction volumes, with varying requirements for self-assessment and external audits.

Specific PCI DSS Compliance Requirements

Each level has specific requirements:

- Level 1 merchants must undergo a full on-site security audit and quarterly network scans by an Approved Scanning Vendor (ASV).

- Levels 2-4 may be eligible to self-assess using the appropriate Self-Assessment Questionnaire (SAQ).

Approaching Scope Reduction and Security Testing

To effectively manage compliance efforts:

- Identify and minimise the cardholder data environment (CDE) to reduce the scope of PCI DSS requirements.

- Implement continuous security testing to ensure that controls are effective and vulnerabilities are addressed promptly.

ISMS.online’s Support for Level-Specific Requirements

At ISMS.online, we assist organisations in meeting their level-specific requirements by providing:

- Integrated compliance frameworks that align with PCI DSS and other relevant standards.

- Efficient document management for organising evidence of compliance.

By partnering with us, you can navigate the complexities of PCI DSS compliance with confidence, regardless of your transaction volume or merchant level.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Effective Access Control Policies

Developing and implementing access control policies is a pivotal step in complying with PCI DSS Requirement 7. These policies are the foundation for safeguarding cardholder data by ensuring that access is granted on a strict ‘need to know’ basis.

Key Components of Access Control Policies

Effective access control policies should include:

- Clear definitions of roles and responsibilities: Specify who can access what data and under which conditions.

- Procedures for granting and revoking access: Outline the process for modifying access rights, ensuring it’s both secure and auditable.

- Audit and review schedules: Establish regular intervals for reviewing and updating access controls to maintain their effectiveness.

Communication and Enforcement of Policies

To ensure policies are effective:

- Disseminate policies widely: Ensure all employees are aware of the access control policies and understand their importance.

- Enforce policies consistently: Apply the rules uniformly across the organisation to prevent unauthorised access and data breaches.

Avoiding Pitfalls in Policy Development

Common pitfalls can be avoided by:

- Engaging stakeholders early: Include input from various departments to ensure the policies are practical and comprehensive.

- Regularly updating policies: Adapt to changes in the threat landscape and business processes to maintain relevance and effectiveness.

ISMS.online’s Role in Policy Development

At ISMS.online, we facilitate the development and implementation of your access control policies by providing:

- Template policies and controls: Jumpstart your policy creation with our pre-built, customisable documents.

- Collaborative tools: Engage with your team to refine and agree upon policies in real-time.

- Compliance tracking: Monitor adherence to policies and manage documentation for audits seamlessly.

By partnering with us, you can ensure that your access control policies are not only robust but also aligned with the stringent requirements of PCI DSS Requirement 7.

Further Reading

The Role of Multi-Factor Authentication

As it pertains to securing sensitive cardholder data, Multi-Factor Authentication (MFA) is not just an option, it’s a critical layer of defence. Let’s explore why MFA is indispensable and how it complements other access control measures within the PCI DSS framework.

The Criticality of MFA in Data Security

MFA is essential because it:

- Adds an extra layer of security by requiring multiple forms of user verification.

- Significantly reduces the risk of unauthorised access, even if login credentials are compromised.

Integrating MFA with Other Access Controls

MFA works best when used in tandem with other security measures, creating a robust security posture that includes:

- Role-Based Access Control (RBAC) to ensure users have access rights aligned with their job functions.

- Access Control Lists (ACLs) to define and enforce what resources users can access.

Selecting the Right MFA Solutions

When choosing MFA solutions, consider:

- Ease of use to ensure high adoption rates among users.

- Compatibility with your existing security infrastructure.

- Regulatory compliance to meet PCI DSS and other relevant standards.

Consequences of PCI DSS Non-Compliance

Non-compliance with PCI DSS Requirement 7 can lead to significant repercussions for your organisation. Understanding these risks is crucial for maintaining the security and trust integral to the payment ecosystem.

Potential Penalties for Non-Compliance

Should you fail to comply with PCI DSS Requirement 7, you may face:

- Financial penalties: These can range from fines to more severe financial liabilities in the event of a data breach.

- Operational disruptions: Non-compliance can result in the suspension of your ability to process payment card transactions.

- Reputational damage: Trust is paramount in financial transactions, and non-compliance can erode customer confidence.

Mitigating Risks of Non-Compliance

To mitigate these risks, it’s essential to:

- Regularly review and update access controls: Ensure they align with current job roles and the principle of least privilege.

- Educate your staff: Ongoing training on the importance of PCI DSS compliance can help prevent accidental breaches.

ISMS.online’s Role in Ensuring Compliance

At ISMS.online, we are committed to helping you avoid the pitfalls of non-compliance by providing:

- Comprehensive tools: Our platform offers robust policy and control management features to maintain PCI DSS compliance.

- Expert guidance: Our team can assist you in understanding and implementing the necessary controls to meet Requirement 7.

- Continuous improvement: We help you stay ahead of evolving threats and compliance requirements.

By partnering with us, you can take proactive steps to ensure your organisation remains compliant with PCI DSS Requirement 7, thereby protecting your business from the potential penalties and loss of trust that come with non-compliance.

Strengthening Cybersecurity with Logical Access Controls

Logical access controls are a fundamental aspect of cybersecurity, serving as the first line of defence in protecting sensitive information from unauthorised access. As cyber threats evolve, so too must our strategies for safeguarding data.

The Role of Logical Access Controls

Logical access controls help to:

- Ensure secure authentication by verifying user identities before granting access to systems.

- Enforce authorization by defining what actions users can perform once access is granted.

- Maintain accountability by tracking user activities, which is critical for detecting and responding to potential security incidents.

Addressing Emerging Cyber Threats

In the face of new cyber threats, logical access controls must:

- Adapt to sophisticated attack vectors, such as social engineering and advanced persistent threats (APTs).

- Incorporate advanced technologies like biometrics and behavioural analytics for stronger authentication.

ISMS.online’s Approach to Logical Access

At ISMS.online, our approach to logical access controls includes:

- Comprehensive access management tools that are easy to implement and manage.

- Continuous monitoring and updating of access control measures to address the latest security trends and threats.

- Expert guidance to ensure that your logical access controls are robust and compliant with PCI DSS Requirement 7.

By utilising our platform, you can enhance your cybersecurity posture and stay ahead of the curve in the ever-changing threat landscape.

Aligning PCI DSS Requirement 7 with ISO 27001:2022

Understanding the alignment between PCI DSS Requirement 7 and ISO 27001:2022 controls is essential for creating a comprehensive access control system that not only meets compliance standards but also enhances your organisation’s security posture.

The Intersection of PCI DSS and ISO 27001:2022

PCI DSS Requirement 7 and ISO 27001:2022 share common goals in protecting information assets:

- Both standards emphasise the importance of defining and restricting access based on the ‘business need to know’ principle.

- They require the establishment of clear organisational roles, responsibilities, and authorities to manage access rights effectively.

Benefits of Standard Alignment

Aligning these two standards offers several benefits:

- Streamlined compliance efforts: By meeting PCI DSS requirements, you’re also addressing key aspects of ISO 27001:2022.

- Enhanced security measures: The combined strength of both standards provides a more robust defence against data breaches.

Specific ISO Controls Supporting PCI DSS

The following ISO 27001:2022 controls support PCI DSS access control requirements:

- A.5.15 Access Control: Ensures that access to systems and data is controlled and managed securely.

- A.5.18 Access Rights: Involves defining and assigning user access rights to prevent unauthorised access to sensitive information.

Leveraging ISMS.online for Compliance Alignment

At ISMS.online, we provide tools and guidance to help you align with both PCI DSS and ISO 27001:2022 standards:

- Our platform includes pre-configured templates that map directly to the required controls.

- We offer integrated frameworks that address all aspects of information security, making compliance more manageable.

By utilising our services, you can ensure that your access control systems are in line with industry best practices and compliance requirements, providing peace of mind and a clear path to certification.

ISMS.online and Your PCI DSS Compliance Journey

Navigating the complexities of PCI DSS compliance can be challenging. At ISMS.online, we understand the intricacies involved and are dedicated to providing tailored support to ensure your compliance journey is smooth and successful.

The ISMS.online Team

Our team of experts offers consultancy services specifically designed to address PCI DSS Requirement 7:

- Gap Analysis: We help you identify areas where your access control systems may not meet the standard’s requirements.

- Policy Development: Our specialists assist in creating or refining access control policies that are both compliant and practical for your organisation.

Enhancing Security and Compliance Posture

Partnering with ISMS.online can significantly enhance your organisation’s security and compliance posture:

- Integrated Management Systems: Our platform offers a comprehensive suite of tools that integrate with your existing systems, streamlining compliance management.

- Continuous Improvement: We provide ongoing support to ensure your access controls evolve with changing regulations and threats.

Choosing ISMS.online for Integrated Management System Needs

Selecting ISMS.online for your integrated management system needs is a strategic decision:

- Expertise: Our deep understanding of PCI DSS requirements ensures that you receive knowledgeable guidance.

- Resource Availability: With a wealth of resources at your disposal, including guides, checklists, and templates, you're well-equipped to achieve and maintain compliance.

By choosing ISMS.online, you're not just adopting a platform; you're gaining a partner committed to your organisation's security and compliance success.

Book a demo