What Is PCI DSS, Requirement 4?

When you’re tasked with safeguarding cardholder data, understanding and implementing PCI DSS Requirement 4 is paramount. This requirement focuses on the protection of cardholder data (CHD) during its transmission over open, public networks using strong cryptography.

The Scope and Objective of PCI DSS Requirement 4

The scope of PCI DSS Requirement 4 is to ensure that all entities that handle CHD employ robust encryption methods when transmitting this sensitive information across networks that are easily accessible to the public. The objective is to mitigate the risk of unauthorised interception and access, which could lead to data breaches and financial fraud.

The Importance of Strong Cryptography

Strong cryptography serves as a critical defence mechanism, creating a secure channel for transmitting CHD by transforming readable data into a coded form that can only be deciphered with the correct cryptographic key. This ensures that even if data is intercepted, it remains indecipherable and useless to potential attackers.

Encrypting Data Over Public Networks

Public networks, including the Internet, wireless networks, and others, are inherently insecure due to their open nature, making encryption not just beneficial but essential. Without encryption, CHD is vulnerable to a range of cyber threats.

Alignment with PCI DSS Compliance Goals

Requirement 4 is integral to the broader goals of PCI DSS, which aim to establish a secure environment for cardholder data across the entire payment ecosystem. By encrypting data in transit, you're taking a significant step towards comprehensive data security and PCI DSS compliance.

At ISMS.online, we understand the complexities of meeting these requirements and offer solutions to streamline your compliance process. Our platform is designed to help you document, manage, and implement the strong cryptographic practices required by PCI DSS Requirement 4, ensuring that your organisation maintains the highest standards of data security.

Book a demoDefining Strong Cryptography Under PCI DSS

When we discuss PCI DSS Requirement 4, it’s essential to understand what is meant by “strong cryptography.” This term refers to encryption protocols that provide a secure method of protecting cardholder data (CHD) during transmission over public networks. Strong cryptography includes protocols such as TLSv1.2 or higher, SSH-2, and IPSEC. These protocols are designed to ensure that sensitive information, like Primary Account Numbers (PAN), remains unreadable and secure from unauthorised access.

Recognising Public Networks in PCI DSS

Public networks encompass a variety of communication channels that are open to the public and, therefore, more susceptible to security breaches. Within the scope of PCI DSS Requirement 4, public networks include the Internet, wireless networks, satellite communications, and MPLS. Each of these networks presents unique challenges and requires specific encryption measures to safeguard CHD effectively.

Impact of Public Networks on Encryption Needs

The type of public network in use can significantly influence the encryption requirements. For instance, wireless networks may require robust authentication and additional security measures to prevent unauthorised access. It’s crucial for your organisation to assess the specific encryption needs based on the public network utilised to ensure PCI DSS compliance.

Implications of Inadequate Cryptography

Failing to use strong cryptography on public networks can lead to severe consequences, including data breaches and non-compliance penalties. It’s imperative that your organisation adheres to the prescribed encryption standards to protect against the vulnerabilities inherent in public networks and to maintain the integrity of cardholder data.

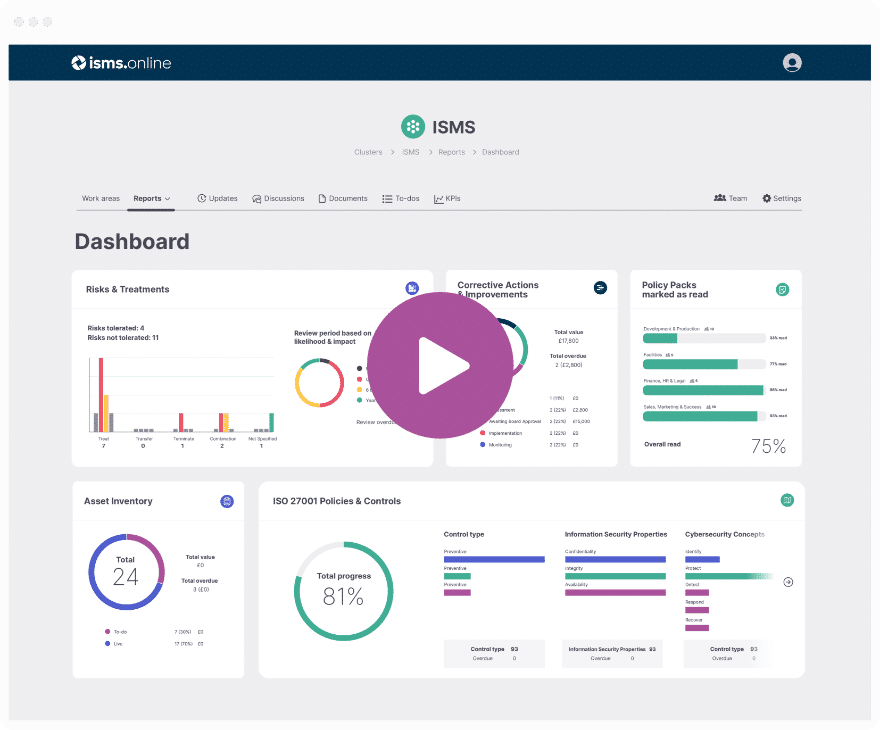

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Adhering to PCI DSS-Approved Encryption Protocols

At ISMS.online, we understand the importance of utilising approved encryption protocols to meet PCI DSS Requirement 4. The protocols that align with this requirement include TLSv1.2 or higher, SSH-2, and IPSEC. These are recognised for their ability to securely encrypt cardholder data during transmission over public networks.

Rejection of SSL and Early TLS

The PCI DSS explicitly rejects SSL and early versions of TLS. This is due to known vulnerabilities that can be exploited by cybercriminals, potentially leading to data breaches. As a result, these outdated protocols do not meet the security standards necessary for protecting sensitive cardholder information.

Best Practices for Encryption Protocol Implementation

To ensure the security of cardholder data, it’s essential to implement strong encryption protocols correctly. Best practices include:

- Regularly updating software to support the latest protocol versions.

- Configuring systems to disable fallback to less secure protocols.

- Ensuring proper certificate and key management.

Ensuring the Use of Secure and Updated Protocols

Organisations must be proactive in maintaining the security of their encryption protocols. This includes:

- Conducting periodic reviews to ensure compliance with the latest PCI DSS requirements.

- Implementing automated alerts for protocol updates and vulnerabilities.

- Engaging with knowledgeable partners like ISMS.online to stay informed on best practices and changes in standards.

Documentation Essentials for PCI DSS

To demonstrate compliance with PCI DSS Requirement 4, your organisation must maintain precise documentation that outlines the encryption protocols in use and the management of cryptographic keys. This documentation serves as a clear record that you’re protecting cardholder data (CHD) with strong cryptography across public networks.

Cryptography Management within Organisations

Cryptography management is a critical aspect of PCI DSS compliance. It involves establishing and documenting procedures for key generation, distribution, storage, and destruction. At ISMS.online, we provide tools to help you manage these processes effectively, ensuring that your cryptographic keys are handled securely throughout their lifecycle.

Sub-Requirements for Securing CHD

Requirement 4 encompasses several sub-requirements focused on safeguarding CHD:

- Encryption of data transmission: Ensuring that CHD is encrypted when transmitted over open, public networks.

- Use of strong cryptography: Implementing industry-recognised encryption methods and protocols.

- Prohibition of unprotected PANs: Preventing the transmission of unencrypted PANs through messaging or other communication channels.

The Role of Documentation in Data Security

Comprehensive documentation supports the overall security of CHD by providing a framework for consistent implementation of encryption practices. It also facilitates audits and reviews, allowing you to demonstrate compliance with PCI DSS Requirement 4 effectively. Our platform at ISMS.online simplifies the creation and maintenance of this critical documentation, streamlining your path to compliance.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Mandatory Encryption of Primary Account Number (PAN)

Protecting the Primary Account Number (PAN) is a cornerstone of PCI DSS Requirement 4. As a compliance officer, you’re tasked with ensuring that specific measures are in place to encrypt PANs during transmission over public networks.

Implementing Strong Cryptography for PAN

To secure PAN during transmission, strong cryptography must be utilised. This involves:

- Encrypting PAN using protocols such as TLSv1.2 or higher, SSH-2, or IPSEC.

- Ensuring encryption remains intact from end-to-end, preventing exposure at any point during transmission.

Consequences of Inadequate PAN Encryption

Failure to properly encrypt PAN can lead to significant risks, including financial penalties, loss of customer trust, and potential data breaches. It is imperative that your organisation adheres to the encryption standards set forth by PCI DSS to mitigate these risks.

Ensuring Secure Transmission with Requirement 4.2

Requirement 4.2 of PCI DSS mandates the encryption of PAN with strong cryptography. At ISMS.online, we provide guidance and tools to help you implement these security protocols, ensuring that your organisation’s transmission of PAN is compliant and secure.

Addressing Legacy Encryption Vulnerabilities

Legacy encryption methods, such as SSL and early TLS, are fraught with risks due to known security flaws that can be exploited by malicious entities. As a compliance officer, you must be aware that these outdated protocols can leave your organisation’s cardholder data vulnerable to cyber-attacks.

Transitioning to Modern Encryption Protocols

To mitigate these risks, it’s crucial to transition to modern encryption protocols endorsed by PCI DSS Requirement 4. This includes upgrading to TLSv1.2 or higher, which provides stronger security measures against interception and unauthorised data access.

The Role of PCI DSS Requirement 4

PCI DSS Requirement 4 plays a pivotal role in guiding organisations away from vulnerable legacy encryption methods. It mandates the use of strong cryptography and secure protocols to protect cardholder data during transmission over public networks.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Extending Strong Cryptography to Internal Networks

In the framework of PCI DSS compliance, the focus often lies on protecting cardholder data (CHD) as it traverses public networks. However, it’s equally imperative to apply strong cryptography within internal networks. This is not just a best practice; it’s a requirement that fortifies the security of CHD at every touchpoint.

Enhancing Security Through Comprehensive Encryption

By extending strong cryptography to internal network transmissions, you’re creating a robust security posture that shields against data breaches from both external and internal threats. This comprehensive approach to encryption ensures that CHD remains secure, whether at rest or in transit, within the boundaries of your organisation.

Challenges in Securing Internal Transmissions

Organisations may encounter several challenges when securing internal transmissions, including:

- Ensuring consistent encryption across all internal systems and devices.

- Managing complex network configurations that may not have been initially designed with PCI DSS requirements in mind.

- Updating legacy systems that might not support modern encryption standards.

Further Reading

Importance of Key Management in PCI DSS Requirement 4

Key management is a critical component of PCI DSS Requirement 4, as it ensures the secure creation, distribution, storage, and destruction of cryptographic keys. Effective key management practices prevent unauthorised access to cardholder data (CHD) during transmission over public networks.

Approaching PAN Masking and Secure Connections

For organisations handling CHD, masking the Primary Account Number (PAN) is essential. Masking ensures that, should the data be intercepted, the full PAN is not exposed. Secure connections, facilitated by strong cryptographic protocols, further protect data from being compromised during transmission.

Strategies for Effective Cryptographic Key Management

To manage cryptographic keys effectively, organisations should:

- Establish a key management policy and procedures.

- Limit access to keys to only those individuals who require it.

- Use automated systems to track key usage and lifecycle.

ISMS.online’s Support for Key Management and Data Masking

At ISMS.online, we offer a robust platform that supports your key management and data masking practices. Our tools help you:

- Document and enforce key management policies.

- Automate key lifecycle management.

- Integrate data masking techniques seamlessly into your data protection strategy.

By utilising our services, you can ensure that your organisation’s approach to key management and data masking aligns with PCI DSS Requirement 4, enhancing the security of your cardholder data.

Securing Wireless Networks Under PCI DSS

Wireless networks, due to their nature, present unique security challenges. Under PCI DSS Requirement 4, it’s crucial for you to implement strong encryption and authentication measures to protect cardholder data (CHD) transmitted via these networks.

Adhering to NIST and OWASP Standards

Standards from the National Institute of Standards and Technology (NIST) and the Open Web Application Security Project (OWASP) provide a foundation for wireless network security. These standards offer guidelines on encryption, access control, and regular security assessments, which are instrumental in safeguarding wireless transmissions against unauthorised access and data breaches.

Best Practices for Strong Authentication

Strong authentication is a key defence mechanism for wireless networks. Best practices include:

- Implementing Multi-factor Authentication (MFA) to add an additional layer of security.

- Using advanced encryption standards for Wi-Fi Protected Access (WPA2 or WPA3).

- Regularly updating default network passwords to complex, unique alternatives.

Implementing Compliance with Requirement 4

To comply with PCI DSS Requirement 4, organisations should:

- Conduct regular wireless network security assessments.

- Ensure that wireless network configurations adhere to the latest security protocols.

- Document all wireless network security policies and procedures.

Emphasising the Importance of PCI DSS Education

Ongoing education about PCI DSS and encryption is vital for maintaining compliance and safeguarding cardholder data. As the threat landscape evolves, so do the standards for data protection. Staying informed about these changes is not just beneficial; it’s necessary for the security of your transactions and the trust of your customers.

Documenting and Communicating Security Policies

Within your organisation, security policies should be documented clearly and communicated effectively. This ensures that all team members are aware of their roles and responsibilities in protecting cardholder data. Policies should be accessible and reviewed regularly to reflect the latest PCI DSS requirements.

Leveraging Resources for PCI DSS Updates

A wealth of resources is available to keep your organisation abreast of PCI DSS updates, including:

- The PCI Security Standards Council website for official documentation and guidance.

- Industry blogs and forums for community-driven insights and discussions.

- Webinars and training sessions that provide in-depth explanations of changes and best practices.

By partnering with us, you gain access to a suite of educational resources designed to keep your organisation informed and compliant with PCI DSS Requirement 4.

Aligning PCI DSS and ISO 27001:2022 Standards

As it relates to information security, aligning different compliance standards is a strategic approach to streamline governance and bolster data protection. For organisations seeking to satisfy both PCI DSS Requirement 4 and ISO 27001:2022 standards, understanding the intersection of these frameworks is crucial.

PCI DSS Requirement 4.1 and ISO 27001:2022 Mapping

Requirement 4.1 of PCI DSS focuses on the processes and mechanisms for protecting cardholder data with strong cryptography during transmission over open, public networks. This requirement correlates with several controls within ISO 27001:2022, notably:

- A.8.24 Use of Cryptography: This control emphasises the importance of implementing cryptographic measures to secure data, aligning with the encryption requirements of PCI DSS.

- 5.3 Organisational Roles, Responsibilities, and Authorities: It underscores the need for clear documentation and assignment of responsibilities, which is essential for managing and enforcing encryption practices.

PCI DSS Requirement 4.2 and ISO 27001:2022 Control A.8.24

Requirement 4.2 of PCI DSS mandates that the Primary Account Number (PAN) must be protected with strong cryptography during transmission. This directly aligns with ISO 27001:2022’s control A.8.24, which calls for the use of cryptography to protect information. By adhering to this control, organisations inherently meet the encryption standards of PCI DSS for PAN protection.

At ISMS.online, we provide the tools and expertise to help you map these requirements effectively, ensuring that your compliance efforts are both efficient and robust. Our platform facilitates the integration of PCI DSS and ISO 27001:2022 controls, allowing you to protect cardholder data while meeting the highest standards of information security.

ISMS.online and PCI DSS Req 4 Compliance

At ISMS.online, we are dedicated to assisting your organisation in achieving and maintaining compliance with PCI DSS Requirement 4. Our comprehensive suite of tools and services is designed to simplify the complex process of protecting cardholder data with strong cryptography.

Benefits of Our Integrated Management System

Organisations can leverage our integrated management system to:

- Streamline Compliance: Consolidate compliance efforts for PCI DSS and other standards like ISO 27001.

- Automate Processes: Reduce manual effort with automated workflows for encryption protocol management.

- Enhance Security Posture: Implement industry-leading practices to protect against data breaches and cyber threats.

Choosing ISMS.online for Comprehensive PCI DSS Compliance

Opting for ISMS.online means selecting a partner that provides:

- Expertise: Access to our team of compliance and security experts.

- Integration: Capability to integrate with over 5000 apps via Zapier for seamless operations.

- Transparency: Dashboards and reporting tools for clear visibility into your compliance status.

We invite you to contact us for expert guidance on PCI DSS compliance and to discover how our platform can fortify your data security measures.

Book a demo