What Is PCI DSS, Requirement 3?

When it comes to protecting sensitive payment information, PCI DSS Requirement 3 is pivotal. It mandates the safeguarding of stored account data, a critical component in the defence against data breaches and fraud. As a compliance officer or an entity handling cardholder data, you’re tasked with ensuring that this data is secured in accordance with the stringent standards set forth by the Payment Card Industry Data Security Standard (PCI DSS).

What Constitutes ‘Stored Account Data’?

Stored account data refers to any cardholder information that your systems retain post-transaction. This includes the Primary Account Number (PAN), cardholder name, service code, and expiration date. To comply with PCI DSS, you must protect this data with robust encryption and other security measures.

Entities Obligated to Adhere to PCI DSS Requirement 3

Any organisation that processes, stores, or transmits cardholder data must adhere to PCI DSS Requirement 3. This includes merchants of all sizes, payment processors, and service providers. Compliance is not optional; it’s a mandatory aspect of operating within the card payment ecosystem.

Application of Requirements to Cardholder Data Types

PCI DSS Requirement 3 applies differently to various types of cardholder data. For instance, while PAN must always be encrypted, other elements like the cardholder’s name or service code have different protection requirements. Understanding these nuances is crucial for effective data protection.

ISMS.online's Role in Facilitating Compliance

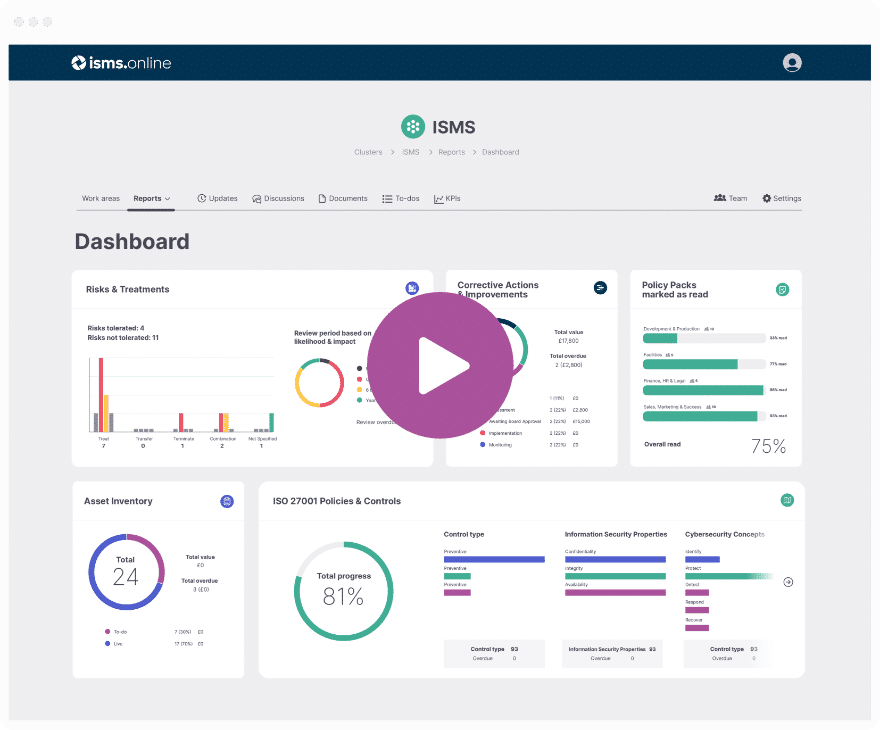

At ISMS.online, we understand the complexities of PCI DSS compliance. Our platform is designed to streamline your compliance efforts, offering tools for policy management, risk assessment, and demonstrating compliance. With our guidance, you can ensure that your organisation not only understands but also effectively implements the requirements of PCI DSS Requirement 3, safeguarding your customers' sensitive data and maintaining the trust that is so vital in the digital economy.

Book a demoThe Importance of Data Encryption in Protecting Stored Data

Encryption is a cornerstone of PCI DSS Requirement 3, serving as a robust barrier against unauthorised access to cardholder data. As you navigate the complexities of data security, understanding and implementing the recommended encryption methods is paramount.

Recommended Encryption Methods by PCI DSS

PCI DSS Requirement 3 advocates for the use of strong encryption algorithms to safeguard stored cardholder data. Among the recommended methods are:

- Data Encryption Standard (DES): Although considered less secure today, it was once a widely adopted symmetric-key algorithm.

- Advanced Encryption Standard (AES): A more secure symmetric-key algorithm that is widely recognised and used.

- Secure Sockets Layer (SSL)/Transport Layer Security (TLS): Protocols that ensure secure data transmission over the internet.

- End-to-End Encryption (E2EE): Ensures that data is encrypted from the point of origin to the point of destination.

Contribution of Encryption to Data Security

Encryption transforms readable data into an unreadable format, requiring a specific key to revert it to its original form. This process is essential for protecting the confidentiality and integrity of cardholder data, both at rest and in transit.

Understanding Different Encryption Standards

Each encryption method offers unique benefits:

- DES: Historically significant, but now largely obsolete due to its shorter key length.

- AES: Currently the gold standard, offering strong security with various key lengths.

- SSL/TLS: Essential for secure web communications, with TLS being the more advanced and secure version.

- E2EE: Provides comprehensive protection as data remains encrypted throughout its entire journey.

ISMS.online’s Support for Cryptographic Controls

At ISMS.online, we understand the critical role of encryption in achieving PCI DSS compliance. Our platform aids in the implementation of cryptographic controls by providing:

- Guidance on Encryption Best Practices: We offer resources to help you select and record appropriate encryption methods.

- Policy and Control Management Tools: Our tools facilitate the documentation and enforcement of encryption policies.

- Risk Management Features: We assist in identifying areas where encryption can mitigate potential data security risks.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Unreadable Primary Account Numbers (PAN)

Ensuring the unreadability of Primary Account Numbers (PAN) is a critical component of PCI DSS Requirement 3. This section outlines the specific measures you must take to protect PAN data effectively.

Requirements for Making PAN Unreadable

PCI DSS mandates that PANs must be rendered unreadable anywhere they are stored. This can be achieved through various methods, including but not limited to:

- Encryption: Transforming PAN data into a ciphered format that can only be decrypted with a key.

- Hashing: Converting PAN into a fixed-size string of characters, which is practically irreversible.

- Truncation: Displaying only a portion of the PAN, thus rendering the full number unreadable.

Tokenization as a Protective Measure

Tokenization replaces the PAN with a unique token that has no exploitable value. This token can then be used in place of the PAN within various internal processes, significantly reducing the risk of data compromise.

Exceptions for Displaying PAN Digits

The PCI DSS allows for the first six and last four digits of the PAN to be displayed, provided that the middle digits are suitably protected. This exception facilitates routine business operations while maintaining a level of security.

Ensuring Compliance with PAN Protection Measures

At ISMS.online, we provide comprehensive tools and guidance to help your organisation implement these protection measures. Our platform supports the development of policies and procedures that align with PCI DSS requirements.

Key Management and the Protection of Stored Data

Effective key management is essential for maintaining the security of encrypted data. As part of PCI DSS Requirement 3, your organisation must establish and follow best practices for cryptographic key management to ensure the protection of stored account data.

Best Practices for Cryptographic Key Management

Key management involves several critical practices:

- Key Generation: Ensure keys are generated using strong and secure random number generation methods.

- Key Storage: Protect keys from unauthorised disclosure by storing them securely, often in hardware security modules (HSMs) or using key vault services.

- Key Access Control: Limit access to cryptographic keys to only those individuals whose job roles require it.

- Key Rotation: Regularly change keys to minimise the risk of compromise over time.

Lifecycle Management’s Impact on Data Security

The lifecycle management of encryption keys includes their creation, distribution, usage, storage, rotation, and eventual destruction. Each stage must be handled with care to prevent unauthorised access to sensitive data.

The Role of Secure Multi-Party Computation (SMPC)

SMPC allows for the processing of encrypted data by multiple parties without revealing the underlying data. This technique can enhance the security of key management processes, particularly in complex environments.

Streamlining Key Management with ISMS.online

At ISMS.online, we provide tools and resources to help you streamline your key management operations. Our platform supports:

- Policy Development: Assisting in the creation of key management policies that comply with PCI DSS requirements.

- Process Documentation: Offering templates and workflows for documenting key management procedures.

- Compliance Tracking: Enabling you to track and demonstrate compliance with key management protocols during audits.

By utilising our services, you can ensure that your key management practices are robust, compliant, and contribute to the overall security of your stored account data.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Data Minimization and Retention Policies

Data minimization is a fundamental principle of PCI DSS Requirement 3, emphasising the importance of storing only the necessary cardholder data for as short a duration as possible. This approach not only reduces the risk of data breaches but also aligns with privacy best practices.

The Role of Data Minimization in PCI DSS Compliance

By minimising the amount of stored cardholder data, you’re effectively shrinking the target for potential attackers. This practice is not just about reducing the volume of data but also about understanding and justifying the need for data retention.

PCI DSS Retention and Disposal Policies

PCI DSS requires specific retention and disposal policies for cardholder data:

- Retention: Only store data for a legitimate business need and for the minimum time required.

- Disposal: Securely delete data when it’s no longer needed, using methods like cryptographic erasure or physical destruction.

Implementing Payment Tokens for Recurring Transactions

Payment tokens can replace sensitive cardholder data in recurring transactions, significantly enhancing security. These tokens are unique identifiers that have no value if breached.

ISMS.online’s Tools for Managing Data Storage Policies

At ISMS.online, we provide you with the tools to manage your data storage policies effectively:

- Policy Templates: Ready-to-use templates that align with PCI DSS requirements.

- Compliance Tracking: Monitor and document your data minimization efforts for audits.

By leveraging our platform, you can ensure that your data minimization and retention policies are not only compliant but also practical and enforceable.

Masking and Displaying Cardholder Data

In the framework of PCI DSS compliance, the way cardholder data is displayed can significantly impact data security. Masking is a critical technique mandated by PCI DSS Requirement 3 to minimise exposure of sensitive information.

Guidelines for Minimal Cardholder Data Display

PCI DSS stipulates that only the minimum necessary amount of cardholder data should be displayed. This typically means:

- Masking: Only the last four digits of the Primary Account Number (PAN) can be visible.

- Restriction: Full PAN should never be displayed post-authorization unless there is a legitimate business need and the viewer has a specific role that requires access.

The Security Benefits of Data Masking

Masking reduces the risk of unauthorised access to full PAN details, thereby protecting against potential fraud and data breaches. It ensures that, even if data is inadvertently exposed, the critical elements remain secure.

Challenges in Implementing Effective Data Masking

Implementing data masking can be challenging due to:

- System Limitations: Some legacy systems may not support masking natively.

- Operational Needs: Determining who needs access to full PAN can be complex.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Navigating the Compliance Validation Process

Understanding and adhering to the annual validation requirements of PCI DSS is crucial for maintaining the security of cardholder data. Let’s explore the validation process and how ISMS.online can assist you in this critical aspect of compliance.

Annual Validation Requirements for PCI DSS Compliance

PCI DSS compliance validation is an annual process that verifies your adherence to the standard’s requirements. This involves:

- Self-Assessment Questionnaires (SAQs): For most merchants, completing an SAQ is a way to self-validate their compliance.

- Reports on Compliance (RoCs): Required for larger merchants, typically those processing over 6 million transactions annually.

Determining Compliance Levels by Transaction Volume

Your organisation’s transaction volume over a 12-month period determines your compliance level:

- Level 1: Over 6 million transactions annually, requiring an external audit by a Qualified Security Assessor (QSA).

- Levels 2-4: Fewer transactions, with varying requirements for validation, including SAQs and possible on-site assessments.

The Role of a Qualified Security Assessor (QSA)

QSAs are trained and certified by the PCI SSC to assist organisations in assessing their compliance with PCI DSS. They play a pivotal role in:

- Conducting Audits: For Level 1 merchants, providing in-depth reviews and generating RoCs.

- Validating Compliance: Ensuring that all PCI DSS requirements are met and properly documented.

Streamlined Compliance Demonstration with ISMS.online

At ISMS.online, we provide tools and resources to simplify the compliance process:

- Integrated Compliance Framework: Our platform aligns PCI DSS requirements with your existing policies and controls.

- Documentation Support: We offer templates and workflows to help you prepare for assessments and audits.

- Expert Guidance: Our team can assist you in understanding the nuances of the validation process and how to best demonstrate compliance.

By partnering with us, you can navigate the PCI DSS validation process with confidence, ensuring that your organisation remains secure and compliant.

Further Reading

Understanding the Implications of Non-Compliance

Navigating the landscape of PCI DSS compliance is not only a matter of best practice but a necessity to avoid significant penalties. Non-compliance can have severe financial and operational repercussions for your organisation.

Potential Fines and Fees for PCI DSS Non-Compliance

Failing to meet PCI DSS standards can result in:

- Fines: These can range up to $100,000 per month, depending on the severity and duration of non-compliance.

- Fees: Additional fees may be imposed to cover the costs of forensic audits and remediation efforts.

Processing Withdrawal and GDPR Implications

Non-compliance can lead to:

- Processing Withdrawal: The revocation of your ability to process payment card transactions.

- GDPR Implications: If you operate within the EU, non-compliance with PCI DSS can also indicate a failure to protect personal data under the GDPR, potentially leading to further penalties.

The MATCH List and PCI DSS Non-Compliance

The Member Alert to Control High-risk (MATCH) list is a tool used by card brands to identify merchants that pose a high risk. Inclusion on this list can result from PCI DSS non-compliance and can lead to:

- Termination of Services: Banks and processors may terminate their services with you.

- Reputational Damage: Being on the MATCH list can harm your reputation and ability to establish relationships with new processors.

Mitigating Risks of Non-Compliance

To mitigate these risks, we at ISMS.online recommend:

- Regular Audits: Conducting regular audits to ensure ongoing compliance.

- Risk Assessments: Performing thorough risk assessments to identify and address vulnerabilities.

- Staff Training: Ensuring that all staff are trained on PCI DSS requirements and best practices.

By taking proactive steps and utilising our platform, you can maintain compliance and protect your organisation from the consequences of non-compliance.

Implementing Risk Mitigation Strategies

Risk mitigation is a multi-faceted approach crucial for safeguarding stored account data. A robust strategy encompasses various components, each playing a vital role in protecting your organisation’s sensitive information.

Core Components of a Risk Mitigation Strategy

A comprehensive risk mitigation strategy includes:

- Risk Assessment: Regularly identifying and evaluating risks to stored data.

- Access Controls: Restricting access to sensitive data based on user roles.

- Monitoring Systems: Implementing tools to continuously monitor for suspicious activities.

Data-at-Rest vs. Data-in-Transit Security Measures

Security measures for data-at-rest and data-in-transit serve different purposes:

- Data-at-Rest: Involves encrypting data stored on discs, databases, or other media.

- Data-in-Transit: Focuses on protecting data as it travels across networks, typically using encryption protocols like TLS.

The Role of DLP Solutions in Preventing Data Breaches

Data Loss Prevention (DLP) solutions are critical for:

- Detecting Potential Data Breaches: Monitoring data usage and transmission to identify unauthorised actions.

- Preventing Data Leaks: Controlling data transfer and preventing sensitive information from leaving the network.

Creating a Comprehensive Security Audit Trail

To create an effective security audit trail, organisations should:

- Log Activities: Record all access and transactions involving sensitive data.

- Review Logs: Regularly review logs for anomalies that could indicate a security incident.

- Automate Alerts: Set up automated alerts for suspicious activities to enable rapid response.

At ISMS.online, we provide the tools and expertise to help you develop and implement these risk mitigation strategies, ensuring that your approach to protecting stored account data is thorough and compliant with PCI DSS Requirement 3.

Aligning PCI DSS with the ISO 27001 Standard

Understanding the relationship between PCI DSS Requirement 3 and ISO 27001:2022 controls is essential for organisations striving to enhance their data protection strategies. We at ISMS.online are committed to helping you navigate this alignment.

Mapping PCI DSS Requirement 3 to ISO 27001:2022 Controls

PCI DSS Requirement 3 focuses on protecting stored account data, which aligns with several ISO 27001:2022 controls:

- Information Access Restriction (8.3): Ensures that access to sensitive information is controlled and restricted to authorised personnel.

- Organisational Roles, Responsibilities, and Authorities (5.3): Defines the roles and responsibilities related to data protection.

- Protection of Records (5.33) and Information Deletion (8.10): Address the retention and secure disposal of sensitive data.

Benefits of Aligning PCI DSS with Other Regulatory Requirements

Aligning PCI DSS with ISO 27001:2022 offers several advantages:

- Unified Compliance Efforts: Streamlines processes and reduces duplication of effort.

- Enhanced Security Posture: Combines the strengths of both standards for a more robust security framework.

- Market Trust: Demonstrates to customers and partners your commitment to comprehensive data security.

Using ISO 27001:2022 to Enhance Data Protection Strategies

ISO 27001:2022’s structured approach to information security can complement your PCI DSS compliance by:

- Risk Management: Providing a framework for identifying and managing security risks.

- Continuous Improvement: Encouraging regular reviews and updates to security practices.

Resources for Requirement Mapping

To assist you in understanding and implementing requirement mapping, we offer:

- Guidance and Consultancy: Our experts can help you interpret and apply the controls of both standards.

- Documentation Templates: Simplify the process of aligning and documenting compliance efforts.

By leveraging these resources, you can ensure a seamless integration of PCI DSS and the ISO 27001:2022 standard, fortifying your data protection measures.

How ISMS.online Can Help

Achieving and maintaining PCI DSS compliance is a complex process that requires a deep understanding of the standard’s requirements. At ISMS.online, we are dedicated to providing expert guidance to ensure your organisation meets these rigorous standards.

How ISMS.online Facilitates PCI DSS Compliance

Our platform offers a comprehensive suite of tools designed to simplify the compliance process:

- Integrated Compliance Framework: Aligns PCI DSS requirements with your business processes for a seamless compliance journey.

- Pre-configured IMS: Provides a structured approach to managing information security, reducing the time and effort required to achieve compliance.

- Guided Certification: Offers step-by-step guidance to help you understand and meet the requirements of PCI DSS.

Gap Analysis and Risk Assessment Support

We understand the importance of identifying and addressing compliance gaps:

- Gap Analysis Tools: Our platform helps you pinpoint areas that need attention, allowing you to focus your efforts effectively.

- Risk Assessment Resources: We provide templates and workflows to conduct thorough risk assessments, ensuring all potential vulnerabilities are identified and mitigated.

Benefits of Our Integrated Compliance Framework

Choosing ISMS.online for your compliance management needs offers several advantages:

- Streamlined Audit Demonstration: Our tools and documentation support make it easier to demonstrate compliance during audits.

- Policy and Control Management: Simplify the creation and enforcement of security policies that are essential for PCI DSS compliance.

- Staff and Supplier Assurance: Enhance the security of your supply chain with our comprehensive assurance modules.

For expert guidance on achieving and maintaining PCI DSS compliance, contact us at ISMS.online. Our team is ready to assist you with every step of the compliance process, ensuring your data protection measures are robust and effective.

Book a demo