What Is PCI DSS, Requirement 11?

When we consider the Payment Card Industry Data Security Standard (PCI DSS), Requirement 11 stands out as a critical component for safeguarding cardholder data. Its primary goals are multifaceted, focusing on the regular testing of security systems and networks. This is not just a procedural step; it’s a fundamental practice to ensure that vulnerabilities are identified and addressed promptly, thereby reducing the risk of data breaches and fraud.

Enhancing Payment Card Data Security

Requirement 11 directly contributes to the robustness of payment card data security. By mandating regular testing, it ensures that security measures are not only in place but are also effective and up-to-date with the latest threats. This continuous vigilance is essential in an era where cyber threats are evolving rapidly.

Intersection with Other PCI DSS Requirements

The interconnectivity of PCI DSS requirements means that Requirement 11 does not operate in isolation. It intersects with other requirements, such as maintaining a vulnerability management programme (Requirement 5) and implementing strong access control measures (Requirement 7). Together, these create a comprehensive defence strategy against potential security breaches.

Maintaining Relevance Amidst Cybersecurity Evolution

Cybersecurity is a dynamic field, with new threats emerging constantly. Requirement 11 maintains its relevance by requiring that the tests are not only regular but also thorough and reflective of the current threat landscape. This adaptability is crucial for the ongoing protection of cardholder data and helps organisations stay one step ahead of malicious actors.

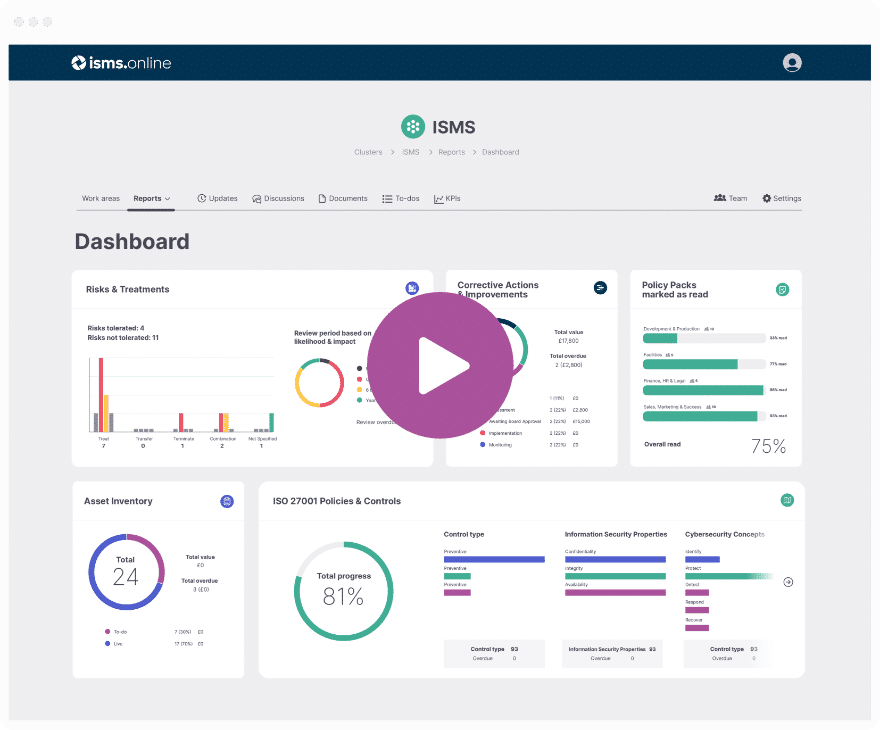

At ISMS.online, we understand the importance of staying current with these requirements and offer services to help you navigate these complexities. Our platform is designed to keep your compliance efforts aligned with the latest standards, ensuring that your security measures are both effective and compliant.

Book a demoTechnicalities of Regular Security Testing

Understanding the intricacies of PCI DSS Requirement 11 is essential for maintaining robust security protocols. As a compliance officer, you’re tasked with ensuring that your organisation’s security measures are not only effective but also adhere to the prescribed standards.

What Does ‘Regular’ Mean in PCI DSS Security Testing?

Regular’ in the context of PCI DSS implies a scheduled and systematic approach to security testing. Specifically, Requirement 11 mandates that you conduct quarterly external and internal vulnerability scans, and annual penetration testing. This regularity ensures ongoing vigilance against potential security threats.

Identifying Systems and Networks for Requirement 11 Testing

Requirement 11 applies to all systems and networks that store, process, or transmit cardholder data. This includes but is not limited to point-of-sale systems, databases, and network infrastructure. Our platform, ISMS.online, can help you identify and manage the scope of these systems for compliance.

Aligning PCI DSS with ISO 27001 Standards

The technical requirements of PCI DSS Requirement 11 complement ISO 27001 standards, particularly in areas of regular security reviews and management of technical vulnerabilities. By aligning with these standards, you ensure a comprehensive security posture that satisfies multiple compliance frameworks.

Addressing Technical Challenges in Compliance

Compliance officers may encounter challenges such as interpreting the nuances of Requirement 11, selecting appropriate testing tools, and managing the remediation process. Our services at ISMS.online provide guidance and resources to navigate these complexities, ensuring your security testing is both effective and compliant.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Frequency and Types of Required Testing

As you delve into the requirements of PCI DSS, particularly Requirement 11, understanding the frequency and types of testing required is paramount. This section will guide you through these critical components, ensuring your compliance efforts are both effective and aligned with industry standards.

Understanding Testing Frequency Under PCI DSS Requirement 11

Requirement 11 stipulates that you must conduct:

- Quarterly External Vulnerability Scans: These are required every three months and must be performed by an Approved Scanning Vendor (ASV).

- Quarterly Internal Scans: While these can be conducted in-house, they must adhere to the same rigorous standards as external scans.

- Annual Penetration Testing: This comprehensive test must be performed at least once a year to simulate a cyberattack and identify potential weaknesses.

Distinguishing Between Internal and External Scans

The primary difference between internal and external scans lies in their focus areas:

- Internal Scans assess the security of your internal network, identifying vulnerabilities that could be exploited from within.

- External Scans target your external IP addresses, simulating attacks that could occur from outside your network.

Both types of scans are crucial for a well-rounded security posture.

Specific Tests Mandated by Requirement 11

Requirement 11 mandates specific types of tests, including but not limited to:

- Vulnerability Scans: To detect known security weaknesses.

- Penetration Tests: To actively exploit vulnerabilities in a controlled environment.

Aligning Testing with PCI DSS and ISO Standards

To ensure your testing frequency meets both PCI DSS and ISO standards, we recommend:

- Regular Review of Compliance Requirements: Stay updated with the latest standards and guidelines.

- Utilising Compliance Management Platforms: Tools like ISMS.online can help streamline your compliance processes, ensuring all tests are conducted as required.

Tools and Methodologies for Effective Security Testing

Selecting the right tools and methodologies is a critical step in fulfilling PCI DSS Requirement 11. As compliance officers, you need to ensure that the security testing of systems and networks is thorough and effective.

Recommended Tools for PCI DSS Requirement 11 Testing

For vulnerability scanning and penetration testing, several industry-standard tools are recommended:

- OpenVAS and Nessus for vulnerability scanning, which help identify security weaknesses in your systems.

- Server Scan for ASV-certified external scans, ensuring compliance with external scanning requirements.

These tools are designed to automate the scanning process and provide detailed reports that can guide your remediation efforts.

Methodologies for Vulnerability Scanning vs. Penetration Testing

The methodologies for these tests differ significantly:

- Vulnerability Scanning is an automated process to identify known vulnerabilities in your systems.

- Penetration Testing involves a more hands-on approach, often with ethical hackers attempting to exploit vulnerabilities to assess the real-world effectiveness of your security measures.

The Role of Automated Tools in Regular Testing

Automated tools play a vital role in regular testing by:

- Providing consistent and repeatable testing processes.

- Allowing for scheduled scans that adhere to the required frequency of testing.

- Reducing the potential for human error in the testing process.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Roles of Professionals Conducting Tests

Ensuring the integrity of your payment card data environment is critical, and this is where the qualifications of professionals conducting PCI DSS Requirement 11 tests become pivotal. Let’s explore the expertise required and the distinct roles these professionals play.

Required Qualifications for Conducting Requirement 11 Tests

Professionals tasked with conducting these tests must possess:

- A deep understanding of the PCI DSS requirements.

- Technical knowledge to identify and address vulnerabilities.

- Certifications that may include CISSP, CISA, or other industry-recognised qualifications.

Distinguishing Between QSAs and ASVs

In the context of Requirement 11, the roles of Qualified Security Assessors (QSAs) and Approved Scanning Vendors (ASVs) are distinct yet complementary:

- QSAs are certified by the PCI SSC to validate an entity’s adherence to PCI DSS requirements.

- ASVs are authorised to perform external vulnerability scans required by PCI DSS.

Merchant and Service Provider Responsibilities

Merchants and service providers are responsible for:

- Ensuring that all tests are conducted as required by PCI DSS.

- Engaging with QSAs and ASVs to validate compliance efforts.

- Maintaining documentation and evidence of all security testing activities.

Verifying Credentials of Security Testing Professionals

As a compliance officer, you can verify the credentials of professionals by:

- Checking their certifications against industry standards.

- Confirming their status on official PCI SSC listings for QSAs and ASVs.

- Reviewing their history of compliance work and client testimonials.

Documenting and Reporting

Accurate documentation and reporting are the cornerstones of demonstrating compliance with PCI DSS Requirement 11. As a compliance officer, you’re tasked with ensuring that all security testing activities are meticulously recorded and reported.

Essential Documentation for PCI DSS Requirement 11

To evidence compliance, you will need to maintain:

- Test Reports: Detailed accounts of all vulnerability scans and penetration tests conducted.

- Remediation Records: Documentation of any vulnerabilities found and the subsequent corrective actions taken.

- Change Logs: A record of all significant changes made to the cardholder data environment (CDE) and their impact on Requirement 11 compliance.

Reporting Test Results and Remediation Efforts

Test results and remediation efforts should be reported through:

- Regular Updates: Providing ongoing status reports to key stakeholders.

- Comprehensive Summaries: Summarising the findings and actions taken for each testing cycle.

- Evidence of Compliance: Including test logs, scan results, and remediation action plans in your Report on Compliance (ROC).

Key Components of a PCI DSS-Compliant ROC

A compliant ROC must include:

- Executive Summary: An overview of the testing scope, methodologies, and findings.

- Detailed Findings: Specific details of any vulnerabilities identified and how they were addressed.

- Attestation of Compliance: A formal declaration that your organisation has met all the requirements of PCI DSS Requirement 11.

Streamlining Documentation with ISMS.online

At ISMS.online, we simplify the documentation and reporting process by providing:

- Pre-configured Templates: To help you accurately record test results and remediation actions.

- Guided Compliance Frameworks: Ensuring that your documentation aligns with both PCI DSS and ISO 27001 standards.

By leveraging our platform, you can ensure that your documentation is precise, comprehensive, and fully compliant with Requirement 11.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Addressing Identified Vulnerabilities

When it comes to PCI DSS Requirement 11, addressing and remediating vulnerabilities is a critical step in safeguarding cardholder data. As a compliance officer, your role is to prioritise and manage these vulnerabilities effectively.

Prioritising Vulnerabilities Post-Testing

After identifying vulnerabilities through testing, prioritise them based on:

- Severity: Focus first on vulnerabilities that pose the greatest risk to your cardholder data environment (CDE).

- Impact: Consider the potential impact of each vulnerability on your organisation’s operations and reputation.

- Exploitability: Address vulnerabilities that are easily exploitable with higher urgency.

Steps for Effective Remediation

The remediation process involves several key steps:

- Assessment: Evaluate the extent of each vulnerability.

- Planning: Develop a remediation plan that outlines the necessary corrective actions.

- Implementation: Execute the remediation plan, ensuring that all actions are carried out thoroughly.

- Verification: Test the system again to confirm that the vulnerabilities have been successfully addressed.

Ensuring Verifiable Remediation Efforts

To verify the effectiveness of your remediation efforts, you should:

- Maintain detailed records of all remediation activities.

- Conduct follow-up scans to ensure vulnerabilities are resolved.

- Keep an audit trail that can be reviewed by internal or external parties.

Preventing Recurrence of Vulnerabilities

To prevent similar vulnerabilities in the future, consider:

- Implementing a robust change management process.

- Conducting regular security awareness training for staff.

- Utilising ISMS.online to manage and track your ongoing security posture.

By following these guidelines, you can ensure that your organisation’s response to vulnerabilities is both proactive and effective.

Further Reading

Integrating Requirement 11 with Broader Security Strategies

Within the scope of information security, PCI DSS Requirement 11 is not an isolated directive but a pivotal component of a comprehensive Information Security Management System (ISMS). Let’s explore how this requirement interlocks with your broader security strategy and how our platform, ISMS.online, facilitates this integration.

The Role of Requirement 11 in Your ISMS

Requirement 11 serves as a critical control within your ISMS, focusing on regular testing to identify and mitigate vulnerabilities. It ensures that:

- Security measures are not only implemented but also effective and up-to-date.

- Continuous improvement is embedded in your security practices.

Benefits of Aligning Requirement 11 with Other Frameworks

Harmonising Requirement 11 with other security frameworks, such as ISO 27001, offers several advantages:

- Unified Compliance Efforts: It streamlines your compliance activities, reducing duplication of effort.

- Enhanced Security Posture: It provides a holistic view of your security landscape, ensuring no aspect is overlooked.

Leveraging Requirement 11 for Enhanced Security

As a compliance officer, you can use Requirement 11 to bolster your organisation’s security posture by:

- Establishing a baseline for security practices.

- Using the requirement as a catalyst for regular security discussions and reviews.

ISMS.online’s Support for Requirement 11 Integration

At ISMS.online, we are committed to supporting you in weaving Requirement 11 into your broader security strategies. Our platform offers:

- Guided Implementation: Step-by-step guidance to align Requirement 11 with your existing ISMS.

- Comprehensive Mapping: Tools to map Requirement 11 controls to other standards like ISO 27001.

- Continuous Monitoring: Features that enable ongoing tracking of your security testing activities.

By leveraging ISMS.online, you ensure that Requirement 11 is not just a compliance checkbox but a cornerstone of your security framework.

Overcoming Common Compliance Challenges

Achieving compliance with PCI DSS Requirement 11 can be daunting. As you navigate this journey, understanding and overcoming common obstacles is crucial for protecting cardholder data effectively.

Addressing Misconceptions About Annual Compliance

One prevalent challenge is the misconception that annual compliance checks are sufficient. It’s important to recognise that:

- Continuous Monitoring is essential for maintaining compliance throughout the year.

- Regular Testing helps promptly identify and address new vulnerabilities that may arise between annual assessments.

The Role of Continuous Monitoring

Continuous monitoring plays a pivotal role in:

- Ensuring that security controls remain effective over time.

- Detecting potential security breaches as they occur, allowing for immediate response.

Navigating Requirement 11 with ISMS.online

At ISMS.online, we are dedicated to simplifying your compliance process by providing:

- Structured Compliance Frameworks: Our platform offers a clear structure for meeting Requirement 11, ensuring that nothing is overlooked.

- Dynamic Risk Management Tools: These tools facilitate the identification and prioritisation of risks, streamlining the remediation process.

- Guidance and Support: Our team is here to guide you through each step of Requirement 11, from initial gap analysis to ongoing compliance management.

By partnering with us, you can confidently address these challenges and maintain robust security measures that meet PCI DSS standards.

Preparing for the Transition to PCI DSS Version 4.0

As we approach the transition to PCI DSS Version 4.0, it’s crucial for you, as compliance officers, to understand the changes related to Requirement 11 and how they will affect your security testing protocols.

Key Changes in PCI DSS Version 4.0 Affecting Requirement 11

The upcoming version 4.0 introduces several changes, including:

- Enhanced focus on continuous security processes rather than periodic compliance checks.

- More flexibility in demonstrating compliance, allowing for customised implementation of controls based on risk.

Steps for Compliance Officers to Prepare for March 2024

To prepare for the transition by March 2024, we recommend that you:

- Begin reviewing the new standard as soon as it’s available to understand the specific changes.

- Assess your current security measures against the new requirements to identify gaps.

- Develop a transition plan that includes training for your team on the new requirements.

Challenges and Opportunities with Version 4.0

Version 4.0 presents both challenges and opportunities:

- Challenges: Adapting to new validation methods and integrating them into your current security framework.

- Opportunities: Leveraging the flexibility offered by the new standard to tailor security controls to your specific environment.

Impact on Existing Compliance and Security Measures

The transition to version 4.0 will require a review of your existing compliance and security measures. It’s essential to:

- Ensure that your current practices align with the new and updated requirements.

- Take advantage of the new standard’s emphasis on continuous monitoring and adaptive security.

At ISMS.online, we are committed to supporting you through this transition, providing the tools and resources necessary to adapt to and embrace the changes brought by PCI DSS Version 4.0.

PCI DSS Requirement 11 and ISO 27001 Mapping

Navigating the complexities of compliance frameworks can be challenging. At ISMS.online, we understand the importance of aligning PCI DSS Requirement 11 with ISO 27001:2022 standards. This alignment ensures a robust approach to information security and compliance.

Aligning Requirement 11.1 with ISO 27001

Requirement 11.1 of PCI DSS focuses on the regular testing of security systems and networks. This aligns with:

- ISO 27001:2022 Clause 5.35: Which calls for an independent review of information security.

- ISO 27001:2022 Clause 5.3: Which outlines organisational roles, responsibilities, and authorities.

By mapping these together, you can ensure that your security testing processes are well-defined and understood across your organisation.

Integrating Requirement 11.2 with Network Security Controls

For Requirement 11.2, which involves monitoring wireless access points:

- ISO 27001:2022 Control A.8.20: Addresses network security management.

- ISO 27001:2022 Control A.5.9: Involves the inventory of information and other associated assets.

This mapping ensures unauthorised access points are effectively identified and managed.

Harmonising Requirement 11.3 with Regular Vulnerability Management

Requirement 11.3’s emphasis on identifying and prioritising vulnerabilities corresponds with ISO 27001:2022’s independent review of information security, reinforcing the importance of regular vulnerability management.

Coordinating Penetration Testing with ISO 27001 Controls

Requirement 11.4’s penetration testing is crucial for uncovering exploitable vulnerabilities, aligning with:

- ISO 27001:2022 Clause 5.35: For independent security reviews.

- ISO 27001:2022 Control A.8.8: For managing technical vulnerabilities.

Synchronising Intrusion Detection with ISO 27001 Incident Response

Lastly, Requirement 11.5’s focus on intrusion detection and file change monitoring is in sync with:

- ISO 27001:2022 Requirement 5.26: Which mandates a response to information security incidents.

- ISO 27001:2022 Control A.8.16: Which involves monitoring activities.

Through our platform, we facilitate the integration of these requirements, ensuring that your compliance is both comprehensive and streamlined.

ISMS.online Support for PCI DSS Requirement 11

At ISMS.online, we understand that navigating PCI DSS Requirement 11 can be complex. Our platform is designed to provide tailored support that aligns with your organisation’s specific compliance needs.

Expert Services for Navigating Requirement 11

We offer a range of expert services to assist you with Requirement 11:

- Guided Risk Assessments: To identify and prioritise vulnerabilities within your systems and networks.

- Compliance Planning Tools: To help you develop and implement a robust testing schedule.

- Documentation Templates: To streamline the recording and reporting of your compliance efforts.

Enhancing Your Security and Compliance Posture

Partnering with ISMS.online can significantly enhance your security and compliance posture by:

- Providing a centralised platform for managing all compliance-related activities.

- Offering real-time insights into your compliance status, enabling proactive management of potential issues.

- Facilitating collaboration among your team members, ensuring that everyone is aligned and informed.

Choosing ISMS.online for Comprehensive PCI DSS Assistance

Selecting ISMS.online for your PCI DSS Requirement 11 needs means choosing a partner that offers:

- Integrated Management Systems: To simplify the alignment of PCI DSS with other standards like ISO 27001.

- Dynamic Risk Management Tools: To keep your security measures current and effective.

- Transparent Reporting: For clear and concise demonstration of compliance to auditors and stakeholders.

By leveraging our platform, you can ensure that your approach to PCI DSS Requirement 11 is thorough, up-to-date, and aligned with best practices.

Book a demo