PCI DSS and Its Impact on Level 2 Merchants

When you’re navigating the complexities of PCI DSS compliance, understanding the foundational principles and specific requirements of the latest version is crucial. As a Level 2 merchant, you’re likely processing between 1 to 6 million transactions annually, which places unique demands on your security infrastructure. Let’s delve into what PCI DSS Version 4.0 entails for you and how we at ISMS.online can support your compliance journey.

Foundational Principles of PCI DSS 4.0

PCI DSS Version 4.0 is built on the bedrock of safeguarding cardholder data through robust security measures. The core objectives remain to protect cardholder data, maintain a secure network, and implement strong access control measures. However, Version 4.0 introduces more flexibility for organisations to demonstrate compliance through customised implementation.

New Requirements for Level 2 Merchants

Compared to its predecessor, Version 4.0 emphasises adaptive security and continuous monitoring. As a Level 2 merchant, you’ll find that the requirements now offer more scope for tailored solutions that fit your specific operational context, without compromising on security.

Specific Controls for Level 2 Compliance

Under the new standards, you must implement controls such as multi-factor authentication and encryption of cardholder data. Additionally, Version 4.0 requires you to maintain an inventory of system components, perform regular testing of security systems, and ensure that all staff are trained on data security protocols.

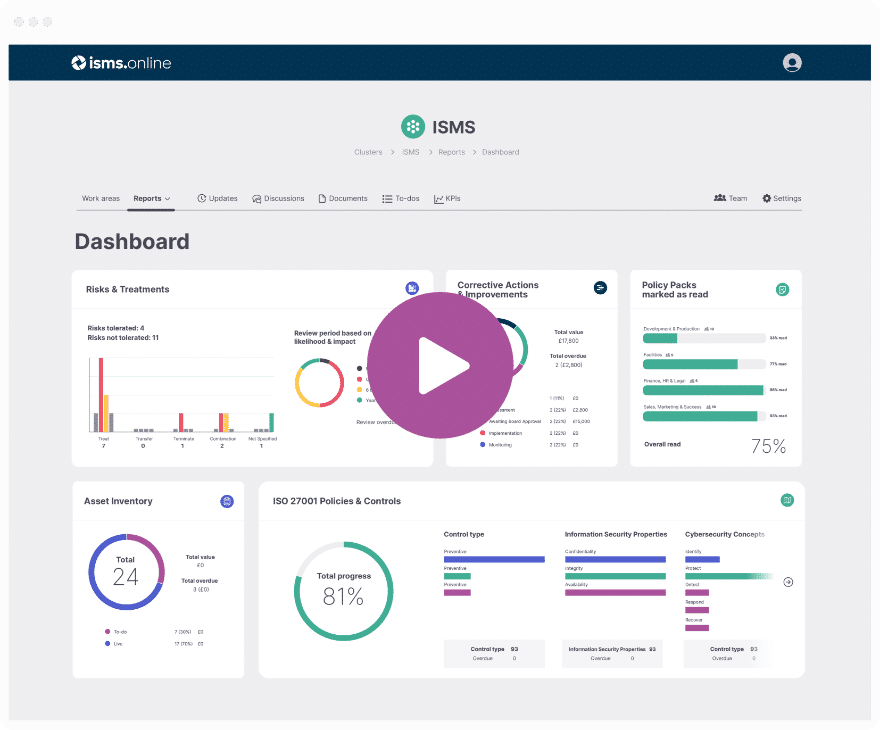

Aligning with Updated Requirements via ISMS.online

At ISMS.online, we facilitate your alignment with these updated requirements through our comprehensive platform. Our tools and frameworks are designed to help you adopt, adapt, and add to the necessary controls and processes, ensuring a streamlined path to compliance. With our guidance, you can confidently navigate the intricacies of PCI DSS Version 4.0 and maintain the trust of your customers and partners.

Book a demoClassifying Merchant Levels and Transaction Volumes

Understanding the classification of merchant levels under the Payment Card Industry Data Security Standard (PCI DSS) is essential for compliance. Merchant levels are primarily determined by the number of transactions processed annually, which directly influences the rigour of compliance validation required.

Determining Level 2 Merchant Status

For PCI DSS, a Level 2 merchant is typically one that processes between 1 and 6 million Visa or Mastercard transactions per year. It’s crucial for you to accurately report your annual transaction volume, as this determines your merchant level.

Importance of Accurate Transaction Reporting

Accurate transaction volume reporting is critical for compliance classification because it ensures that you’re following the correct validation and security measures for your level. Misclassification can lead to insufficient data security practices or unnecessary compliance efforts.

Transaction Volume’s Impact on Compliance

Transaction volume not only defines your merchant level but also influences the type of Self-Assessment Questionnaire (SAQ) you’ll complete and the frequency of required security scans. At ISMS.online, we understand the nuances of these classifications and provide guidance to ensure your compliance efforts are aligned with your specific transaction volume.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Compliance Journey for Level 2 Merchants

Embarking on the PCI DSS compliance journey is a critical step for Level 2 merchants to secure cardholder data and maintain customer trust. Understanding the compliance process and its milestones is essential for a smooth navigation through the requirements.

Initiating the Compliance Process

To begin, a Level 2 merchant must identify which Self-Assessment Questionnaire (SAQ) applies to their business operations. This is the first step in self-evaluating their compliance with PCI DSS standards. Additionally, you must establish a secure network to protect cardholder data, implement robust access control measures, and maintain a vulnerability management programme.

Maintaining Ongoing Compliance

Ongoing adherence to PCI DSS is not a one-time event but a continuous process. For Level 2 merchants, this means regularly monitoring and testing networks, maintaining information security policies, and ensuring that all staff are aware of compliance responsibilities.

Compliance Milestones

Key milestones for Level 2 merchants include completing the appropriate SAQ annually, conducting required vulnerability scans every quarter, and submitting an Attestation of Compliance (AOC) to validate adherence to the PCI DSS.

Streamlining Compliance with ISMS.online

At ISMS.online, we provide an integrated framework that simplifies the compliance journey for Level 2 merchants. Our platform supports you in managing documentation, risk assessments, and policy controls, making it easier to maintain and demonstrate compliance with PCI DSS standards.

Self-Assessment Questionnaire (SAQ) Explained

The Self-Assessment Questionnaire (SAQ) is a pivotal tool in the PCI DSS compliance process, enabling Level 2 merchants to self-evaluate their adherence to the required security standards.

Purpose of the SAQ in Compliance

The SAQ serves to assess your security measures against the PCI DSS requirements. It’s designed to guide you through a thorough review of your cardholder data environment, ensuring that necessary protections are in place to safeguard sensitive information.

Applicable SAQ Version for Level 2 Merchants

For Level 2 merchants, the applicable SAQ version depends on the specific card payment channels you use and the extent to which you have outsourced card processing activities. It’s imperative to select the correct SAQ version to accurately reflect your operational environment.

Frequency of SAQ Completion and Submission

You’re required to complete and submit the SAQ annually. This regular self-assessment is crucial for maintaining compliance and identifying areas where security enhancements may be needed.

Support from ISMS.online

At ISMS.online, we provide comprehensive support to help you complete and manage the SAQ. Our platform offers:

- Document management tools to organise evidence of compliance.

- Risk assessment features to identify and mitigate potential vulnerabilities.

We are committed to making the SAQ process as straightforward as possible, ensuring that you can confidently demonstrate compliance with PCI DSS standards.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Annual Compliance Validation and Reporting

As a Level 2 merchant, you are required to validate your compliance with PCI DSS annually. This process is crucial to ensure the ongoing security of cardholder data and to maintain the trust of your customers and partners.

Understanding the Attestation of Compliance (AOC)

The Attestation of Compliance (AOC) is a formal declaration of your compliance status. It is a critical component of the validation process, serving as proof that you have met all the necessary PCI DSS requirements.

Required Documentation for Compliance

To demonstrate compliance annually, you will need to:

- Complete the appropriate Self-Assessment Questionnaire (SAQ) for your business.

- Undergo quarterly network scans by an Approved Scanning Vendor (ASV), if applicable.

- Compile a Report on Compliance (ROC) if required, based on your transaction volume and other factors.

Implementing Cybersecurity Measures

Ensuring the protection of cardholder data is a fundamental requirement for PCI DSS compliance. As a Level 2 merchant, you are obligated to implement specific cybersecurity measures to safeguard sensitive information.

Mandatory Cybersecurity Measures for Level 2 Merchants

Under PCI DSS 4.0, Level 2 merchants must adhere to a set of mandatory cybersecurity measures that include, but are not limited to:

- Installing and maintaining a firewall configuration to protect cardholder data.

- Encrypting transmission of cardholder data across open, public networks.

- Using and regularly updating anti-virus software or programmes.

- Developing and maintaining secure systems and applications.

The Role of Encryption and Tokenization

Encryption and tokenization are critical in the protection of cardholder data:

- Encryption transforms cardholder data into a secure format during transmission, making it unreadable to unauthorised parties.

- Tokenization replaces sensitive data elements with non-sensitive equivalents, known as tokens, which have no exploitable value.

Recommended Continuous Monitoring Strategies

For effective threat detection, we recommend continuous monitoring strategies such as:

- Implementing intrusion detection systems (IDS) and intrusion prevention systems (IPS).

- Conducting regular testing of security systems and processes.

- Monitoring all access to network resources and cardholder data.

Enhancing Cybersecurity with ISMS.online

Our integrated management system at ISMS.online enhances your cybersecurity posture by providing:

- A comprehensive platform for managing all your security policies and procedures.

- Tools for continuous risk assessment and incident management.

- Integration capabilities with existing security technologies for a unified approach to data protection.

By leveraging our platform, you can ensure that your cybersecurity measures are robust, up-to-date, and aligned with PCI DSS requirements.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Consequences of Non-Compliance for Level 2 Merchants

Adhering to the PCI DSS is not just a regulatory requirement; it’s a critical component of your business’s security posture. Non-compliance can have significant repercussions, affecting various facets of your operations.

Understanding the Penalties for Non-Compliance

If you fail to comply with PCI DSS, you may face:

- Fines: Payment brands can impose fines ranging from a few thousand to several hundred thousand dollars, depending on the severity and duration of non-compliance.

- Increased Transaction Fees: Banks may increase transaction fees, which can impact your profitability.

- Compensatory Costs: Costs associated with fraud losses, card replacements, and forensic investigations can be substantial.

Impact on Reputation and Customer Trust

Non-compliance can severely damage your reputation, leading to:

- Customer Distrust: Customers may lose confidence in your ability to protect their data, potentially leading to a loss of business.

- Brand Damage: Negative publicity from a data breach can have long-lasting effects on your brand’s image.

Risks of Data Breaches

Data breaches resulting from non-compliance can lead to:

- Loss of Sensitive Data: Exposure of cardholder information can result in identity theft and fraudulent activities.

- Legal Repercussions: You may face lawsuits or regulatory actions if a breach occurs due to non-compliance.

Mitigating Risks with ISMS.online

At ISMS.online, we provide a robust platform to help you maintain compliance and avoid these risks:

- Comprehensive Compliance Tools: Our platform offers tools for risk assessment, policy management, and incident response planning.

- Guided Certification Process: We guide you through the certification process, ensuring you understand and meet all PCI DSS requirements.

- Continuous Improvement: Our adapt-adopt-add strategy ensures that your security measures evolve with changing regulations and threats.

By partnering with us, you can strengthen your compliance efforts and protect your business from the consequences of non-compliance.

PCI DSS Merchant Level Table

| PCI DSS Merchant Level | Transactions Per Year |

|---|---|

| PCI DSS Merchant Level 1 | Over 6 million |

| PCI DSS Merchant Level 2 | Between 1 to 6 million per year |

| PCI DSS Merchant Level 3 | Between 20,000 to 1 million per year |

| PCI DSS Merchant Level 4 | Fewer than 20,000 per year |

Further Reading

Tailoring Your Security Posture with PCI DSS in Mind

Designing a security posture that aligns with PCI DSS standards is a strategic imperative for Level 2 merchants. It’s about creating a robust framework that not only protects cardholder data but also supports your business objectives.

Crafting a Compliant Security Posture

As a Level 2 merchant, your security posture should be built on the foundation of PCI DSS requirements. This includes:

- Implementing strong access control measures.

- Maintaining a vulnerability management programme.

- Regularly monitoring and testing networks.

- Establishing an information security policy.

The Importance of Security Certifications

Security certifications such as SOC 2 and ISO 27001 play a pivotal role in demonstrating your commitment to compliance. They provide external validation of your security practices and can enhance trust with customers and stakeholders.

Building Trust Through Security

A strong security posture is instrumental in building trust. It reassures customers that their sensitive data is protected, which is crucial for maintaining and growing your customer base.

ISMS.online: Enhancing Your Security Posture

At ISMS.online, we offer features that support the development of a tailored security posture:

- Integrated Framework: Our platform provides a structured approach to aligning with PCI DSS standards.

- Policy Control: We help you establish and manage security policies that are compliant with PCI DSS.

- Risk Tools: Our risk assessment tools enable you to identify and mitigate potential security threats.

By leveraging our platform, you can ensure that your security posture is not only compliant but also a cornerstone of your business’s success.

The Role of Qualified Security Assessors (QSAs)

Navigating the PCI DSS compliance landscape requires understanding the pivotal role of Qualified Security Assessors (QSAs). These professionals are crucial in validating the security measures you have implemented to protect cardholder data.

Function of QSAs in Compliance

QSAs are certified by the PCI Security Standards Council to conduct assessments of merchants’ and service providers’ compliance with PCI DSS. They bring an expert eye to your security infrastructure, ensuring that all PCI DSS requirements are met.

QSA Audit Requirements for Level 2 Merchants

While Level 2 merchants typically validate compliance through a Self-Assessment Questionnaire (SAQ), engaging with a QSA is not mandatory but can be highly beneficial. A QSA audit provides a deeper level of scrutiny and can offer insights into the effectiveness of your security measures.

Preparing for a QSA Audit

To prepare for a QSA audit, you should:

- Review your current compliance status and rectify any gaps.

- Gather all relevant documentation, such as policies, procedures, and previous audit reports.

- Ensure that your staff are well-informed and prepared for the assessment process.

Navigating the PCI SSC and Compliance Resources

The Payment Card Industry Security Standards Council (PCI SSC) offers a wealth of resources designed to assist Level 2 merchants in navigating the complexities of PCI DSS compliance.

Utilising PCI SSC Resources

As a Level 2 merchant, you have access to a range of resources on the PCI SSC website, including:

- Comprehensive Documentation: Detailed guidelines and best practices for implementing PCI DSS requirements.

- Self-Assessment Questionnaires (SAQs): Tools to help you assess your compliance status.

- Training and Education: Opportunities to enhance your understanding of PCI DSS through webinars, workshops, and certification programmes.

Best Practices for Using Compliance Resources

To effectively use these resources, we recommend:

- Regularly reviewing the latest documentation to stay up-to-date with PCI DSS requirements.

- Engaging with the PCI SSC community through forums and special interest groups for peer support and advice.

- Taking advantage of training programmes to ensure your staff are well-versed in compliance procedures.

Staying Informed on PCI DSS Updates

It’s crucial to stay informed about updates to PCI DSS standards. The PCI SSC website is the authoritative source for:

- Updates and Announcements: Information on the latest changes to PCI DSS and upcoming deadlines.

- Security Alerts: Notifications about new threats and vulnerabilities affecting cardholder data security.

At ISMS.online, we are committed to helping you leverage these resources effectively. Our platform integrates the latest PCI DSS guidelines and provides tools to manage your compliance processes efficiently, ensuring you remain informed and compliant.

ISMS.online and PCI DSS Compliance Support

Achieving and maintaining PCI DSS compliance can be a complex process, especially for Level 2 merchants with specific requirements. At ISMS.online, we specialise in simplifying this journey for you.

Tailored Support for Level 2 Merchants

Our team of experts is well-versed in the nuances of PCI DSS 4.0, particularly for Level 2 merchants. We offer:

- Guided Compliance: Step-by-step assistance through the compliance process, ensuring no requirement is overlooked.

- Resource Library: Access to comprehensive documentation, templates, and checklists tailored to Level 2 compliance needs.

Simplifying Your Compliance Efforts

Contacting ISMS.online can streamline your compliance efforts by providing:

- Centralised Management: A single platform to manage all your compliance activities, from policy documentation to risk assessments.

- Continuous Monitoring Tools: Integrated solutions for ongoing monitoring of your security posture, ensuring continuous compliance.

Choosing ISMS.online for Compliance Solutions

Selecting ISMS.online for your compliance needs means choosing a partner dedicated to your success. We provide:

- Integrated Frameworks: Our platform is designed to integrate with your existing systems, facilitating a seamless compliance experience.

- Expertise and Experience: Our team brings a wealth of knowledge to support your compliance initiatives, from initial assessment to ongoing management.

By partnering with us, you're ensuring that your approach to PCI DSS compliance is thorough, efficient, and aligned with industry best practices.

Book a demo