Understanding PCI DSS and Failure to Comply

When you’re handling cardholder data, compliance with the Payment Card Industry Data Security Standard (PCI DSS) isn’t just a recommendation it’s a necessity. As a comprehensive set of security measures, PCI DSS is designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. This isn’t just about checking a box for compliance; it’s about protecting your customers and your business from the devastating effects of data breaches.

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It’s a set of security standards created to control and minimise the risk to cardholder data. Developed by the PCI Security Standards Council (PCI SSC), which was founded by major credit card companies, it’s a mandatory standard for all entities dealing with cardholder data.

Why Mandatory Compliance?

Compliance with PCI DSS is mandatory because it’s the best line of defence against data breaches and fraud. If you’re processing, storing, or transmitting cardholder data, you must adhere to these standards. It’s not just about avoiding penalties; it’s about maintaining the trust of your customers and the integrity of your business.

Protecting Cardholder Data

PCI DSS aims to protect cardholder data by establishing a secure network and systems environment. This includes implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

Benefits Beyond Legal Requirements

While compliance is mandatory, the benefits extend beyond just meeting legal requirements. Adhering to PCI DSS helps you create a robust security posture, fosters customer confidence, and can even give you a competitive edge. At ISMS.online, we understand the importance of these benefits and offer an Integrated Management System that aligns with PCI DSS to help you manage compliance more effectively.

Book a demoThe Governance Role of PCI Security Standards Council

Understanding the governance of the Payment Card Industry Data Security Standard (PCI DSS) is crucial for any organisation handling cardholder data. The PCI Security Standards Council (PCI SSC) plays a pivotal role in this ecosystem.

Who Constitutes the PCI Security Standards Council?

The PCI SSC was founded by major credit card companies, including Visa, Mastercard, JCB, American Express, and Discover. These founding members continue to govern the council, setting the direction for data security standards across the payment card industry.

Enforcement Influence of the PCI SSC

The PCI SSC does not directly enforce compliance; instead, it influences enforcement through its governance. Compliance is enforced via contracts between merchants and the payment brands or acquirers. Our platform, ISMS.online, helps you understand these relationships and how they impact your compliance obligations.

Responsibilities in Standard Maintenance

The council is responsible for maintaining and updating the PCI DSS to adapt to the evolving landscape of data security. This includes releasing new versions of the standard, like the recent transition to version 4.0 in March 2022.

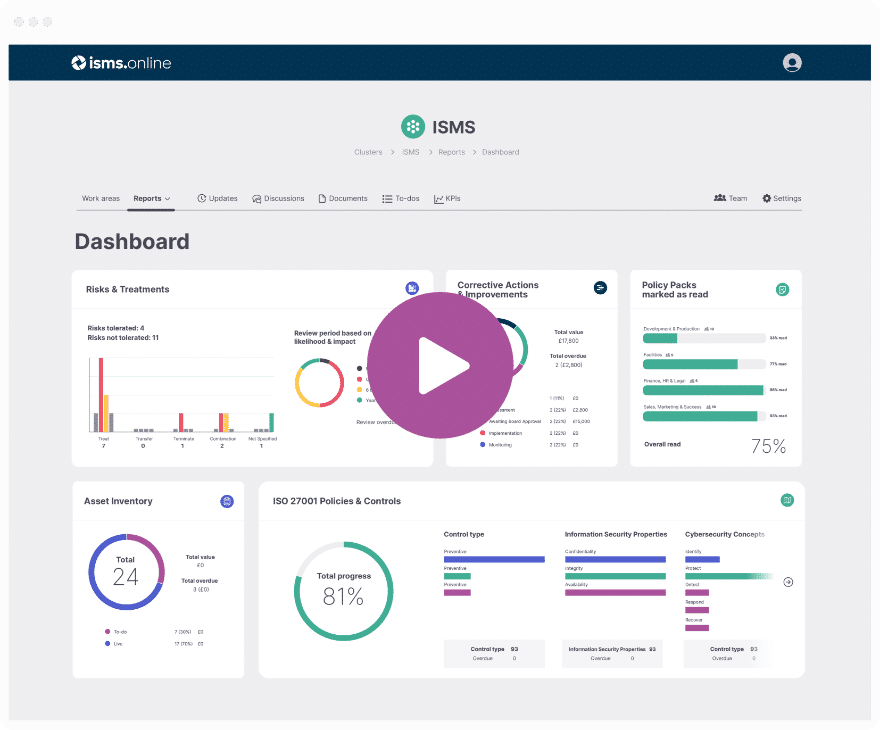

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Financial Risk from PCI DSS Non-Compliance

Navigating the financial implications of PCI DSS non-compliance is essential for any organisation that processes, stores, or transmits cardholder data. Understanding the potential penalties and additional costs is the first step in mitigating financial risks.

Immediate Financial Penalties for Non-Compliance

Organisations that fail to comply with PCI DSS may face substantial financial penalties. These fines can range from $5,000 to $100,000 per month, depending on the severity and duration of the non-compliance. It’s important for you to recognise that these fines are not static and can escalate over time if compliance issues are not resolved promptly.

Calculation and Enforcement of Fines

Fines for PCI DSS non-compliance are typically mediated by banks or payment processors, which may then pass these costs onto the merchant. The exact amount can vary based on factors such as the volume of transactions, the level of non-compliance, and the merchant’s history with data security.

Additional Costs from Compliance Breaches

Beyond fines, a breach of PCI DSS compliance can lead to other financial burdens, including the costs associated with card replacement, fraud recovery, and customer compensation. These expenses can quickly accumulate, significantly impacting your organisation’s financial health.

Mitigating Financial Risks with an Integrated Management System

At ISMS.online, we understand the importance of mitigating these financial risks. Our Integrated Management System provides a structured approach to managing your PCI DSS compliance, helping to prevent breaches and the resulting financial fallout. By maintaining a robust compliance posture, you can avoid the costly consequences of non-compliance.

Legal and Operational Repercussions

The legal and operational consequences of PCI DSS non-compliance are significant and can extend far beyond immediate financial penalties.

Legal Liabilities from Non-Compliance

Failing to comply with PCI DSS can expose your organisation to a range of legal liabilities. These may include lawsuits from affected parties, defence costs, and settlements that can escalate quickly. Moreover, non-compliance can trigger federal audits by entities such as the FTC, leading to additional penalties.

Operational Disruptions Due to Non-Compliance

Operational disruptions are a direct consequence of PCI DSS non-compliance. These disruptions can manifest as payment processing bans, which can cripple your ability to conduct business. Furthermore, non-compliance can result in your organisation being listed on the MATCH List or Terminated Merchant File (TMF), severely limiting your merchant capabilities.

Long-Term Impact of a PCI DSS Breach

The long-term operational impacts of a PCI DSS breach can be devastating. They can include loss of customer trust, damage to business partnerships, and even the risk of bankruptcy or business closure. These outcomes underscore the importance of robust compliance measures.

Protecting Against Risks with Compliance

Maintaining PCI DSS compliance is your best defence against these legal and operational risks. At ISMS.online, we provide the tools and guidance necessary to ensure that your compliance is not only achieved but sustained. By doing so, you protect your organisation from the severe repercussions that accompany non-compliance.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Reputational Damage of PCI DSS Non-Compliance

The repercussions of PCI DSS non-compliance extend beyond immediate financial and legal consequences; they can also severely tarnish a company’s reputation.

Impact on Industry Reputation

When your organisation fails to comply with PCI DSS, it can lead to a loss of customer trust and confidence. This erosion of trust can be particularly damaging in industries where data security is paramount. As a result, non-compliance can diminish your standing among peers and consumers, potentially leading to a loss of business.

Consequences for Business Sustainability

Reputational damage can have a profound impact on the sustainability of your business. Customers and partners may choose to dissociate from a company that has suffered a data breach due to non-compliance. This can lead to a decrease in revenue and, in severe cases, jeopardise the future of the company.

Rebuilding Trust Post-Compliance Failure

Rebuilding trust after a compliance failure requires a transparent and proactive approach. It involves not only addressing the compliance issues but also communicating effectively with stakeholders about the steps taken to prevent future breaches.

Role of an Integrated Management System

At ISMS.online, we believe that an Integrated Management System (IMS) is key to supporting reputational integrity. Our platform helps you to maintain a strong compliance posture, demonstrating to customers and partners that you are committed to protecting their data. By leveraging our IMS, you can enhance your organisation’s credibility and rebuild trust in the wake of compliance challenges.

Navigating the Complexities of PCI DSS Compliance

Achieving and maintaining compliance with the Payment Card Industry Data Security Standard (PCI DSS) can be a complex endeavour, particularly for organisations with limited resources.

Common Challenges in Achieving Compliance

Organisations often encounter several challenges when striving for PCI DSS compliance:

- Understanding the 12 fundamental security requirements and how they apply to their specific operations.

- Keeping up with evolving standards, such as the transition from PCI DSS version 3.2 to 4.0.

- Implementing tailored security measures that align with their transaction volume and business size.

Impact of Resource Limitations

Resource limitations can significantly affect your ability to comply with PCI DSS:

- Limited financial resources may restrict the ability to invest in necessary security technologies.

- A shortage of skilled personnel can hinder the development and maintenance of secure systems.

Strategies for Overcoming Compliance Complexities

To overcome these challenges, you can employ several strategies:

- Prioritise the most critical security measures to manage risks effectively.

- Seek external expertise, such as consulting with Qualified Security Assessors (QSAs).

- Utilise compliance automation tools to streamline the process.

Facilitating Compliance Management with ISMS.online

At ISMS.online, we understand these complexities and provide a comprehensive solution to facilitate your PCI DSS compliance management:

- Our platform offers pre-configured tools and frameworks to help you adapt, adopt, and add to your compliance programme.

- We provide integration capabilities with apps like Zapier and document management systems such as SharePoint and Google Drive.

- Our dynamic risk management tools and robust policy/control management features support your compliance journey every step of the way.

By leveraging ISMS.online, you can navigate the complexities of PCI DSS compliance with confidence, ensuring that your organisation remains secure and aligned with industry standards.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Compliance Through Effective Security Measures

Ensuring adherence to the Payment Card Industry Data Security Standard (PCI DSS) is a multifaceted process that involves implementing and demonstrating a range of security measures.

Key Security Measures for PCI DSS Compliance

PCI DSS compliance is built on 12 fundamental security measures that safeguard cardholder data:

- Installing and maintaining a firewall to protect data

- Changing vendor-supplied defaults for system passwords and other security parameters

- Protecting stored cardholder data

- Encrypting transmission of cardholder data across open, public networks

- Using and regularly updating antivirus software

- Developing and maintaining secure systems and applications

- Restricting access to cardholder data by business need-to-know

- Assigning a unique ID to each person with computer access

- Restricting physical access to cardholder data

- Tracking and monitoring all access to network resources and cardholder data

- Regularly testing security systems and processes

- Maintaining a policy that addresses information security

Demonstrating Compliance Effectively

To demonstrate compliance, you can engage in:

- Self-assessments, where you internally review your adherence to the PCI DSS requirements.

- Third-party assessments, conducted by Qualified Security Assessors (QSAs) who provide an external validation of your compliance status.

Role of Self-Assessments and Third-Party Assessments

Self-assessments and third-party assessments play a critical role in compliance verification:

- They help identify gaps in your security measures.

- They provide evidence of compliance to acquiring banks and payment brands.

Streamlining Compliance with an Integrated Management System

Our Integrated Management System at ISMS.online streamlines the demonstration of compliance by:

- Offering templates and tools to document and manage your security measures.

- Providing dynamic risk management features to continuously monitor and improve your security posture.

- Facilitating transparent reporting to stakeholders on your compliance status.

By utilising these tools, you can ensure that your organisation not only meets but exceeds the requirements set forth by PCI DSS, thereby protecting your customers’ data and your business’s reputation.

Further Reading

The Role of Training and Awareness in Preventing Non-Compliance

As it relates to PCI DSS compliance, the importance of training and awareness cannot be overstated. It is the bedrock upon which a secure payment environment is built.

Tailoring Training to Organisational Roles

Training programmes must be customised to address the specific roles and responsibilities within your organisation. From IT staff to customer service representatives, each employee plays a distinct part in safeguarding cardholder data. At ISMS.online, we advocate for role-based training that equips each team member with the knowledge and tools they need to contribute to PCI DSS compliance effectively.

Resources for PCI DSS Training and Awareness

A wealth of resources is available to support your PCI DSS training initiatives. These include online courses, in-person workshops, and comprehensive guides. We provide access to a variety of training materials that can help you understand and implement the necessary security measures.

Fostering a Culture of Security

Creating a culture of security is a collective effort. It involves regular training sessions, updates on the latest security practices, and open communication about the importance of data protection. By fostering this culture, you ensure that compliance is not just a checkbox exercise but a fundamental aspect of your daily operations.

Through continuous education and a proactive approach to security, you can significantly reduce the risk of non-compliance and the associated penalties.

Overlap with Other Regulatory Standards

In the intricate web of regulatory requirements, PCI DSS compliance often intersects with other standards. Understanding this interplay is crucial for maintaining a comprehensive compliance posture.

Interactions Between PCI DSS and Other Regulations

PCI DSS compliance does not exist in isolation. It often overlaps with other regulatory frameworks such as HIPAA for healthcare, GDPR for data protection in the EU, and SOX for financial reporting. As a compliance officer, you’re tasked with navigating these intersections to ensure that your organisation meets all applicable requirements.

Benefits of a Holistic Compliance Approach

Adopting a holistic approach to regulatory compliance offers several benefits:

- Efficiency: Streamlines compliance efforts by identifying commonalities between different standards.

- Cost-effectiveness: Reduces the need for redundant measures and controls.

- Risk management: Enhances overall security posture by addressing a broader range of risks.

Ensuring Alignment Across Compliance Standards

To ensure alignment, you can:

- Conduct a comprehensive assessment of all regulatory obligations.

- Identify areas of overlap and potential conflicts between different standards.

- Develop integrated policies and procedures that address multiple requirements simultaneously.

Simplifying Adherence with an Integrated Management System

Our Integrated Management System at ISMS.online simplifies regulatory adherence by:

- Providing a unified framework to manage all compliance activities.

- Offering tools and resources that address the requirements of various standards.

- Enabling clear and transparent reporting on compliance status across all regulations.

By leveraging our platform, you can confidently manage PCI DSS compliance alongside other regulatory standards, ensuring a robust and cohesive security strategy.

ISMS.online and PCI DSS Compliance

At ISMS.online, we are dedicated to supporting your organisation’s journey to PCI DSS compliance with a comprehensive suite of tools and resources.

How We Support Your Compliance Journey

Our platform offers a structured approach to PCI DSS compliance:

- Guided Certification Process: We provide a step-by-step guide to help you understand and meet the requirements of PCI DSS.

- Pre-configured Tools: Our tools are designed to align with PCI DSS requirements, making it easier for you to manage compliance tasks.

Tools and Resources

To streamline your compliance processes, we offer:

- Document Management: Integrate with SharePoint or Google Drive for easy document control and versioning.

- Risk Management Tools: Utilise our dynamic tools to identify and manage risks associated with cardholder data.

- Policy and Control Management: Develop robust policies and controls directly within our platform.

Enhancing with ISMS.online

Partnering with us enhances your security posture by:

- Supply Chain Security Management: Manage and monitor the compliance of your suppliers to ensure end-to-end security.

- Transparent Reporting: Generate reports that provide clear insights into your compliance status.

ISMS.online and Your Integrated Management System Needs

You should choose ISMS.online because:

- We offer a comprehensive solution that is adaptable to your organisation's specific needs.

- Our platform is designed to be intuitive, reducing the learning curve and enabling a quicker path to compliance.

- We are committed to providing considerate customer support to assist you at every stage of your compliance journey.

For expert guidance on PCI DSS compliance, reach out to us at ISMS.online. Let us help you secure your cardholder data environment and achieve compliance with confidence.

Book a demo