What Are PCI Compliance Service Providers?

Businesses handling cardholder data turn to PCI compliance service providers for expertise and support. These specialised entities play a critical role in the payment card industry by offering a suite of services designed to ensure that businesses meet the stringent requirements set forth by PCI DSS.

What Constitutes a PCI Compliance Service Provider?

A PCI compliance service provider is an organisation that assists businesses in managing, storing, and transmitting cardholder data securely. Their services are tailored to help businesses achieve and maintain compliance with PCI DSS, a set of security standards designed to protect cardholder information from data breaches and other security threats.

Why Is PCI DSS Compliance Mandatory?

For businesses that handle cardholder data, PCI DSS compliance is not optionalit’s a crucial requirement. Compliance ensures the protection of sensitive cardholder information, thereby maintaining customer trust and avoiding potential legal and financial repercussions associated with data breaches.

How Do Service Providers Assist Businesses?

PCI compliance service providers offer a range of services, including vulnerability scans, compliance audits, risk assessments, and guidance on implementing security measures. By leveraging their expertise, businesses can navigate the complex landscape of PCI DSS compliance more efficiently and effectively.

Distinguishing Features of PCI Compliance Service Providers

Unlike general cybersecurity services, PCI compliance service providers focus specifically on the requirements of the PCI DSS. Their specialised knowledge and experience in this area distinguish them from other types of cybersecurity firms, making them invaluable partners for businesses in the payment card industry.

Book a demoUnderstanding PCI DSS and Its Importance

The Payment Card Industry Data Security Standard (PCI DSS) is a critical framework designed to ensure the secure handling, storage, and transmission of cardholder data. Established by major card brands, including Visa, Mastercard, American Express, Discover, and JCB, PCI DSS aims to protect sensitive cardholder information and maintain trust in the global payment ecosystem.

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. This standard is necessary for protecting the payment card industry from data breaches and fraud.

Why PCI DSS Was Established

The standard was established by major card brands to address the increasing concerns regarding cardholder data security. By creating a unified standard, these brands aimed to ensure that all entities involved in the payment process adhere to a minimum level of security, thereby reducing the risk of data breaches.

How PCI DSS Protects Cardholder Data

PCI DSS employs a comprehensive approach to security, encompassing various measures such as encryption, access control, and network monitoring. These measures are designed to protect cardholder data from unauthorised access, ensuring that sensitive information remains secure throughout the transaction process.

Consequences of Non-Compliance

Non-compliance with PCI DSS can have severe consequences for businesses, including hefty fines, increased transaction fees, and potential legal liabilities. Moreover, a data breach resulting from non-compliance can lead to loss of customer trust, which can have a long-lasting impact on a business’s reputation and financial health.

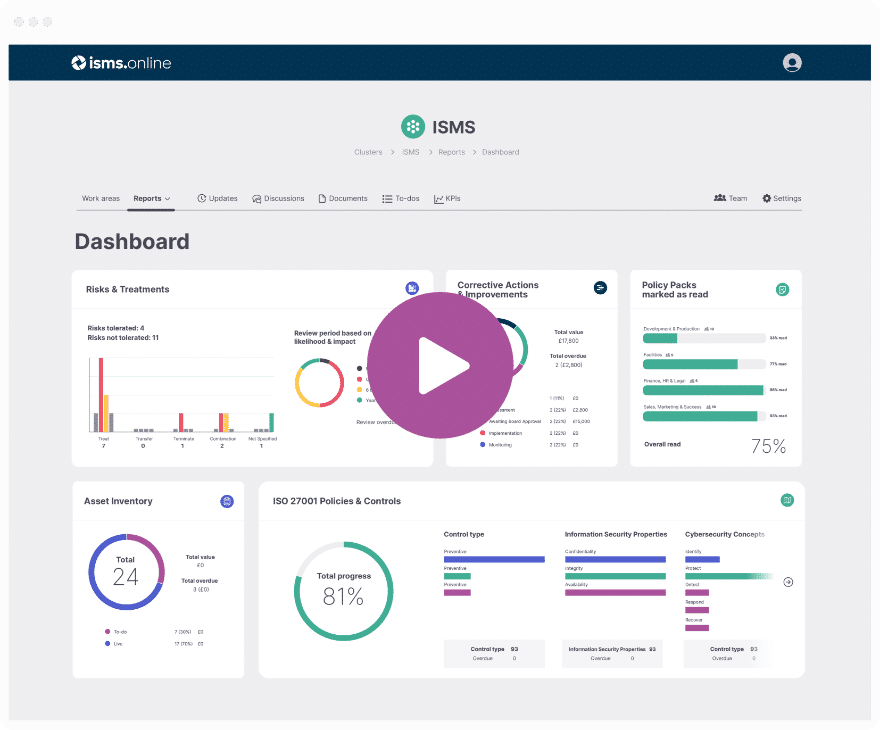

At ISMS.online, we understand the importance of PCI DSS compliance and offer solutions to help businesses achieve and maintain compliance efficiently. Our platform provides tools and resources to manage compliance tasks, ensuring that your business adheres to the highest standards of data security.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Roles and Responsibilities of PCI Compliance Service Providers

PCI compliance service providers play a pivotal role in ensuring that businesses handling cardholder data adhere to the stringent security standards set by the Payment Card Industry Data Security Standard (PCI DSS). Their responsibilities are multifaceted, focusing on the secure management, storage, and transmission of sensitive information.

Services Offered by PCI Compliance Providers

PCI compliance service providers offer a comprehensive suite of services designed to help businesses achieve and maintain compliance with PCI DSS requirements. These services include:

- Secure Data Management: Ensuring the secure storage, transmission, and processing of cardholder data through encryption, tokenization, and other security measures.

- Vulnerability Scans and Risk Assessments: Conducting regular scans of the network and systems to identify vulnerabilities and assess risks to cardholder data.

- Compliance Audits: Assisting businesses in preparing for and navigating through the compliance audit process, including the provision of necessary documentation and evidence of compliance.

Ensuring Secure Data Handling

To protect cardholder data, PCI compliance service providers implement robust security measures, including:

- Encryption and Tokenization: Transforming sensitive data into unreadable formats during storage and transmission.

- Secure Storage Solutions: utilising secure databases and storage solutions that comply with PCI DSS standards.

Support in Vulnerability Management

Service providers assist businesses in identifying and mitigating vulnerabilities through:

- Regular Vulnerability Scans: Automated scanning of systems and networks to detect security weaknesses.

- Risk Assessment: analysing the potential impact of identified vulnerabilities and recommending mitigation strategies.

Response to Data Breaches

In the event of a data breach, PCI compliance service providers offer critical support by:

- Incident Response Planning: Helping businesses develop and implement an effective incident response plan.

- Breach Investigation and Remediation: Assisting in the investigation of the breach, identifying the cause, and implementing measures to prevent future incidents.

At ISMS.online, we understand the complexities of PCI DSS compliance and offer tailored solutions to support your business in meeting these requirements. Our platform provides the tools and resources necessary for secure data management, comprehensive vulnerability assessments, and effective incident response, ensuring your business remains compliant and your customers’ data is protected.

The Process of PCI Compliance Validation

Validating a business’s compliance with the Payment Card Industry Data Security Standard (PCI DSS) is a critical step in ensuring the secure handling, storage, and transmission of cardholder data. This process involves several key steps and entities, each playing a vital role in the comprehensive assessment of a business’s security measures.

Role of Qualified Security Assessors (QSA) and Approved Scanning Vendors (ASV)

Qualified Security Assessors (QSA) are organisations certified by the PCI Security Standards Council to assess compliance with the PCI DSS. QSAs play a crucial role in the validation process by:

- Conducting thorough assessments of a business’s PCI DSS compliance.

- Identifying gaps in compliance and recommending corrective actions.

- Validating the effectiveness of implemented security measures.

Approved Scanning Vendors (ASV), on the other hand, are certified by the PCI Council to conduct external vulnerability scanning services. ASVs contribute by:

- Performing regular scans of a business’s internet-facing environments.

- Identifying vulnerabilities that could potentially be exploited by malicious actors.

- Providing reports that assist in the remediation of identified vulnerabilities.

Significance of the Report on Compliance (ROC) and Attestation of Compliance (AOC)

The Report on Compliance (ROC) is a detailed document produced by a QSA that outlines the findings of the PCI DSS assessment. The ROC is significant because it:

- Provides a comprehensive review of a business’s adherence to PCI DSS requirements.

- Serves as evidence of compliance for acquiring banks and card brands.

The Attestation of Compliance (AOC) is a formal declaration by a business that it has met all the necessary PCI DSS requirements. The AOC is essential as it:

- Acts as proof of compliance for merchants and service providers.

- Is often required by partners and financial institutions to establish business relationships.

Facilitation of Compliance Through Self-Assessment Questionnaires (SAQ)

For smaller merchants, the Self-Assessment Questionnaire (SAQ) offers a simplified mechanism to validate compliance with PCI DSS. The SAQ:

- Allows merchants to self-evaluate their compliance with relevant PCI DSS requirements.

- Provides a range of questionnaires tailored to different merchant environments.

- Helps in identifying areas of non-compliance and guides the implementation of necessary security measures.

At ISMS.online, we understand the complexities involved in achieving and maintaining PCI DSS compliance. Our platform is designed to simplify the compliance process, offering tools and resources that support you in preparing for QSAs, completing SAQs, and maintaining continuous compliance with PCI DSS standards.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Security Measures and Technologies

In the realm of PCI DSS compliance, the employment of robust security measures and technologies is non-negotiable. These measures are designed to safeguard cardholder data against unauthorised access and potential breaches. As a compliance service provider, we at ISMS.online are committed to ensuring that your business adheres to these stringent standards through the implementation of advanced security technologies and practices.

Encryption, Tokenization, and Secure Data Storage

Encryption and tokenization are pivotal in the protection of cardholder data. Encryption transforms sensitive information into a coded format that can only be accessed with the correct decryption key, while tokenization replaces sensitive data with unique identification symbols that retain all the essential information without compromising its security.

- Secure Data Storage: We ensure that all cardholder data stored within your systems is encrypted, rendering it unreadable and secure from unauthorised access.

Network Security Measures

Firewalls, Intrusion Detection Systems (IDS), and Intrusion Prevention Systems (IPS) form the cornerstone of network security within the PCI DSS framework.

- Firewalls act as a barrier between your secure internal network and untrusted external networks, such as the internet.

- IDS and IPS systems monitor network traffic for suspicious activities and potential threats, providing real-time protection against cyber attacks.

Secure Software Development practices

Under PCI DSS, secure software development practices are mandatory to ensure that applications handling cardholder data are not vulnerable to attacks.

- We guide your development teams in adhering to secure coding guidelines, ensuring that any software developed meets the highest security standards.

Secure Transmission of Cardholder Data

The secure transmission of cardholder data over public networks is a critical aspect of PCI DSS compliance.

- We implement SSL/TLS protocols to encrypt data during transmission, ensuring that sensitive information remains secure from point-to-point.

At ISMS.online, our expertise in PCI DSS compliance ensures that your business employs the most effective security measures and technologies to protect cardholder data.

Compliance Levels and Merchant Categories

Understanding the categorization under PCI DSS compliance levels is essential for businesses handling cardholder data. These levels determine the specific compliance requirements and validation processes that a merchant or service provider must follow. At ISMS.online, we aim to clarify these categories and their implications for your business.

Categorization Under PCI DSS Compliance Levels

Businesses are categorised into different compliance levels based on the volume of credit card transactions they process annually. These levels are designed to ensure that appropriate security measures are in place relative to the size and scope of the business.

- Level 1: Applies to merchants processing over 6 million card transactions per year.

- Level 2: For those processing 1 to 6 million transactions annually.

- Level 3: categorises merchants with 20,000 to 1 million transactions.

- Level 4: Includes merchants processing fewer than 20,000 transactions annually.

Criteria Determining Compliance Levels

The primary criterion for determining a merchant’s or service provider’s compliance level is the annual volume of credit card transactions. However, factors such as the merchant’s history of data breaches and the types of transactions (e.g., e-commerce vs. in-store) may also influence their categorization.

Variation in Compliance Requirements

Compliance requirements intensify with each level, with Level 1 merchants subjected to the most stringent validation processes, including annual on-site assessments by a Qualified Security Assessor (QSA) and quarterly network scans by an Approved Scanning Vendor (ASV).

- Levels 2 to 4 may have less rigorous validation requirements, such as self-assessment questionnaires (SAQs), but still necessitate adherence to all PCI DSS requirements.

Implications for the Validation Process

The compliance level of a business directly impacts the validation process it must undergo. Higher-level merchants face more comprehensive assessments, reflecting the greater risk associated with processing a higher volume of transactions.

- For our clients, understanding your compliance level is the first step in developing a tailored PCI DSS compliance strategy. We provide guidance and support throughout the validation process, ensuring that your business meets all necessary requirements efficiently and effectively.

At ISMS.online, we are committed to helping you navigate the complexities of PCI DSS compliance, regardless of your business’s size or transaction volume.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Challenges in Maintaining PCI DSS Compliance

Achieving and maintaining PCI DSS compliance presents a set of challenges that businesses must navigate. These challenges can stem from evolving technology, the dynamic nature of cyber threats, and the complexities of the compliance process itself.

Common Obstacles in PCI DSS Compliance

Businesses often encounter several obstacles in their journey towards PCI DSS compliance, including:

- Complexity of Requirements: Understanding and implementing the detailed and technical requirements of PCI DSS can be daunting.

- Resource Constraints: Small to medium-sized businesses may lack the financial and human resources necessary for compliance efforts.

- Evolving Technology: Keeping up with rapid technological changes and integrating new systems securely can complicate compliance.

Impact of Technology Changes and Cyber Threats

The digital landscape is continuously evolving, with new technologies and cyber threats emerging regularly. This evolution can impact compliance efforts by:

- Introducing New Vulnerabilities: New technologies may introduce unforeseen vulnerabilities that need to be addressed.

- Requiring Continuous Monitoring: The dynamic nature of cyber threats necessitates ongoing vigilance and adaptation of security measures.

Strategies for Addressing Compliance Challenges

Businesses can employ several strategies to overcome these challenges, such as:

- Regular Training and Awareness: Ensuring that staff are aware of compliance requirements and best practices.

- Leveraging Technology Solutions: utilising compliance software and tools to streamline and automate parts of the compliance process.

- Engaging with Experts: Consulting with PCI DSS experts or compliance service providers for guidance and support.

How ISMS.online Can Assist

At ISMS.online, we understand the complexities of PCI DSS compliance. Our integrated management systems are designed to simplify and support your compliance efforts by:

- Providing a centralised Platform: For managing all aspects of your PCI DSS compliance, from policy documentation to risk assessments.

- Offering Pre-configured Frameworks: That align with PCI DSS requirements, helping you to quickly establish and maintain compliance.

- Facilitating Continuous Improvement: Through tools that support ongoing monitoring, reporting, and management of compliance activities.

By leveraging our platform, you can address the common challenges associated with PCI DSS compliance, ensuring that your business remains secure and compliant in an ever-changing digital environment.

Further Reading

The Role of Continuous Monitoring and Improvement

In the dynamic landscape of data security, maintaining PCI DSS compliance is not a one-time achievement but a continuous process. Continuous monitoring and improvement are essential components of an effective PCI DSS compliance strategy. At ISMS.online, we understand the importance of these processes and provide the tools and guidance necessary to ensure your business remains compliant over time.

Why Continuous Monitoring is Important

Continuous monitoring is vital for maintaining PCI DSS compliance due to the ever-evolving nature of cyber threats and technology. It allows businesses to:

- Detect Security Threats Early: By continuously monitoring your systems, you can identify potential security threats before they escalate into breaches.

- Stay Compliant with PCI DSS: Regular monitoring ensures that your security controls remain effective and in line with PCI DSS requirements.

Facilitating Ongoing Risk Assessments and Security Audits

Compliance service providers play a key role in facilitating ongoing risk assessments and security audits by:

- Providing Expertise: Offering guidance on the latest PCI DSS requirements and how to meet them.

- Conducting Regular Audits: Performing security audits to assess compliance and identify areas for improvement.

Tools and Technologies for Continuous Monitoring

To support continuous monitoring efforts, various tools and technologies are employed, including:

- Security Information and Event Management (SIEM): For real-time analysis of security alerts generated by applications and network hardware.

- Vulnerability Scanning Tools: To regularly scan systems and networks for vulnerabilities.

Streamlining Compliance and Monitoring with ISMS.online

Our platform, ISMS.online, enables businesses to streamline their compliance and monitoring processes by:

- Centralising Compliance Activities: Offering a single platform for managing all compliance-related tasks and documentation.

By leveraging ISMS.online, you can ensure that your business not only achieves but maintains PCI DSS compliance through effective continuous monitoring and ongoing improvement.

Regulatory Compliance and PCI DSS

Navigating the landscape of regulatory compliance, including the Payment Card Industry Data Security Standard (PCI DSS) and other regulations such as the General Data Protection Regulation (GDPR), presents a complex challenge for businesses. At ISMS.online, we understand the intricacies of aligning PCI DSS compliance with broader regulatory requirements and offer solutions to streamline this process.

Intersection with Other Regulatory Requirements

PCI DSS compliance often intersects with other regulatory frameworks, notably GDPR, which governs data protection and privacy for individuals within the European Union. Both PCI DSS and GDPR emphasise the secure handling and protection of personal information, albeit with different scopes and focuses. Ensuring compliance with both sets of regulations requires a comprehensive understanding of their requirements and how they overlap.

Challenges in Navigating Multiple Compliance Landscapes

Businesses face several challenges when navigating multiple compliance landscapes, including:

- Understanding Specific Requirements: Each regulatory framework has its unique set of requirements, which can vary significantly.

- Resource Allocation: Implementing and maintaining compliance across different regulations demands significant resources.

- Consistency in Compliance Efforts: Ensuring consistent compliance practices that meet the standards of all applicable regulations.

Aligning PCI DSS Compliance with Other Regulations

Service providers, including ISMS.online, assist businesses in aligning PCI DSS compliance with other regulatory requirements by:

- Providing Expert Guidance: Offering insights into the nuances of each regulation and how they intersect.

- Streamlining Compliance Processes: utilising tools and frameworks that address multiple compliance requirements simultaneously.

Role of ISMS.online in Ensuring Comprehensive Regulatory Compliance

ISMS.online plays a important role in ensuring comprehensive regulatory compliance by:

- Offering an Integrated Compliance Framework: Our platform aligns with various regulatory standards, including PCI DSS and GDPR, facilitating a holistic approach to compliance.

- Simplifying Compliance Management: Through pre-configured templates and automated workflows, we make it easier for businesses to manage their compliance activities across different regulations.

By leveraging the capabilities of ISMS.online, businesses can effectively navigate the complexities of PCI DSS and other regulatory compliance requirements, ensuring the secure handling of sensitive data and maintaining trust with their customers.

Partnering with a PCI Compliance Service Provider

In today’s digital age, where data breaches are increasingly common, partnering with a PCI compliance service provider is not just beneficial; it’s essential. For businesses handling cardholder data, ensuring the security of this sensitive information becomes obligatory. A PCI compliance service provider offers the expertise and tools necessary to navigate the complex landscape of PCI DSS compliance, safeguarding your business and your customers’ data.

Long-Term Benefits of PCI DSS Compliance

Achieving and maintaining PCI DSS compliance offers several long-term benefits for businesses, including:

- Enhanced Data Security: Protecting cardholder data from potential breaches and cyber threats.

- Customer Trust: Demonstrating a commitment to security can significantly boost customer confidence and loyalty.

- Reduced Risk of Fines: Compliance helps avoid costly penalties associated with data breaches and non-compliance.

Beginning Your Journey Toward PCI DSS Compliance

To start your journey toward PCI DSS compliance, businesses should:

- Assess Current Security Measures: Understand where your business stands in terms of PCI DSS requirements.

- Identify Gaps: Pinpoint areas that need improvement to meet compliance standards.

- Seek Expert Guidance: Consider partnering with a PCI compliance service provider for specialised support.

How ISMS.online Can Streamline Your Compliance Efforts

Contacting ISMS.online can significantly streamline your compliance efforts. Our platform offers:

- Comprehensive Tools: From risk assessments to policy management, we provide all the tools you need in one place.

- Expert Support: Our team of experts is here to guide you through every step of the compliance process.

- Tailored Solutions: We understand that every business is unique and offer customised solutions to meet your specific needs.

By choosing ISMS.online, you're not just working towards compliance; you're enhancing the overall security posture of your business.

Book a demo