PCI DSS and Its Impact on Small Businesses

What is PCI DSS 4.0?

The Payment Card Industry Data Security Standard (PCI DSS) 4.0 is the latest framework designed to secure cardholder data during and after transactions. Established by the PCI Security Standards Council (PCI SSC), it is not a law but a contractual obligation between merchants and the major card brands. This standard is crucial for small businesses that handle card payments, as it outlines the necessary security measures to protect sensitive data.

Differences from Previous Versions

PCI DSS 4.0 brings significant changes from its predecessors, tailored to adapt to evolving technology and threats. Unlike version 3.2.1, the new standard introduces more flexibility with a customised approach to compliance, allowing businesses to adapt the requirements to their specific environments. It also includes 60 new requirements, with 13 immediate changes and others phased in by March 31, 2025.

The Importance of Compliance

For small businesses, compliance with PCI DSS 4.0 is not just about avoiding fines or reputational damage; it’s about safeguarding customer trust and building a secure foundation for data security. By adhering to the standard, you’re not only protecting your customers’ data but also enhancing the overall trustworthiness of your business.

Interpreting the Six Principles and Twelve Requirements

PCI DSS 4.0 is structured around six guiding principles and twelve core requirements, which provide a comprehensive framework for securing cardholder data. As a small business, understanding and implementing these principles and requirements is essential. At ISMS.online, we can help you interpret and apply these to your business, ensuring that you not only comply with the standard but also strengthen your security posture.

Book a demoHow Long Is the Compliance Timeline?

Understanding the timeline for PCI DSS 4.0 compliance is essential for small businesses to plan and execute their security strategies effectively. As your partner in compliance, we at ISMS.online are committed to guiding you through each critical deadline and milestone.

Critical Deadlines for PCI DSS 4.0 Compliance

The transition to PCI DSS 4.0 introduces a set of deadlines that your business must be aware of:

- Mandatory Compliance Date: All entities must adhere to the new standard by April 1, 2024.

- Staggered Deadlines: Certain new requirements have extended deadlines, providing additional time for implementation until March 31, 2025.

Impact of Staggered Deadlines on Planning

The staggered deadlines for the 60 new requirements of PCI DSS 4.0 necessitate a phased approach to compliance:

- Immediate Requirements: 13 requirements must be met by the 2024 deadline.

- Future-Dated Requirements: 50 requirements have the extended 2025 deadline, allowing for a more manageable transition.

Consequences of Non-Compliance

Failing to meet these deadlines can result in:

- Non-Compliance Fines: Financial penalties imposed by card brands or acquirers.

- Reputational Damage: Loss of customer trust and potential business due to security concerns.

Ensuring On-Track Compliance

To ensure you are on track for the April 1, 2024, deadline:

- Gap Assessments: Conduct thorough reviews to identify areas needing attention.

- Planning: Develop a detailed plan that includes all necessary updates and changes.

- Resources: Utilise the tools and guidance provided by ISMS.online to streamline your compliance journey.

By staying informed and proactive, you can navigate the PCI DSS 4.0 compliance landscape with confidence.

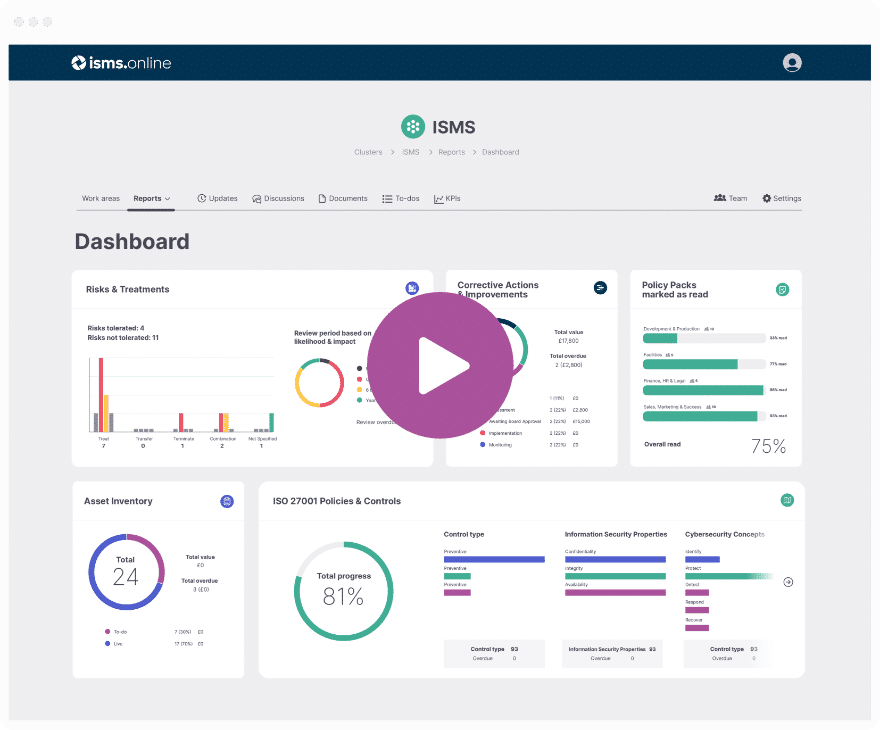

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Approach to PCI DSS for Small Business

PCI DSS 4.0 introduces a more tailored approach to compliance, recognising the unique needs of small businesses. This flexibility is crucial in developing a security strategy that aligns with your specific operational context.

Flexibility in Technology Adaptation and Security Measures

PCI DSS 4.0 offers:

- Customised Implementation: You can now adapt the standard’s requirements to fit your business’s technology and processes.

- Continuous Security: A shift towards ongoing security practices rather than periodic compliance checks.

Determining Appropriate Compliance Strategies

To identify the best compliance strategy for your business:

- Assess Your Environment: Understand your specific payment card operations and technology infrastructure.

- Prioritise Your Needs: Focus on the most critical areas where security must be strengthened.

- Leverage Guidance: Utilise the resources and tools provided by PCI SSC and partners like ISMS.online.

ISMS.online: Your Partner in Customising Compliance

At ISMS.online, we assist you by:

- Providing a Framework: Our platform offers a structured approach to managing your PCI DSS 4.0 compliance journey.

- Offering Tools and Resources: Access to documentation templates, risk management tools, and policy frameworks.

- Expert Support: Our team is ready to help you understand and implement the requirements of PCI DSS 4.0.

By embracing the customised approach of PCI DSS 4.0, you can ensure that your compliance efforts are both effective and efficient.

Risk Assessment and Management Under PCI DSS

Risk assessment and management are pivotal in the PCI DSS 4.0 framework, with new protocols introduced to enhance the security posture of small businesses.

New Protocols for Risk Assessment

PCI DSS 4.0 emphasises:

- Continuous Security: A shift towards ongoing vigilance rather than periodic compliance.

- Enhanced Validation: More rigorous testing procedures to ensure robust security controls.

Conducting Formal Risk Assessments

As a small business, you should:

- Identify Assets: Catalogue all components involved in the storage, processing, or transmission of cardholder data.

- Evaluate Threats: Determine potential threats to your cardholder data environment (CDE).

- Assess Vulnerabilities: Identify weaknesses that could be exploited by threats.

- Prioritise Risks: Rank risks based on their potential impact and likelihood of occurrence.

Best Practices for Vulnerability Management

To effectively manage vulnerabilities:

- Regular Scanning: Perform authenticated internal vulnerability scans to detect issues.

- Patch Management: Apply security patches promptly to mitigate identified vulnerabilities.

- Incident Response: Develop a plan to respond to security incidents swiftly.

Leveraging ISMS.online for PCI DSS 4.0 Compliance

Our platform, ISMS.online, supports your compliance efforts by providing:

- Dynamic Risk Management: Tools to assess, prioritise, and track risks in real-time.

- Documentation Templates: Pre-configured records to streamline your risk assessment process.

- Expert Guidance: Access to our knowledge base and support for understanding PCI DSS 4.0 requirements.

By integrating these practices, you can build a resilient defence against security threats and align with PCI DSS 4.0 standards.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Role of Qualified Security Assessors

Qualified Security Assessors (QSAs) play a pivotal role in the PCI DSS 4.0 compliance process, especially for small businesses navigating the complexities of the standard.

Selecting and Working with QSAs

When choosing a QSA, consider the following steps to ensure a fruitful collaboration:

- Research: Look for QSAs with experience in your industry and a proven track record.

- Verify Credentials: Ensure the QSA is certified by the PCI Security Standards Council (PCI SSC).

- Define Scope: Clearly outline the areas of your business that require assessment.

Testing Procedures and Validation Methods

QSAs utilise a range of methods to validate compliance:

- Onsite Evaluations: Conducting thorough inspections of your physical and digital security measures.

- Documentation Review: Assessing your policies, procedures, and records for adherence to PCI DSS 4.0.

- Penetration Testing: Simulating attacks to test the effectiveness of your security controls.

Enhancing Credibility and Security

Working with a QSA can significantly benefit your business by:

- Ensuring Accuracy: QSAs provide an external perspective to verify that all PCI DSS 4.0 requirements are met.

- Building Trust: Demonstrating to customers and partners that your business takes data security seriously.

- Improving Security Posture: Identifying potential vulnerabilities and recommending enhancements.

At ISMS.online, we understand the importance of QSAs in the compliance journey and can guide you in integrating their expertise with our comprehensive compliance solutions.

Self-Assessment Questionnaires (SAQs)

For small businesses, Self-Assessment Questionnaires (SAQs) are a critical component of PCI DSS 4.0 compliance. Understanding the various SAQ types and selecting the appropriate one is a key step in validating your security measures.

Types of SAQs Available Under PCI DSS 4.0

PCI DSS 4.0 offers several SAQs tailored to different business environments:

- SAQ A: For merchants who outsource all cardholder data functions.

- SAQ B: For merchants using only imprint machines or standalone dial-out terminals.

- SAQ C-VT: For merchants with virtual terminal solutions not connected to other systems.

- SAQ C: For merchants with payment application systems connected to the internet.

- SAQ P2PE-HW: For merchants using hardware payment terminals in a validated P2PE solution.

- SAQ D: For all other merchants and service providers not covered by the above.

Determining the Applicable SAQ

To identify which SAQ fits your operations:

- Assess Your Payment Channels: Review how your business handles cardholder data.

- Evaluate Your Payment Systems: Determine if your payment systems are connected to the internet or other systems.

- Consult with a QSA: A Qualified Security Assessor can provide expert advice on the most suitable SAQ for your business.

Steps for Completing an SAQ

Completing an SAQ involves:

- Gathering Documentation: Compile evidence of your compliance with the applicable PCI DSS 4.0 requirements.

- Answering Questions: Respond to each question in the SAQ accurately, reflecting your security controls.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Incident Response Planning for Small Businesses

As it pertains to PCI DSS 4.0, incident response planning is not just a requirement; it’s a fundamental component of your security strategy. As small businesses are increasingly targeted by cyber threats, having a robust incident response plan is critical.

The Criticality of Incident Response Planning

An effective incident response plan ensures that you can:

- React Swiftly: Minimise the impact of a data breach or security incident.

- Maintain Compliance: Meet the PCI DSS 4.0 standards for incident response.

- Preserve Reputation: Protect your business’s reputation by demonstrating preparedness.

Components of an Effective Incident Response Plan

Your incident response plan should include:

- Roles and Responsibilities: Define who does what in the event of an incident.

- Notification Procedures: Establish clear guidelines for internal and external communication.

- Assessment Protocols: Outline steps for evaluating the scope and impact of an incident.

- Remediation Steps: Detail actions to contain and mitigate the effects of the incident.

Developing and Testing Your Incident Response Plan

To develop and test your plan:

- Draught the Plan: Use ISMS.online’s templates to create a comprehensive incident response plan.

- Conduct Simulations: Test the plan with tabletop exercises or simulated breaches.

- Review and Revise: Regularly update the plan based on test outcomes and evolving threats.

Further Reading

Cybersecurity Training and Awareness for Employees

In the context of PCI DSS 4.0, the human element is as critical as any technology or policy. For small businesses, empowering employees through cybersecurity training and awareness is a cornerstone of compliance and overall security posture.

The Essence of Cybersecurity Training in PCI DSS 4.0 Compliance

Cybersecurity training is not just a compliance checkbox; it’s a vital defence mechanism. It equips your team with the knowledge to:

- Identify Threats: Recognise potential security risks, from phishing attempts to social engineering tactics.

- Respond Appropriately: Understand the steps to take when a security threat is identified.

- Protect Sensitive Data: Handle cardholder data securely, adhering to PCI DSS 4.0 protocols.

Core Topics for Employee Training Programmes

Your cybersecurity training should cover:

- Data Security Principles: Basic concepts of data protection and the importance of PCI DSS 4.0.

- Specific PCI DSS Requirements: The 12 principal requirements and how employees’ actions impact compliance.

- Secure Handling of Cardholder Data: Best practices for processing and storing sensitive information.

Frequency of Training Sessions

To maintain a vigilant and informed workforce, conduct training:

- Annually: As a minimum requirement to refresh knowledge and cover any updates.

- Following Significant Changes: Whenever there are changes in your payment environment or new threats emerge.

Technology and Third-Party Service Provider Requirements

In the updated PCI DSS 4.0, small businesses must navigate new requirements for technology use and third-party service providers to ensure the security of cardholder data.

New Requirements for Network Infrastructure Security

PCI DSS 4.0 introduces enhanced requirements for network infrastructure security:

- Encryption and Hashing: Mandates for stronger encryption protocols to protect data in transit and at rest.

- Multi-Factor Authentication (MFA): Requirement for MFA for all access to the cardholder data environment (CDE).

- Automated Log Reviews: Implementation of automated mechanisms for reviewing logs to detect anomalies.

Ensuring Compliance Among Technology and Service Providers

To ensure your technology and service providers comply with PCI DSS 4.0:

- Due Diligence: Conduct thorough assessments of providers’ security practices and PCI DSS compliance status.

- Contractual Agreements: Include specific PCI DSS compliance clauses in contracts with service providers.

- Continuous Monitoring: Regularly review service providers’ compliance through audits and security assessments.

Managing Third-Party Risks

Managing third-party risks involves:

- Risk Assessment: Evaluate the potential risks associated with each service provider.

- Vendor Management Programme: Develop a programme to manage and monitor third-party relationships.

- Incident Response: Ensure that third-party contracts include protocols for incident response and breach notification.

At ISMS.online, we provide the tools and guidance necessary for you to manage these new requirements and third-party risks effectively, helping you maintain compliance with PCI DSS 4.0.

Documentation and Record Keeping

Accurate documentation and meticulous record-keeping are non-negotiable under PCI DSS 4.0. They serve as the foundation for demonstrating compliance and maintaining the integrity of your security practices.

Mandated Documentation Practices

Under PCI DSS 4.0, you’re required to maintain:

- Policies and Procedures: Documented security policies that outline your compliance measures.

- Access Logs: Records of who accessed cardholder data and when.

- Audit Trails: Detailed logs that track user activities and system changes affecting data security.

Establishing Effective Change Control Processes

To establish robust change control and documentation processes:

- Implement a Formal Procedure: Define steps for making changes to your systems and security measures.

- Document Changes: Keep records of all changes, including what was done, by whom, and why.

- Review Regularly: Periodically review and update your documentation to ensure it reflects current practices.

The Importance of Cryptographic Inventory

Maintaining a cryptographic inventory is crucial for:

- Tracking Key Management: Ensuring that encryption keys are managed securely and changed periodically.

- Verifying Security Controls: Demonstrating that data encryption aligns with PCI DSS 4.0 standards.

Tools for Documentation and Record Keeping

At ISMS.online, we provide tools to help manage your documentation:

- Pre-configured Templates: Ready-to-use templates that align with PCI DSS 4.0 requirements.

- Document Management System: A centralised platform to store, manage, and track changes to your documentation.

By leveraging these tools, you can ensure that your documentation and record-keeping practices are thorough, up-to-date, and compliant with PCI DSS 4.0.

Cost-Effective Compliance Strategies for Small Businesses

Navigating the financial aspects of PCI DSS 4.0 compliance can be challenging for small businesses. Understanding the cost implications and employing strategic planning are key to managing expenses without compromising on security.

Understanding Compliance Costs

Compliance with PCI DSS 4.0 involves various costs, including:

- Assessment Fees: Payments for Qualified Security Assessors (QSAs) to validate compliance.

- Technology Investments: Costs for upgrading systems to meet security requirements.

- Training Expenses: Investment in employee training to ensure they understand compliance protocols.

Budgeting for Compliance

To effectively budget for PCI DSS 4.0 compliance, consider:

- Prioritising Requirements: Focus on the most critical requirements first to manage costs better.

- Staggered Implementation: Utilise the phased approach of PCI DSS 4.0 to spread out expenses.

Employing Cost-Effective Strategies

Small businesses can reduce compliance costs by:

- Leveraging Free Resources: Utilise free guidelines and tools provided by the PCI Security Standards Council.

- Open-Source Solutions: Consider open-source security tools that can offer cost savings.

Choosing ISMS.online for Cost Management

At ISMS.online, we support your cost-effective compliance journey by providing:

- Pre-configured Templates: Reduce the time and resources needed to create compliance documents.

- Integrated Management System: Streamline your compliance processes in one centralised platform.

By adopting these strategies, you can achieve PCI DSS 4.0 compliance in a cost-effective manner, ensuring the security of cardholder data without straining your financial resources.

ISMS.online Supports Small Businesses

At ISMS.online, we provide comprehensive support to small businesses navigating PCI DSS 4.0:

- Guided Framework: Our platform offers a structured approach to managing your compliance efforts.

- Resource Library: Access a wealth of documentation, templates, and best practices.

- Dedicated Assistance: Our team of experts is available to answer your questions and provide personalised advice.

Benefits of Partnering with ISMS.online

By partnering with us, you gain:

- Streamlined Compliance: Simplify the compliance process with our pre-configured tools and resources.

- Dynamic Risk Management: Utilise our dynamic risk management features to identify and mitigate potential security risks.

Next Steps in Your Compliance Process

To advance your PCI DSS 4.0 compliance:

- Contact Us: Reach out to our team for an initial consultation.

- Plan Your Approach: We'll help you develop a tailored compliance plan that suits your business needs.

- Implement and Review: Use our platform to implement necessary changes and regularly review your security posture.

Taking these steps will set you on a clear path to PCI DSS 4.0 compliance, with ISMS.online by your side to ensure a smooth and successful journey.

Book a demo