What Is PCI DSS and Why Do E-commerce Companies Need It?

As we delve into the Payment Card Industry Data Security Standard (PCI DSS) 4.0, it’s crucial to understand how it revolutionises e-commerce security. This latest iteration introduces a suite of new requirements and security measures designed to fortify online transaction safety. Let’s unpack these changes and their implications for your e-commerce platform.

New Requirements and Security Measures

PCI DSS 4.0 heralds a significant shift with the introduction of 51 new requirements, set to take effect by April 2025. These requirements are not just incremental changes but represent a comprehensive overhaul aimed at addressing modern cybersecurity challenges. As your partner in compliance, we at ISMS.online are committed to guiding you through these changes.

Impact on E-commerce Platforms

The new requirements will necessitate a thorough review of your current security protocols. For e-commerce platforms, this means adapting to more stringent data handling procedures and implementing robust customer browser security measures. The goal is to not only comply with the standards but also to enhance the overall security posture of your platform.

Focus on Customer Browser Security and Data Handling

PCI DSS 4.0 places a strong emphasis on safeguarding customer interactions through enhanced browser security. This includes protecting against online skimming and Magecart attacks, which have become increasingly prevalent. By focusing on these areas, the update aims to ensure that customer data is handled with the utmost care and diligence, thereby maintaining the integrity of online transactions.

In your journey toward compliance, our platform offers the tools and expertise necessary to navigate these updates effectively. With ISMS.online, you can be confident that your e-commerce business is not only compliant but also secure against emerging cyber threats.

Book a demoProactive PCI DSS 4.0 Compliance Planning

For the purpose of e-commerce, early preparation for PCI DSS 4.0 compliance is not just beneficial; it’s essential. As we navigate towards the April 2025 deadline, with 51 new requirements on the horizon, starting now affords you the necessary time to thoroughly understand and implement the changes. This proactive approach mitigates the risk of non-compliance and ensures a seamless transition, safeguarding your customer’s data and your business’s reputation.

Strategising for a Smooth Transition to PCI DSS 4.0

To facilitate a smooth transition, it’s imperative to develop a comprehensive strategy that encompasses policy planning, execution, and the necessary technical and cultural shifts within your organisation. By doing so, you’re not only aligning with the new standards but also reinforcing your commitment to data security and customer trust.

Phased Implementation: Managing the Compliance Journey

A phased approach to implementing PCI DSS 4.0 allows for manageable, incremental changes, reducing the potential for disruption. This methodical progression through the compliance milestones enables continuous assessment and refinement, ensuring each new requirement is met with precision and confidence.

Role of an Integrated Management System in Compliance

An Integrated Management System (IMS) like ISMS.online is instrumental in achieving early compliance. Our platform provides a structured framework that aligns with PCI DSS 4.0, offering tools for risk management, policy control, and audit readiness. By leveraging our IMS, you can demonstrate adherence to the highest standards of payment security, positioning your e-commerce business at the forefront of industry best practices.

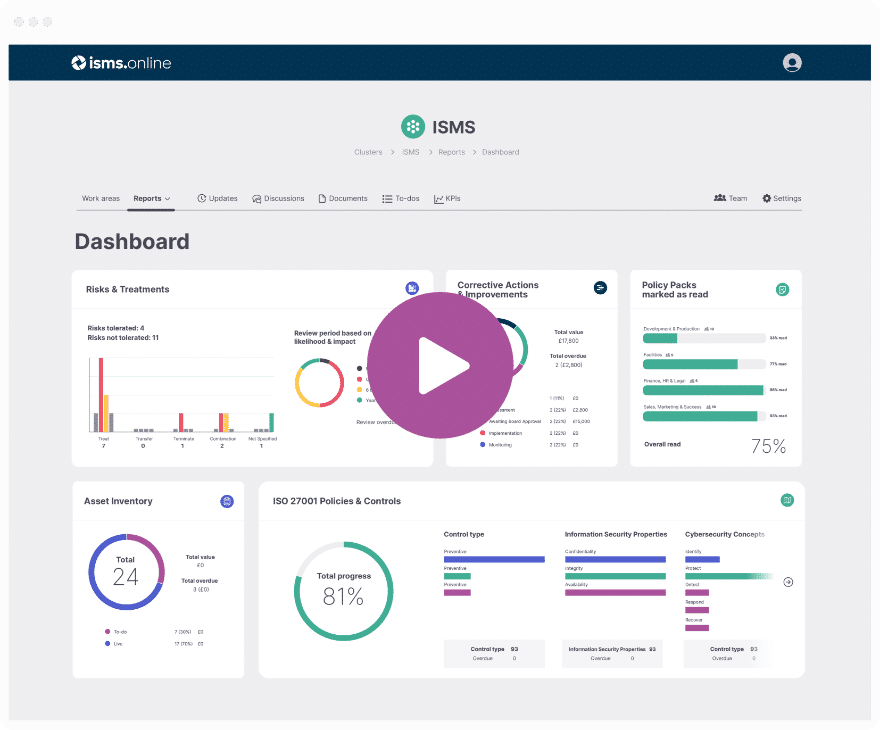

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Compliance Deadlines for PCI DSS 4.0

Understanding the compliance deadlines for PCI DSS 4.0 is crucial for your e-commerce business. The new standard introduces significant changes, and being aware of the timeline is essential for planning and preparation.

Mark Your Calendars: Critical PCI DSS 4.0 Dates

The transition to PCI DSS 4.0 comes with specific milestones:

- April 2024: Auditors begin using the new standard for assessments.

- March 2025: Full enforcement of PCI DSS 4.0 commences.

These dates are pivotal for your compliance journey, influencing how you plan and allocate resources.

Transition Period: Preparing for Change

The period leading up to March 31, 2024, is a transition phase. During this time, you should be:

- Assessing your current compliance status.

- Identifying gaps against the new requirements.

- Planning and beginning implementation of necessary changes.

This phase is about laying the groundwork for full compliance.

Achieving Full Compliance by March 2025

To ensure full compliance by the March 2025 deadline, consider the following steps:

- Engage in continuous assessment of your hardware and software.

- Educate your staff on the new requirements.

- Utilise tools like ISMS.online to manage and document your compliance efforts.

By following these steps, you can position your e-commerce platform to meet the PCI DSS 4.0 standards effectively.

Navigating the Compliance Process

Ensuring compliance with PCI DSS 4.0 is a multi-step process that requires meticulous planning and execution. As an e-commerce business, you’re tasked with safeguarding cardholder data, and understanding the compliance process is paramount.

Understanding the Steps to PCI DSS 4.0 Compliance

The compliance journey involves several key steps:

- Self-Assessment: Begin with a self-assessment to evaluate your current security posture against PCI DSS 4.0 standards.

- Gap Analysis: Identify any discrepancies between your current practices and the new requirements.

- Remediation: Address identified gaps by implementing necessary changes to your security infrastructure and business processes.

The Role of the Report on Compliance (RoC)

The Report on Compliance (RoC) is a critical document that validates your adherence to PCI DSS standards. It includes:

- A detailed assessment performed by a Qualified Security Assessor (QSA).

- Evidence of compliance with each requirement.

- Attestation of the effectiveness of your security controls.

Continuous Assessment: A Cornerstone of Compliance

Continuous assessment of your hardware and software ensures ongoing compliance and allows for:

- Prompt detection and remediation of vulnerabilities.

- Assurance that security measures are functioning as intended.

- Maintenance of a robust security posture in the face of evolving threats.

The Impact of Level 1 External Audits

For large e-commerce merchants, Level 1 external audits are mandatory and involve:

- An in-depth examination by a QSA.

- Verification of compliance at the highest transaction volumes.

- A more rigorous scrutiny to reflect the increased risk profile.

At ISMS.online, we understand the complexities of PCI DSS 4.0 compliance. Our platform is designed to support you through each step, ensuring that your e-commerce business meets the stringent requirements set forth by the PCI Security Standards Council.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Addressing Client-Side Security Risks in E-Commerce

Understanding and mitigating client-side risks is a cornerstone of PCI DSS 4.0, which introduces enhanced measures to protect against the evolving threats in the e-commerce landscape.

Mitigating Specific Client-Side Risks with PCI DSS 4.0

PCI DSS 4.0 aims to mitigate several client-side risks, including:

- Magecart attacks: Malicious scripts injected into websites to steal card data during transactions.

- Formjacking: Cybercriminals’ use of malicious code to hijack form data, including payment information.

- Digital skimming: Unauthorised copying of personal and financial data during online transactions.

- PII harvesting: Collection of Personally Identifiable Information without consent, often through deceptive means.

Protective Measures Against Client-Side Threats

To protect against these threats, e-commerce platforms should:

- Implement strict Content Security Policies (CSP) to control which scripts are allowed to run.

- Employ regular code reviews and security assessments to detect vulnerabilities.

- Utilise Web Application Firewalls (WAFs) and automated tools to monitor and block suspicious activities.

Enhancements in PCI DSS 4.0 for Client-Side Security

PCI DSS 4.0 enhances client-side security by:

- Requiring multi-factor authentication to add an extra layer of protection.

- Focusing on secure coding practices to prevent the introduction of vulnerabilities.

- Mandating payment page script integrity checks to ensure scripts have not been tampered with.

PCI DSS Framework and Enhanced Transaction Safety

The PCI DSS framework is a comprehensive set of requirements designed to ensure the security of cardholder data throughout its lifecycle. As e-commerce platforms, you must be vigilant in protecting this sensitive information from the point of transaction to the end of data processing.

Lifecycle Security of Cardholder Data

Under PCI DSS 4.0, the lifecycle security of cardholder data is ensured through:

- Data Encryption: Encrypting data during transmission and storage to prevent unauthorised access.

- Access Controls: Limiting access to cardholder data to only those individuals whose job requires such access.

- Monitoring and Testing: Regularly testing security systems and processes to ensure they are effective in protecting cardholder data.

New Client-Side Protection Focus in Requirement 11

Requirement 11 of PCI DSS 4.0 introduces new client-side protections, emphasising:

- Code Integrity: Ensuring the integrity of code running on users’ browsers, particularly payment scripts.

- Tamper Detection: Implementing mechanisms to detect and alert on unauthorised modifications of critical scripts.

Overseeing JavaScript Browser Security

To effectively oversee JavaScript browser security, e-commerce platforms should:

- Regularly Update and Patch: Keep all scripts and libraries up to date with the latest security patches.

- Use Subresource Integrity (SRI): Implement SRI to validate that resources fetched by browsers are delivered without unexpected manipulation.

Best Practices for Payment Page Script Security

For securing payment page scripts and ensuring tamper detection, best practices include:

- Content Security Policy (CSP): Implementing CSP to specify which scripts are allowed to run on the payment page.

- Continuous Monitoring: Employing tools that continuously monitor for changes to scripts, alerting you to any unauthorised modifications.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Content Security Policy

Within the scope of e-commerce, a robust Content Security Policy (CSP) is a critical component in the defence against cyber threats. As part of PCI DSS 4.0 compliance, CSPs play a pivotal role in safeguarding your online transactions.

The Contribution of CSP to PCI DSS 4.0 Compliance

A CSP contributes to PCI DSS 4.0 compliance by:

- Restricting Resources: It limits which external resources can be loaded, effectively preventing the execution of unauthorised scripts that could compromise cardholder data.

- Mitigating XSS Attacks: By specifying legitimate sources of executable scripts, CSP helps mitigate cross-site scripting (XSS) attacks.

Managing Third-Party Code Complexity

The challenges of managing third-party code include:

- Ensuring Script Integrity: Verifying that scripts from third-party vendors have not been altered or compromised.

- Complexity: The sheer volume and dynamic nature of third-party scripts can make oversight challenging.

Effective Implementation and Management of CSPs

To effectively implement and manage CSPs, e-commerce businesses should:

- Regularly Review and Update: Keep the CSP up-to-date with the latest security practices and external script sources.

- Automate Monitoring: Use automated tools to track and validate the integrity of third-party scripts.

Policy Management’s Role in Data Protection

Policy management is crucial for:

- Maintaining Control: Ensuring that only authorised scripts run on your website.

- Preventing Data Leaks: Stopping unauthorised scripts from accessing sensitive data.

Further Reading

Gaining a Competitive Edge with PCI DSS 4.0 Compliance

In the competitive world of e-commerce, PCI DSS 4.0 compliance is not just a regulatory requirement; it’s a strategic advantage. By adhering to the latest data security standards, your business can stand out as a trusted entity in a market where consumer confidence is paramount.

Building Customer Trust Through Compliance

Compliance with PCI DSS 4.0 can significantly enhance customer trust by:

- Demonstrating Commitment: Showcasing your dedication to protecting customer data.

- Transparency: Being open about your security practices helps build a relationship of trust with your customers.

Strengthening Security Posture to Mitigate Risks

A strong security posture is essential for reducing the risk of data breaches and fraud. PCI DSS 4.0 compliance ensures that you are implementing the most up-to-date security measures, which include:

- Multi-factor Authentication: Adding an extra layer of security to verify user identities.

- Enhanced Encryption: Protecting data both in transit and at rest from unauthorised access.

The Long-Term Benefits of Compliance

The long-term benefits of demonstrating compliance with PCI DSS 4.0 include:

- Sustained Customer Loyalty: Customers are more likely to return to platforms where they feel their data is secure.

- Market Differentiation: Compliance can set you apart from competitors who may not prioritise data security as highly.

At ISMS.online, we provide the framework and tools to help you achieve and maintain PCI DSS 4.0 compliance, ensuring that your e-commerce business is recognised for its commitment to security and customer trust.

Navigating Global Regulations Alongside PCI DSS 4.0

In the global e-commerce sector, aligning with international regulations such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and the Payment Services Directive 2 (PSD2) is as crucial as adhering to PCI DSS 4.0. These regulations intersect with PCI DSS 4.0, particularly in areas concerning data protection and consumer rights.

Understanding the Intersection of PCI DSS 4.0 with Global Regulations

- GDPR: Emphasises data privacy and gives individuals control over their personal data, which complements PCI DSS 4.0’s focus on secure data handling.

- CCPA: Like GDPR, it provides consumers with rights over their data, aligning with PCI DSS 4.0’s aim to protect cardholder information.

- PSD2: Introduces stringent security requirements for electronic payments, which dovetail with PCI DSS 4.0’s enhanced security measures.

The Role of 3D Secure Solutions in PCI DSS 4.0 Compliance

3D Secure solutions are an integral part of PCI DSS 4.0 compliance, providing an additional authentication step during online transactions to reduce fraud and increase security.

Addressing the Complexities of Multi-Regulation Compliance

To navigate the complexities of complying with multiple regulations, e-commerce platforms should:

- Conduct a comprehensive assessment to identify overlapping requirements.

- Implement unified strategies that satisfy multiple regulatory standards simultaneously.

Aligning PCI DSS 4.0 with Privacy Preferences and Consent Management

Challenges in aligning PCI DSS 4.0 with privacy preferences include:

- Balancing security measures with user experience.

- Managing consent mechanisms that comply with both privacy laws and security standards.

Solutions involve:

- Integrating consent management platforms that are both user-friendly and compliant.

- Regularly updating privacy policies to reflect changes in both privacy regulations and PCI DSS standards.

At ISMS.online, we provide the expertise and tools to help you navigate these regulations, ensuring your e-commerce platform is compliant and trusted globally.

Anticipating E-Commerce Security Trends in the PCI DSS 4.0 Era

As e-commerce continues to evolve, staying ahead of security trends is imperative for safeguarding your business and customer data. PCI DSS 4.0 sets the stage for a proactive approach to these emerging challenges.

Emerging Threats and PCI DSS 4.0 Preparedness

You must be vigilant about new forms of cyber threats, such as sophisticated phishing schemes and advanced persistent threats (APTs). PCI DSS 4.0 addresses these by introducing more rigorous controls and encouraging a culture of continuous security improvement.

Proactive Measures Against Evolving Digital Threats

To anticipate and respond to new threats, consider:

- Regular Risk Assessments: Continuously evaluate your security posture to identify potential vulnerabilities.

- Adaptive Security Strategies: Implement flexible security measures that can quickly adjust to new threats.

The Imperative of Ongoing Security Education

Ongoing employee security education is crucial for:

- Maintaining Awareness: Keeping staff informed about the latest threats and prevention techniques.

- Cultivating a Security-Minded Culture: Encouraging vigilance and proactive behaviour in all aspects of your operations.

Integrating Secure Coding into Long-Term Security Strategies

Secure coding practices are essential for:

- Preventing Vulnerabilities: Ensuring that software is developed with security as a priority to prevent exploitable flaws.

- Maintaining Payment Page Integrity: Implementing and enforcing coding standards to protect against script tampering and data breaches.

At ISMS.online, we provide the resources and support you need to integrate these practices into your security strategy, ensuring your e-commerce platform is resilient against current and future threats.

ISMS.online and PCI DSS Compliance

At ISMS.online, we understand the complexities of achieving and maintaining PCI DSS 4.0 compliance. Our platform is designed to streamline the compliance process for your e-commerce business, ensuring that you meet the latest security standards efficiently and effectively.

Streamlining Your Compliance Journey

Our services are tailored to assist you in:

- Simplifying the Compliance Process: We provide a structured approach to managing the 251 requirements of PCI DSS 4.0, making the journey towards compliance less daunting.

- Integrated Management System: Our platform offers a pre-configured IMS that aligns with PCI DSS 4.0, facilitating a guided certification process.

Tools and Services for Enhanced Security and Compliance

ISMS.online equips you with:

- Policy and Control Management: To help you establish and maintain security policies that meet PCI DSS 4.0 standards.

- Dynamic Risk Management Tools: Enabling you to identify and mitigate risks effectively.

- Document Management: To keep your compliance documentation organised and accessible.

Meeting Global Payment Security Standards

By partnering with us, you’ll benefit from:

- Global Standards Mapping: Our platform includes ISO 27001:2022 mapping, ensuring that you’re prepared to meet not just PCI DSS 4.0, but also other global payment security standards.

- Transparent Reporting: For clear demonstration of compliance to auditors and stakeholders.

Expert Guidance in the PCI DSS 4.0 Landscape

Choosing ISMS.online means:

- Access to Expertise: Our team offers the guidance and support you need to navigate the PCI DSS 4.0 compliance landscape with confidence.

- Continuous Support: We're here to help you adapt to the evolving requirements and maintain compliance over time.

Let ISMS.online be your trusted partner in achieving and sustaining PCI DSS 4.0 compliance, enhancing your security posture, and building customer trust.

Book a demo