What Are the PCI DSS Certification Costs?

Understanding how transaction volumes influence classification into PCI DSS compliance levels is crucial. These levels are determined by the number of transactions your business processes annually and have a direct bearing on the specific requirements you must meet.

Understanding Transaction Volume Impact

Transaction volume is a key determinant in categorising businesses into one of four PCI DSS compliance levels. Higher transaction volumes typically indicate a greater risk of data breaches, thus requiring more stringent controls:

- Level 1: Over 6 million transactions per year

- Level 2: 1 to 6 million transactions per year

- Level 3: 20,000 to 1 million transactions per year

- Level 4: Fewer than 20,000 transactions per year

Deciphering Compliance Level Requirements

Each level has its own set of requirements:

- Level 1 merchants must undergo an annual onsite review by a Qualified Security Assessor (QSA) or Internal Security Assessor (ISA) and perform quarterly network scans.

- Levels 2 and 3 merchants can self-assess using a Self-Assessment Questionnaire (SAQ), but they also need a QSA or ISA for validation.

- Level 4 merchants have the most straightforward requirements, typically self-assessment and network scans.

E-Commerce Considerations

For e-commerce businesses, the compliance categorization also considers the nature of online transactions, which can be more susceptible to security breaches. This may necessitate additional controls beyond those required for their transaction volume level.

Impact on Certification Costs

The compliance level your business falls under will significantly impact the overall certification costs. Higher levels entail more rigorous assessments and, consequently, higher expenses. Our platform, ISMS.online, can help streamline this process, offering guidance and tools to manage your compliance effectively and efficiently.

Book a demoUnderstanding Merchant Level Classifications

When you’re navigating PCI DSS compliance, understanding the merchant level classifications is crucial. These levels are determined by transaction volume and dictate the rigour of the validation process required.

Merchant Levels Defined

PCI DSS categorises businesses into four merchant levels based on annual transaction volumes. Here’s how they break down:

- Level 1: Merchants processing over 6 million card transactions annually.

- Level 2: Merchants processing 1 to 6 million transactions annually.

- Level 3: Merchants processing 20,000 to 1 million e-commerce transactions annually.

- Level 4: Merchants processing fewer than 20,000 e-commerce transactions annually, or up to 1 million transactions total.

Validation Requirements by Level

Each level has its own set of validation requirements:

- Level 1 merchants must undergo an annual on-site audit by a Qualified Security Assessor (QSA) or an Internal Security Assessor (ISA), and complete a Report on Compliance (RoC).

- Levels 2-4 may validate compliance through Self-Assessment Questionnaires (SAQs), but Level 2 merchants are also encouraged to have an on-site assessment at their discretion.

The Role of Internal Auditors

For Level 1 merchants, an internal auditor plays a pivotal role in the compliance process. They work alongside the QSA to ensure all standards are met and help maintain ongoing compliance.

Correlation with SAQs, ASV Scans, and RoCs

The necessity for SAQs, Approved Scanning Vendor (ASV) scans, and RoCs correlates with your merchant level:

- Level 1 requires RoC and ASV scans.

- Levels 2-4 typically complete SAQs, with ASV scans required if applicable.

At ISMS.online, we understand the complexities of PCI DSS compliance and offer services to help you determine your merchant level and navigate the associated validation requirements efficiently.

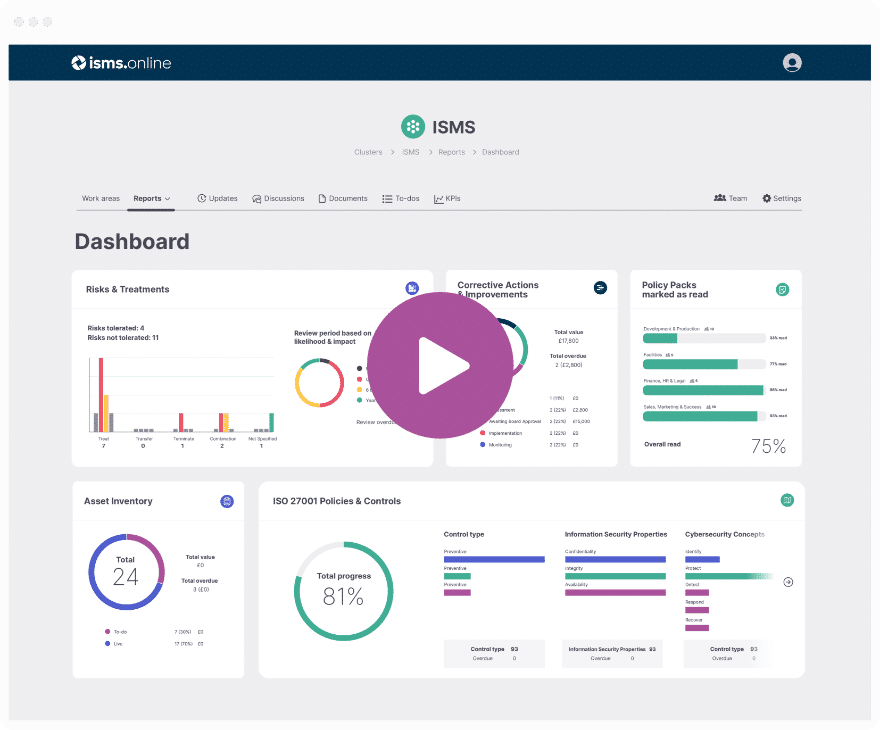

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Navigating the PCI DSS Certification Journey

Embarking on the PCI DSS certification process can be a complex endeavour, but understanding the key steps can demystify the journey and set clear expectations for your business.

Key Steps in PCI DSS Certification

The certification process typically involves several stages:

- Assessment: Identifying cardholder data, taking an inventory of IT assets and business processes for payment card processing, and analysing them for vulnerabilities.

- Remediation: Addressing any vulnerabilities and ensuring no storage of prohibited cardholder data.

- Reporting: Compiling and submitting required remediation validation records and compliance reports to the acquiring bank and card brands you do business with.

Tailoring the Process to Business Size and Type

The certification process is not one-size-fits-all. It varies depending on your business size and the volume of transactions you handle. Larger businesses may require a more in-depth assessment, while smaller businesses might qualify for self-assessment questionnaires.

The Role of External Audits

External audits are significant for Level 1 merchants or those that have suffered a breach. A Qualified Security Assessor (QSA) conducts these audits to provide an independent validation of compliance.

Scope Reduction Through PCI-Compliant Gateways

Utilising PCI-compliant gateways can significantly reduce the scope of your PCI DSS assessment by outsourcing the handling of cardholder data to a third party, which can lead to a more streamlined and cost-effective certification process.

At ISMS.online, we’re committed to guiding you through each step, ensuring that you understand the nuances of the certification process and how it applies to your specific business context.

Costs of Achieving PCI DSS Compliance

Understanding the direct costs associated with PCI DSS compliance is essential for budgeting and financial planning. These costs vary widely depending on several factors, including your merchant level, the complexity of your Cardholder Data Environment (CDE), and the specific requirements you must meet.

Typical Audit Expenses

For many businesses, the most significant direct cost is the audit expense. If you’re a Level 1 merchant, you can expect to pay for an annual on-site audit by a Qualified Security Assessor (QSA), which can range from $15,000 to $70,000 or more. Smaller merchants may be eligible for self-assessment, which can reduce this cost.

Vulnerability Scans and Penetration Tests

Regular vulnerability scans and penetration tests are required to maintain compliance. These can cost anywhere from a few hundred to several thousand dollars per year, depending on the service provider and the complexity of your systems.

Training and Remediation Costs

Training your staff on PCI DSS requirements is another cost to consider. Additionally, if vulnerabilities are found, you must budget for remediation costs to address them. These expenses will vary based on the nature and severity of the required fixes.

Impact of Implementation Factors

Implementation factors such as encryption and network security also influence costs. Investing in robust security measures may have a higher initial cost but can lead to long-term savings by preventing costly data breaches and non-compliance penalties.

At ISMS.online, we provide tools and guidance to help you manage these costs effectively, ensuring that you achieve and maintain compliance without unnecessary financial strain.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Hidden Costs of PCI DSS Compliance

While direct costs such as audits and scans are often at the forefront of compliance budgeting, it’s the indirect costs that can be elusive. These are the expenses not immediately apparent but integral to maintaining PCI DSS compliance.

Investing in a Security Culture

A robust security culture is an investment that pays dividends. Training employees, developing secure business processes, and maintaining vigilant data protection practices can reduce the likelihood of breaches. Over time, this investment mitigates the risk of incurring hefty fines and remediation costs associated with non-compliance.

Compliance as a Long-Term Investment

Viewing PCI DSS compliance as a long-term investment rather than a short-term expense is crucial. By doing so, you’re not only safeguarding cardholder data but also fortifying your business’s reputation and customer trust, which are invaluable assets.

The Business Growth Benefits of Compliance

Compliance with PCI DSS can be a catalyst for business growth. It demonstrates to your customers that you’re committed to protecting their data, which can accelerate revenue and facilitate market expansion. In an era where data breaches are costly, compliance becomes a competitive advantage.

At ISMS.online, we’re dedicated to helping you understand these indirect costs and investments. Our platform provides the tools and resources you need to foster a security culture, view compliance as an investment, and leverage it for business growth.

The Risks of PCI DSS Non-Compliance

Non-compliance with PCI DSS can lead to significant financial, reputational, and operational consequences for your business. Understanding these risks is essential for maintaining the integrity and trustworthiness of your company.

Financial Repercussions of Non-Compliance

If you fail to comply with PCI DSS, you may face substantial fines from payment card issuers, which can range from $5,000 to $100,000 per month until compliance is achieved. Additionally, you may incur costs related to forensic investigations, card replacement, and fraud reimbursement.

Brand and Reputation at Stake

Non-compliance can severely damage your company’s reputation. The loss of customer trust, especially after a data breach, can have long-lasting effects on your business relationships and customer loyalty.

Legal Implications and Operational Disruptions

Legal actions may be taken against your company if non-compliance leads to a data breach. This includes lawsuits and settlements, which can be financially draining and time-consuming. Operationally, you may face transaction bans or increased transaction fees, which can disrupt your business flow and sales.

At ISMS.online, we emphasise the importance of PCI DSS compliance to protect you from these risks. Our platform provides the tools and guidance necessary to ensure that you’re not only compliant but also well-informed about the potential consequences of non-compliance.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Further Reading

Calculating Your Compliance Fee Structure

Navigating the financial aspects of PCI DSS compliance requires an understanding of how fees are structured and what factors contribute to their calculation.

Determining Processor Charges and Compliance Fees

Processor charges and compliance fees are typically determined by your merchant service provider. These fees can include:

- Monthly or annual service fees for maintaining a merchant account.

- Transaction fees, which may vary based on the type and volume of transactions processed.

- Compliance fees to cover the cost of additional security measures and compliance management tools.

Influencing Factors on Compliance Costs

Several factors influence the annual cost of compliance tools and support:

- Business size and transaction volume: Larger businesses with higher transaction volumes may face higher fees due to the increased risk and complexity of their payment environments.

- Type of data handling: Businesses that store, process, or transmit cardholder data may require more advanced security measures, which can increase costs.

Impact of Transaction Volume and Data Handling

Transaction volume and data handling complexity directly affect fees by determining:

- The level of PCI DSS compliance required.

- The scope of the assessment and validation efforts needed.

Budgeting Strategies for Compliance

To optimise compliance spending, consider the following strategies:

- Scope reduction: Implement measures to minimise the amount of cardholder data you handle, thereby reducing the complexity of your compliance requirements.

- Service provider comparison: Evaluate different merchant service providers to find competitive rates and bundled services that meet your needs.

At ISMS.online, we provide resources and support to help you understand and manage your PCI DSS compliance costs effectively. Our platform offers tools to streamline compliance efforts and reduce the overall financial impact on your business.

Implementing GRC Tools for Simplified Compliance

In the intricate landscape of PCI DSS compliance, Governance, Risk, and Compliance (GRC) tools serve as a beacon of simplification. At ISMS.online, we recognise the pivotal role these tools play in streamlining your compliance efforts.

Centralising Compliance Management

Centralising compliance management offers several benefits:

- Improved oversight: A single source of truth for compliance status and requirements.

- Easier reporting: Quick access to compliance data for reporting purposes.

- Consistency: Uniform application of compliance policies and procedures across the organisation.

Cost Savings Through Simplification

By simplifying compliance management, GRC tools can lead to cost savings by:

- Reducing the need for external consultants: Through in-built expertise and guidance.

- Decreasing the time to compliance: Enabling a more efficient use of resources.

Prioritising Risks for Effective Management

Risk prioritisation is integral to GRC unit management, ensuring that:

- High-impact risks are addressed first: Allocating resources to the most critical areas.

- Compliance efforts are focused: Avoiding unnecessary expenditure on low-risk areas.

Our platform at ISMS.online integrates these principles, providing you with the tools to manage your PCI DSS compliance effectively and efficiently.

Navigating Compliance Validation and Documentation

Ensuring compliance with PCI DSS is a multifaceted process that involves thorough documentation and validation. At ISMS.online, we provide guidance to help you navigate this process efficiently.

The Crucial Role of External Audits

External audits are a cornerstone of PCI DSS compliance validation. They serve to:

- Objectively assess your compliance with PCI DSS standards.

- Identify vulnerabilities within your payment card operations.

- Provide a roadmap for remediation and ongoing compliance.

Contributions of QSAs and ISAs

Qualified Security Assessors (QSAs) and Internal Security Assessors (ISAs) are instrumental in the compliance process. They:

- Conduct thorough assessments to ensure all PCI DSS requirements are met.

- Compile the Report on Compliance (RoC), detailing your compliance status.

- Offer expert advice on maintaining and improving security measures.

Documentation for Attestation of Compliance

The Attestation of Compliance (AOC) is a formal document that verifies your adherence to PCI DSS requirements. It includes:

- A declaration of your compliance status.

- Details of the assessment conducted by the QSA or ISA.

- Evidence of passed vulnerability scans and other compliance measures.

Managing Costs of Scans and Audits

To manage the costs associated with scanning and audit requirements effectively, consider:

- Scheduling regular reviews to avoid last-minute compliance rushes.

- Leveraging automated tools to streamline the scanning process.

- Utilising ISMS.online’s resources to prepare for audits, reducing the time and expense involved.

By staying proactive and utilising the right tools and expertise, you can ensure that compliance validation and documentation are handled efficiently and cost-effectively.

Achieve PCI DSS Compliance with ISMS.online

At ISMS.online, we understand the complexities of PCI DSS compliance and are dedicated to aligning your business with these critical requirements. Our platform is designed to simplify the compliance process, making it more manageable for you.

Certification Guidance

We offer strategies for rapid deployment of compliance measures, ensuring that you can quickly respond to the evolving standards of PCI DSS. Our certification guidance is tailored to your business’s specific needs, helping you navigate the path to compliance with confidence.

Simplifying Audits with Risk Tools and Policy Control

Our risk tools and policy control features are engineered to streamline your audit process. By automating risk assessments and policy management, we help you maintain a clear and organised approach to compliance, saving you time and resources.

Stakeholder Management and Reporting

Choosing ISMS.online for your compliance journey means you'll have access to advanced tools for stakeholder management and reporting. Our platform enables you to keep all stakeholders informed and engaged, ensuring a transparent and collaborative compliance process.

For expert guidance on PCI DSS compliance, reach out to us at ISMS.online. We're here to support you every step of the way, from initial assessment to ongoing management and reporting.

Book a demo