Cardholder Data Environment (CDE) and PCI DSS Compliance

In the realm of payment security, understanding the Cardholder Data Environment (CDE) is essential for businesses that handle card payments. This section aims to demystify the concept of CDE, its significance, and its components.

What is the Definition of a Cardholder Data Environment?

A Cardholder Data Environment encompasses all systems, processes, people, and technology that store, process, or transmit cardholder data (CHD) and sensitive authentication data (SAD). It is a critical concept within the framework of payment security, ensuring that all interactions with cardholder information are securely managed.

Why is Understanding CDE Mandatory for Businesses Handling Card Payments?

For businesses involved in card transactions, comprehending the scope and requirements of CDE is essential. It not only aids in achieving compliance with the Payment Card Industry Data Security Standard (PCI DSS) but also fortifies the business against data breaches and financial fraud. Understanding CDE helps in identifying the areas within an organisation that require stringent security measures.

How Does CDE Fit Within the Broader Context of Payment Security?

CDE is a foundational element of payment security. It is directly tied to the PCI DSS, a set of security standards designed to protect card transactions against misuse and unauthorised access. By securing the CDE, businesses contribute to the overall integrity and security of the payment ecosystem.

What are the Primary Components That Make Up a CDE?

The primary components of a CDE include:

- Systems: Hardware and software that store, process, or transmit CHD/SAD.

- Processes: Operational procedures involving CHD/SAD.

- People: Individuals who have access to or manage CHD/SAD.

- Technology: Security technologies and controls implemented to protect CHD/SAD.

By identifying and securing these components, businesses can ensure the safety of cardholder data and maintain compliance with PCI DSS standards. At ISMS.online, we provide comprehensive solutions to help businesses manage their CDE effectively, ensuring robust security and compliance.

Book a demoUnderstanding PCI DSS and Its Role in CDE

The Payment Card Industry Data Security Standard (PCI DSS) is a critical framework designed to ensure the security of cardholder data within the Cardholder Data Environment (CDE). As businesses increasingly rely on electronic payments, understanding and adhering to PCI DSS standards becomes indispensable for safeguarding sensitive information.

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. This standard is required for the protection of cardholder data within the CDE.

Importance of PCI DSS for CDE Security

PCI DSS aims to protect cardholder data from breaches and theft. By establishing a secure CDE, businesses mitigate the risk of data compromise, which can lead to financial loss and damage to reputation. Compliance with PCI DSS is not just a regulatory requirement but a fundamental component of a robust security posture.

Key Requirements of PCI DSS for CDE Compliance

organisations must adhere to several key requirements to achieve PCI DSS compliance, including:

- Implementing strong access control measures

- Maintaining a vulnerability management programme

- Regularly monitoring and testing networks

- Protecting stored cardholder data

- Encrypting transmission of cardholder data across open, public networks

Compliance Frequency

PCI DSS compliance is an ongoing process, requiring annual validation. organisations must continuously monitor and maintain their security controls to ensure they meet the standard’s requirements. This includes regular updates to security measures in response to emerging threats and vulnerabilities.

By understanding and implementing the principles of PCI DSS, you’re taking a significant step towards securing your CDE against potential threats. At ISMS.online, we provide comprehensive solutions to help you achieve and maintain PCI DSS compliance, ensuring your cardholder data is protected.

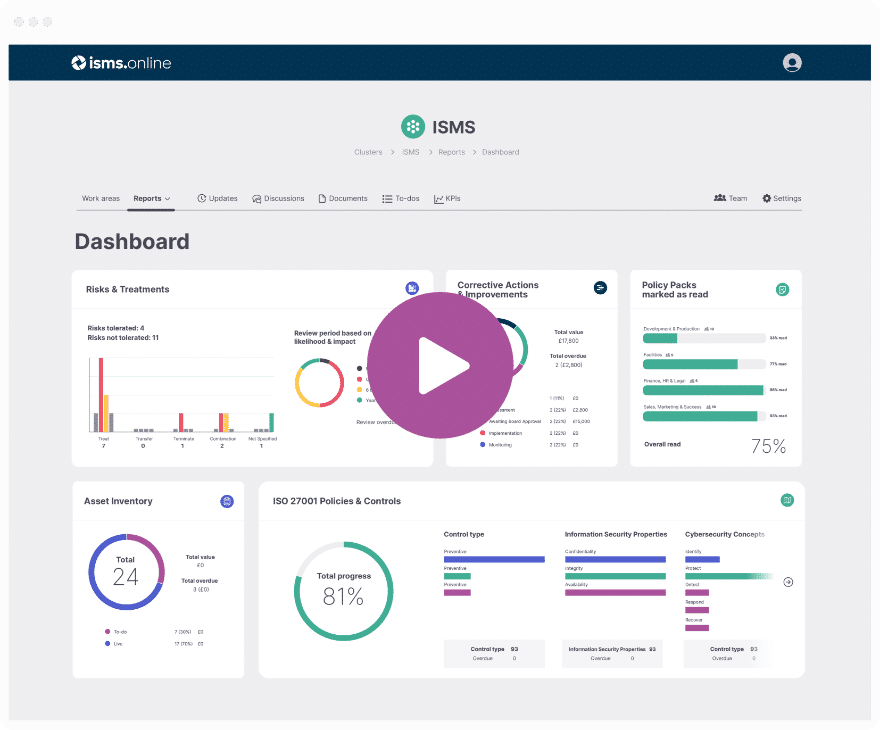

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Types of Data Protected within the CDE

Understanding the types of data protected within the Cardholder Data Environment (CDE) is essential for businesses to ensure compliance with PCI DSS and safeguard sensitive information effectively.

What Constitutes Cardholder Data (CHD) and Sensitive Authentication Data (SAD)?

Cardholder Data (CHD) primarily includes the Primary Account Number (PAN) along with cardholder names, expiration dates, and service codes. Sensitive Authentication Data (SAD), on the other hand, encompasses full track data, CAV2/CVC2/CVV2/CID, PINs, and any data forbidden post-authorization.

Criticality of Protecting CHD and SAD within the CDE

Protecting CHD and SAD is essential due to the potential financial and reputational damage resulting from data breaches. Ensuring the security of this data helps in maintaining customer trust and compliance with legal and regulatory requirements.

Identifying CHD and SAD in Systems

Businesses can identify CHD and SAD within their systems by conducting thorough data mapping exercises. This involves tracking how cardholder data enters, moves through, and exits the organisation, ensuring all touchpoints are secure.

Risks Associated with Mishandling CHD and SAD

Mishandling CHD and SAD can lead to severe consequences, including financial penalties, legal actions, and loss of customer trust. It is important for businesses to implement robust security measures to mitigate these risks.

At ISMS.online, we understand the importance of protecting cardholder data. Our platform offers comprehensive tools and guidance to help you identify, secure, and manage CHD and SAD effectively, ensuring your business remains compliant and your customers’ data is protected.

Components and Systems within the CDE

The Cardholder Data Environment (CDE) encompasses a variety of systems and processes, each playing a pivotal role in the handling of cardholder data. Understanding these components and their interactions is mandatory for maintaining a secure CDE.

Systems and Processes Involved in a CDE

The CDE includes any system or process that stores, processes, or transmits cardholder data (CHD) and sensitive authentication data (SAD). This can range from point-of-sale (POS) systems, databases, and payment gateways to online shopping carts and cloud storage solutions.

Interaction of Components to Process Cardholder Data

These components work in tandem to facilitate the secure handling of cardholder data. For instance, a POS system captures CHD at the time of transaction, which is then transmitted through a payment gateway for processing. Throughout this process, data must be encrypted and securely managed to prevent unauthorised access.

Essential Security Measures for CDE Systems

To safeguard these systems, organisations must implement robust security measures, including firewalls, encryption, access controls, and regular vulnerability assessments. Adherence to the Payment Card Industry Data Security Standard (PCI DSS) is also mandatory for ensuring comprehensive protection.

Ensuring Compliance of CDE Systems

Organisations can ensure their CDE systems remain compliant by conducting regular PCI DSS assessments, maintaining up-to-date security protocols, and training staff on data security best practices. At ISMS.online, we provide a suite of tools and resources to help you manage your CDE’s compliance effectively, ensuring that your systems are not only secure but also aligned with industry standards.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

The Importance of Network Segmentation in CDE

Network segmentation plays a pivotal role in enhancing the security of the Cardholder Data Environment (CDE) and optimising compliance with the Payment Card Industry Data Security Standard (PCI DSS).

What is Network Segmentation?

Network segmentation involves dividing a computer network into subnetworks, each serving as a separate security domain. This practice is essential for CDE security as it limits access to sensitive areas, thereby reducing the potential attack surface for cyber threats.

Benefits of Network Segmentation for CDE Security

By implementing network segmentation, businesses can ensure that access to cardholder data is strictly controlled and monitored. This not only enhances security but also simplifies the management of data access policies.

Implementing Effective Network Segmentation

To implement effective network segmentation, businesses should:

- Identify and classify data and resources within the network.

- Define security zones based on data sensitivity.

- Apply strict access controls and monitoring for each segment.

Challenges in Network Segmentation

organisations might face challenges such as:

- Determining the appropriate level of segmentation.

- Managing the complexity introduced by additional network segments.

- Ensuring consistent policy enforcement across all segments.

Impact on PCI DSS Scope and Compliance Costs

Network segmentation can significantly reduce the scope of PCI DSS compliance by isolating the systems that store, process, or transmit cardholder data from the rest of the network. This not only minimises the risk of data breaches but also reduces compliance costs by limiting the number of systems subject to PCI DSS requirements.

Third-Party Compliance and CDE Management

In the realm of cardholder data security, third-party vendors play a necessary role. Their compliance with the Payment Card Industry Data Security Standard (PCI DSS) is not optional but a necessity to ensure the integrity of the Cardholder Data Environment (CDE).

Why Must Third-Party Vendors Be Compliant with PCI DSS?

Third-party vendors often handle, process, or have access to cardholder data as part of their services. Their compliance with PCI DSS ensures that all entities involved in the payment processing chain maintain a consistent and high level of security, thereby minimising the risk of data breaches.

Ensuring Third-Party Vendors Protect the CDE

To ensure third-party vendors protect the CDE, businesses should:

- Conduct thorough due diligence before engaging with vendors.

- Include PCI DSS compliance requirements in contractual agreements.

- Regularly monitor and assess the vendor’s compliance status.

Consequences of Third-Party Non-Compliance

Non-compliance by third-party vendors can lead to data breaches, resulting in financial penalties, legal consequences, and damage to reputation. It underscores the importance of rigorous compliance management and oversight.

How We Assist in Managing Third-Party Compliance

At ISMS.online, we offer a comprehensive platform that simplifies the management of third-party compliance. Our tools enable you to:

- Assess and document vendor compliance.

- Track and manage compliance tasks.

- Facilitate communication and documentation sharing with vendors.

By leveraging our platform, you can ensure that your third-party vendors adhere to PCI DSS requirements, thereby protecting your CDE and maintaining trust in your payment processing ecosystem.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Strategies for Reducing CDE Scope and Enhancing Security

Reducing the Cardholder Data Environment (CDE) scope is a strategic approach to minimising the risk of data breaches while also simplifying compliance with the Payment Card Industry Data Security Standard (PCI DSS). Here, we explore effective strategies for scope reduction and enhancing security within the CDE.

Effective Strategies for Minimising CDE Scope

To effectively minimise the CDE scope, businesses can:

- Implement Network Segmentation: Isolating the CDE from the rest of the network can significantly reduce the scope of PCI DSS compliance.

- Use Point-to-Point Encryption (P2PE): Encrypting data from the point of interaction to the payment processor limits the exposure of sensitive data.

The Role of Tokenization and Encryption in CDE Security

- Tokenization: Replacing sensitive cardholder data with a unique identifier (token) that has no exploitable value reduces the risk of data breaches.

- Encryption: Encrypting data both at rest and in transit ensures that even if data is intercepted, it remains unreadable and secure.

Outsourcing and CDE Risk Management

Outsourcing payment processing to third-party vendors can transfer the risks associated with data breaches. However, it’s mandatory to ensure these vendors are PCI DSS compliant to maintain the integrity of cardholder data security.

Balancing Scope Reduction with Operational Efficiency

While reducing the CDE scope is beneficial for security and compliance, it’s essential to balance these efforts with maintaining operational efficiency. This involves:

- Regularly Reviewing and Updating Security Measures: To adapt to new threats and technologies.

- Training Employees: Ensuring staff are aware of security protocols and the importance of protecting cardholder data.

At ISMS.online, we understand the complexities involved in managing the CDE and complying with PCI DSS. Our platform offers tools and resources to help you effectively reduce your CDE scope, enhance security measures, and maintain operational efficiency, ensuring your business remains secure and compliant.

Further Reading

Annual Compliance Assessments and Penetration Testing

Annual compliance assessments and penetration testing are foundational elements in maintaining the security of the Cardholder Data Environment (CDE). These processes not only ensure adherence to the Payment Card Industry Data Security Standard (PCI DSS) but also validate the effectiveness of security measures in place.

Why Are Annual Assessments Critical for Maintaining CDE Security?

Annual assessments provide a structured approach to reviewing and verifying the security controls and processes protecting cardholder data. They help identify vulnerabilities and ensure that all PCI DSS requirements are met consistently, thereby reducing the risk of data breaches.

What Does a Comprehensive CDE Compliance Assessment Entail?

A comprehensive CDE compliance assessment involves:

- Reviewing documentation to ensure policies and procedures align with PCI DSS requirements.

- Inspecting physical and technical security controls to protect cardholder data.

- Testing access controls to ensure only authorised personnel can access sensitive information.

- Evaluating network security measures, including firewalls and intrusion detection systems.

How Does Penetration Testing Validate Network Segmentation Efforts?

Penetration testing simulates cyber-attacks to assess the effectiveness of security measures. It is particularly valuable in validating network segmentation by:

- Identifying potential pathways attackers could use to access the CDE.

- Testing the strength of isolation controls between segmented networks.

- Providing insights into areas where security could be enhanced.

Best practices for Organisations During These Assessments

organisations should follow these best practices during assessments:

- Engage qualified assessors who understand the intricacies of PCI DSS and CDE security.

- Maintain comprehensive documentation of all security policies, procedures, and controls.

- Regularly update and patch systems to protect against known vulnerabilities.

- Foster a culture of security awareness among employees to ensure ongoing vigilance.

At ISMS.online, we recognise the importance of these assessments in safeguarding cardholder data. Our platform offers tools and resources to streamline the compliance process, making it easier for you to prepare for and conduct annual assessments and penetration testing, ensuring your CDE remains secure and compliant.

Virtualization and Its Impact on CDE

Virtualization has become a cornerstone in modern IT infrastructure, offering flexibility, scalability, and cost savings. However, when it comes to the Cardholder Data Environment (CDE), virtualization introduces specific challenges and considerations for maintaining security and compliance.

How Virtualization Affects CDE Management and Security

Virtualization allows for the creation of multiple virtual environments from a single physical hardware system, which can complicate the management and security of the CDE. The shared nature of virtual resources necessitates stringent controls to ensure that cardholder data remains isolated and protected.

Considerations for Virtual CDEs

For virtual CDEs, it’s mandatory to:

- Implement robust access controls to restrict access to virtual environments containing cardholder data.

- Ensure data encryption both at rest and in transit within and across virtual environments.

- Maintain clear documentation of the virtual infrastructure to accurately define the CDE scope.

Securing Virtualized Environments within the CDE

To secure virtualized environments, businesses should:

- Use firewalls and intrusion detection/prevention systems to monitor and protect virtual networks.

- Regularly update and patch virtualization software to protect against vulnerabilities.

- Conduct regular security assessments specific to the virtualized infrastructure.

Challenges of Maintaining Compliance in Virtual Settings

Maintaining PCI DSS compliance in virtual settings involves:

- Accurately defining the scope of the CDE within a virtualized infrastructure.

- Ensuring consistent application of security controls across both physical and virtual systems.

- Navigating the complexity of virtual networks and shared resources to prevent unauthorised access to cardholder data.

At ISMS.online, we understand the complexities of managing and securing virtual CDEs. Our platform provides the tools and guidance necessary to help you navigate these challenges, ensuring your virtualized environments are secure and compliant with PCI DSS requirements.

Addressing Over and Under Scoping in CDE Compliance

Accurately defining the scope of the Cardholder Data Environment (CDE) is critical for effective compliance with the Payment Card Industry Data Security Standard (PCI DSS). Both over scoping and under scoping present risks and challenges that can impact an organisation’s security posture and compliance efforts.

Risks of Over and Under Scoping

Over scoping can lead to unnecessary allocation of resources, increasing the complexity and cost of compliance efforts. Conversely, under scoping may result in insufficient coverage of security measures, leaving critical assets unprotected and vulnerable to breaches.

Accurately Defining CDE Scope

To accurately define the CDE scope, organisations should: – Conduct a thorough data flow analysis to understand where cardholder data resides and moves within the network. – Identify all systems, processes, and personnel that interact with or could impact the security of cardholder data.

Tools and Methods for Correct CDE Scoping

Effective tools and methods for scoping include: – Automated discovery tools to identify systems that store, process, or transmit cardholder data. – Regular audits and assessments to ensure all elements of the CDE are identified and properly secured.

How ISMS.online Facilitates Accurate CDE Scoping and Compliance

At ISMS.online, we offer a comprehensive suite of tools and resources designed to assist organisations in accurately defining their CDE scope. Our platform enables you to:

- Document and manage data flows and processes within a centralised system.

- Conduct risk assessments to identify and address vulnerabilities.

- Maintain an up-to-date inventory of all assets within the CDE.

By leveraging ISMS.online, you can ensure your CDE is accurately scoped, enhancing your organisation’s security measures and simplifying compliance with PCI DSS requirements.

Emerging Technologies and the Future of CDE Security

The landscape of Cardholder Data Environment (CDE) security is continually evolving, with emerging technologies playing a pivotal role in shaping its future. As we navigate these changes, understanding the impact of technologies such as artificial intelligence (AI) and blockchain is crucial for organisations aiming to enhance their CDE management and protection.

Impact of AI on CDE Management and Protection

AI has the potential to revolutionise CDE security by automating threat detection and response. Through machine learning algorithms, AI can analyse patterns in data transactions to identify anomalies that may indicate a breach. However, the reliance on AI also introduces challenges, such as ensuring the accuracy of threat detection and the potential for sophisticated AI-driven attacks.

Blockchain’s Role in Enhancing CDE Security

Blockchain technology offers a decentralised approach to securing cardholder data, providing transparency and immutability in transactions. By leveraging blockchain, organisations can reduce the risk of data tampering and enhance the integrity of the payment process. The challenge lies in integrating blockchain with existing payment infrastructures and ensuring scalability.

Preparing for Future Changes in CDE Security

To stay ahead in the rapidly changing landscape of CDE security, organisations should:

- Invest in ongoing education and training on emerging technologies.

- Conduct regular security assessments to identify and address vulnerabilities.

- Foster a culture of innovation to explore and adopt new security solutions.

At ISMS.online, we are committed to helping you navigate the complexities of CDE security. Our platform provides the tools and resources necessary to adapt to emerging technologies, ensuring your organisation remains secure and compliant in the face of future changes.

ISMS.online and PCI DSS Compliance

Navigating the complexities of Cardholder Data Environment (CDE) management and Payment Card Industry Data Security Standard (PCI DSS) compliance can be challenging. At ISMS.online, we specialise in providing comprehensive solutions to help your business achieve and maintain compliance with confidence.

How Can ISMS.online Help Your Business?

Our platform offers a suite of tools designed to simplify the process of achieving and maintaining PCI DSS compliance. From documenting your CDE scope to managing and mitigating risks, we provide a centralised system to streamline your compliance efforts.

A Trusted Partner for CDE Security and PCI DSS Compliance

ISMS.online is built on a foundation of security expertise and a deep understanding of the PCI DSS requirements. Our platform is designed to adapt to the evolving landscape of data security, ensuring that your compliance efforts are always aligned with the latest standards.

Getting Started With ISMS.online

Getting started with ISMS.online is straightforward. You can contact our team for a personalised demonstration of our platform. We’ll guide you through the features and functionalities that can benefit your specific compliance needs.

Partner with ISMS.online for Long-Term Compliance

Partnering with ISMS.online means gaining a reliable ally in your compliance journey. Our platform not only helps you achieve compliance but also supports the ongoing management of your CDE, ensuring long-term security and peace of mind.

For expert support in managing your CDE and achieving PCI DSS compliance, reach out to us at ISMS.online. Let us help you navigate the complexities of data security with ease.

Book a demo