Understanding PCI DSS and Access Control Measures

As we navigate the transition from PCI DSS v3.2.1 to v4.0, it’s crucial to understand the enhancements in access control requirements. The evolution to PCI DSS v4.0 brings forth a more dynamic and adaptable framework to address the ever-changing landscape of security threats and technological advancements.

How PCI DSS v4.0 Differs in Access Control

PCI DSS v4.0 introduces more rigorous access control measures, emphasising the importance of Multi-Factor Authentication (MFA) and enhanced user identification management. These changes reflect a shift towards stronger security protocols to protect cardholder data against unauthorised access.

New Access Control Challenges

With the advent of v4.0, organisations face new challenges such as integrating advanced access control systems that are both robust and flexible enough to adapt to emerging technologies and threats. This includes ensuring compatibility with cloud environments and fintech solutions.

Updates to the “Need to Know” Principle

The “Need to Know” principle under v4.0 has been refined to ensure that access to sensitive data is strictly limited to individuals whose job roles require it, thereby reducing the risk of data exposure.

ISMS.online's Role in Facilitating Transition

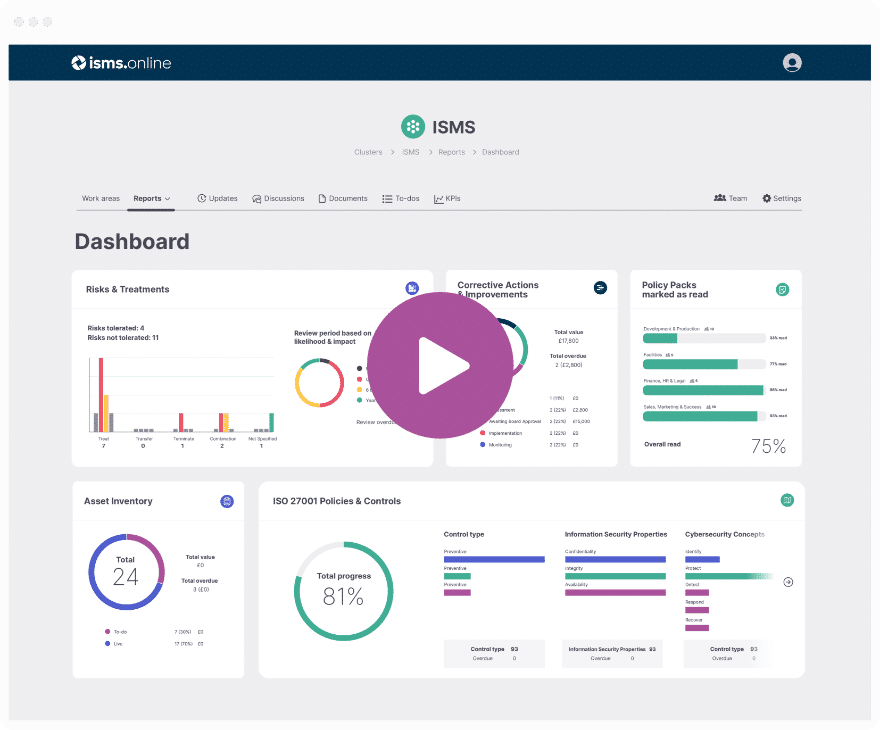

At ISMS.online, we understand the complexities involved in meeting the new standards. Our platform offers comprehensive tools and resources to streamline your transition to PCI DSS v4.0. We provide guided certification, risk assessment tools, and policy management to ensure that your access control measures are up-to-date and compliant with the latest requirements.

By leveraging our Adapt, Adopt, Add framework, you can customise your Information Security Management System (ISMS) to align with PCI DSS v4.0, ensuring a seamless integration of access control protocols into your organisation's security strategy.

Book a demoThe Role of Access Control in PCI DSS Compliance

Access control stands as a fundamental element of the Payment Card Industry Data Security Standard (PCI DSS). It serves as the first line of defence in safeguarding cardholder data against unauthorised access. By enforcing strict access controls, organisations can significantly reduce the risk of data breaches.

Mitigating Data Breach Risks Through Effective Access Control

Effective access control systems are designed to limit access to sensitive data to only those individuals who require it to perform their job functions. This minimization of access points helps in mitigating potential breaches, as it reduces the number of vectors through which attackers can gain illicit entry.

Maintaining Cardholder Data Security

Access control plays a pivotal role in the security of cardholder data. It ensures that only authorised personnel have the ability to interact with sensitive information, thereby maintaining the integrity and confidentiality of cardholder data.

Contributing to Organisational Security Posture

Beyond protecting cardholder data, access control contributes to the overall security posture of an organisation. It is a critical component that supports compliance with PCI DSS and other regulatory requirements, reflecting an organisation’s commitment to security.

At ISMS.online, we understand the importance of robust access control measures. Our platform is designed to help you implement and manage these controls, ensuring that your organisation’s data security practices are up to the standards required by PCI DSS 4.0.

Get an 81% headstart

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

PCI DSS Access Control Requirements

Access control is a cornerstone of PCI DSS v4.0, with specific measures designed to protect cardholder data by ensuring that only authorised individuals have system access. As you navigate these requirements, it’s essential to understand the nuances of each mandate.

Mandated Access Control Measures

PCI DSS v4.0 requires entities to implement robust access control systems. These include:

- Systematic User Identification: Assigning a unique ID to each person with computer access ensures that actions on critical data can be traced to individual users.

- Restriction of Access to Cardholder Data: Access rights must be set according to job classification and function, limiting exposure to sensitive data.

Multi-Factor Authentication (MFA)

MFA is now a necessity under PCI DSS v4.0 for any personnel with non-console administrative access to the systems handling cardholder data. This requirement adds an additional layer of security, verifying the user’s identity through multiple methods before granting access.

User Authentication and Lifecycle Management

The standard mandates rigorous user authentication measures, including:

- Authentication Protocols: Deployment of strong cryptography and security protocols to safeguard against unauthorised access.

- Lifecycle Management: Regular reviews and revocation of access rights when no longer required or when an individual’s role changes.

Implementing Least Privilege

Organisations must adopt the principle of least privilege, ensuring users have only the access necessary to perform their duties. This minimises the risk of accidental or deliberate data exposure.

PCI DSS v4.0 Timeline and Transition

Transitioning to the latest PCI DSS standards requires careful planning and adherence to a set timeline. PCI DSS v4.0, released in March 2022, sets forth a new paradigm in protecting cardholder data, with full compliance mandated by March 31, 2024.

Planning for a Smooth Transition

To ensure a seamless transition to PCI DSS v4.0, organisations should:

- Begin Early: Start the transition process as soon as possible to allow ample time for implementation and troubleshooting.

- Conduct Gap Analysis: Assess current systems against v4.0 requirements to identify areas needing attention.

Best Practices During Transition

During the transition period, it is recommended to:

- Stay Informed: Keep abreast of updates from the PCI Security Standards Council and integrate them into your transition plan.

- Train Staff: Ensure that all relevant personnel are trained on the new requirements and understand their roles in compliance.

Your Partner in Compliance

At ISMS.online, we are equipped to assist you in managing the compliance timeline effectively. Our platform offers:

- Guided Certification: Step-by-step guidance through the certification process.

- Document Management: Organise and store all compliance documentation in one secure location.

- Risk Tools: Identify and manage risks associated with the transition to v4.0.

By leveraging our comprehensive suite of tools and expertise, you can navigate the complexities of PCI DSS v4.0 with confidence.

Compliance doesn't have to be complicated.

We've done the hard work for you, giving you an 81% Headstart from the moment you log on.

All you have to do is fill in the blanks.

Stakeholders and PCI DSS v4.0

The Payment Card Industry Data Security Standard (PCI DSS) v4.0 introduces a comprehensive set of requirements that impact a broad range of stakeholders within the payment ecosystem. Understanding who is affected and their responsibilities is crucial for achieving compliance.

Key Entities Required to Comply

All entities involved in payment processing are mandated to comply with PCI DSS v4.0, including:

- Merchants: Any business that accepts card payments must adhere to the new standards.

- Service Providers: Companies that process, store, or transmit cardholder data on behalf of merchants are also required to comply.

- Payment Software Vendors: Developers of payment applications must ensure their products meet PCI DSS v4.0 requirements.

Stakeholder Responsibilities in the Payment Ecosystem

Under PCI DSS v4.0, stakeholders have specific responsibilities:

- Risk Assessment: Regularly evaluate their systems and processes for vulnerabilities.

- Data Protection: Implement and maintain robust access control measures to safeguard cardholder data.

- Compliance Documentation: Maintain accurate records of compliance efforts and measures.

Collaborative Compliance Efforts

To ensure comprehensive compliance, stakeholders should:

- Share Best Practices: Engage in community forums and discussions to learn from others’ experiences.

- Utilise Resources: Take advantage of training and guidance provided by the PCI Security Standards Council (PCI SSC).

At ISMS.online, we provide the tools and support to help you and your organisation navigate these responsibilities and collaborate effectively to maintain PCI DSS v4.0 compliance.

Customised vs. Defined Approaches to Compliance

PCI DSS v4.0 introduces two distinct methodologies for achieving compliance: the Customised Approach and the Defined Approach. Understanding the differences between these two paths is essential for organisations to determine the most suitable strategy for their operations.

Understanding the Customised Approach

The Customised Approach offers flexibility, allowing you to tailor security controls based on your unique environment and risk exposure. This method encourages innovation and adaptation of controls that align with your specific business processes and technologies.

- Flexibility: Adapt controls to fit your organisational needs.

- Innovation: Implement cutting-edge security measures that exceed standard requirements.

Advantages of the Defined Approach

Conversely, the Defined Approach provides a set of prescribed controls, offering a clear and straightforward path to compliance. This approach is beneficial for organisations seeking foundational compliance without the complexity of customization.

- Simplicity: Follow a clear set of specified controls.

- Foundation: Establish a baseline of security measures that meet PCI DSS standards.

Determining the Best Fit for Your Organisation

To decide which approach is best for you, consider:

- Risk Profile: Assess your organisation’s specific risks related to cardholder data.

- Resource Availability: Evaluate your capacity to design and implement custom controls.

Manage all your compliance in one place

ISMS.online supports over 100 standards

and regulations, giving you a single

platform for all your compliance needs.

Access Control Monitoring and Auditing

Within the scope of PCI DSS 4.0, continuous monitoring and regular auditing of access control systems are not just recommendations; they are essential practices that ensure the ongoing security of cardholder data.

Continuous Monitoring of Access Control

Continuous monitoring is a proactive security measure that involves:

- Real-Time Alerts: Implementing systems that provide immediate notifications of unauthorised access attempts.

- Regular Reviews: Conducting daily analyses of access logs to detect any irregularities or patterns that may indicate a security breach.

Auditing Access Control Measures

When it comes to auditing your access control measures, best practices include:

- Comprehensive Audits: Regularly scheduled audits that review all aspects of access control, ensuring that policies are being followed and controls are effective.

- Documentation: Maintaining detailed records of audit trails and access logs to support compliance efforts and investigations.

The Role of Logging and Surveillance

Effective access control is bolstered by:

- Detailed Logging: Capturing and maintaining logs that record all access to systems containing cardholder data.

- Surveillance Systems: Utilising video surveillance to deter unauthorised physical access and to provide a record of activity around sensitive areas.

Tools and Strategies for Enhanced Monitoring and Auditing

To enhance your monitoring and auditing processes, consider:

- Security Information and Event Management (SIEM) Tools: These tools aggregate and analyse data from various sources to identify potential security incidents.

- Automated Scanning: Deploying automated vulnerability scanning tools to regularly assess the security of your systems.

Further Reading

Training and Resources for PCI DSS v4.0 Access Control

Understanding and implementing the access control requirements of PCI DSS v4.0 is a critical step in safeguarding cardholder data. To support this endeavour, a variety of training resources and educational opportunities are available.

Available Training Resources

For those seeking to deepen their understanding of PCI DSS v4.0 access control, the following resources are invaluable:

- Official PCI SSC Training: The PCI Security Standards Council offers comprehensive training programmes, including instructor-led courses and e-learning modules.

- Guidance Documents: Detailed documentation provided by the PCI SSC elucidates the access control requirements and offers practical guidance.

Staying Updated on Access Control Standards

Compliance officers can stay informed about the latest standards by:

- Subscribing to PCI SSC Communications: Regular updates, including newsletters and bulletins, provide the latest information on standards and best practices.

- Participating in Industry Forums: Engaging with peers in industry forums allows for the exchange of knowledge and experiences related to access control.

The Role of PCI SSC Community Meetings and Webcasts

PCI SSC community meetings and webcasts serve as platforms for:

- Direct Learning: These events offer direct insights from the council and industry experts on access control and other critical security topics.

- Networking: Attendees can network with peers, share challenges, and discuss solutions related to PCI DSS compliance.

Preparing for Access Control Audits and Assessments

As you approach the critical task of preparing for access control audits under PCI DSS v4.0, it’s essential to have a structured plan in place. This ensures that your organisation’s access controls are not only compliant but also effective in protecting cardholder data.

Conducting Effective Gap Analyses

To begin, conducting a gap analysis is a strategic move:

- Identify Current Controls: Map out your existing access control measures.

- Measure Against v4.0 Requirements: Compare your current state to the PCI DSS v4.0 standards to identify areas needing improvement.

Key Considerations for Vulnerability Scanning

Vulnerability scanning is a non-negotiable part of the preparation process:

- Regular Scans: Schedule regular scans to identify and address vulnerabilities promptly.

- Comprehensive Coverage: Ensure that scans cover all systems involved in cardholder data processing.

Risk Assessments: A Proactive Approach

Risk assessments are vital for proactive security management:

- Identify Threats: Recognise potential threats to your access control systems.

- Evaluate Impact: Assess the potential impact of identified risks on cardholder data security.

Streamlining the Audit Process with ISMS.online

At ISMS.online, we simplify the audit and assessment process by providing:

- Integrated Tools: Our platform offers integrated tools for gap analysis and risk assessment, making it easier to prepare for audits.

- Guided Support: We provide step-by-step guidance to ensure that your access control systems align with PCI DSS v4.0 requirements.

By leveraging our platform, you can approach your access control audits with confidence, knowing that you have the tools and support necessary for thorough preparation and compliance.

Addressing Non-Compliance and Mitigating Risks

Non-compliance with PCI DSS v4.0, particularly in terms of access control, can lead to severe consequences for organisations. Understanding these implications and proactively addressing compliance gaps is crucial.

Consequences of Non-Compliance

Should your organisation fail to comply with the access control requirements of PCI DSS v4.0, you may face:

- Penalties and Fines: Non-compliance can result in substantial fines from payment card brands and acquirers.

- Reputational Damage: A lapse in compliance can lead to a loss of consumer trust and potential damage to your brand’s reputation.

Proactive Measures to Address Non-Compliance

To avoid these consequences, it’s important to:

- Regular Compliance Reviews: Conduct periodic reviews of your access control measures to ensure ongoing compliance.

- Employee Training: Ensure that all staff members are educated on compliance requirements and their role in maintaining them.

Risk Mitigation Strategies

Effective risk mitigation strategies include:

- Implementing Strong Access Controls: Enforce robust authentication and authorization mechanisms.

- Continuous Monitoring: Utilise tools to monitor access to cardholder data environments in real-time.

ISMS.online: Bridging Compliance Gaps

At ISMS.online, we provide a comprehensive platform to help you identify and address compliance gaps:

- Gap Analysis Tools: Our platform offers tools to help you conduct thorough gap analyses of your access control systems.

- Expert Guidance: We provide expert guidance to navigate the complexities of PCI DSS v4.0 and ensure your access control measures are up to standard.

By partnering with us, you can take proactive steps to ensure compliance, mitigate risks, and protect your organisation from the consequences of non-compliance.

ISMS.online Offers Support for PCI DSS Compliance

Navigating the complexities of PCI DSS v4.0, especially the access control requirements, can be daunting. At ISMS.online, we understand the intricacies involved and are committed to providing tailored support to ensure your compliance journey is smooth and successful.

Expert Guidance on Access Control Complexities

Our team of experts is well-versed in the nuances of PCI DSS v4.0 and is ready to assist you in:

- Understanding New Requirements: We’ll help you comprehend the new access control mandates and how they apply to your organisation.

- Customising Your Approach: Our platform allows for a flexible adaptation of the PCI DSS v4.0 requirements to fit your unique business environment.

Enhancing Compliance Efforts with ISMS.online

Partnering with us enhances your compliance efforts by providing:

- Comprehensive Tools: Utilise our suite of tools designed for risk assessment, policy management, and compliance tracking.

- Streamlined Processes: Our platform simplifies the management of your compliance activities, making it easier to maintain and demonstrate compliance.

Choosing ISMS.online for Integrated Solutions

Selecting ISMS.online for your compliance needs offers you:

- A Unified Platform: Manage all aspects of your information security management system (ISMS) in one place.

- Alignment with Annex L: Our platform aligns with Annex L, ensuring a systematic approach to managing and protecting cardholder data.

For expert guidance and a comprehensive suite of tools to support your PCI DSS v4.0 compliance, especially in access control, reach out to us at ISMS.online. We're here to help you protect cardholder data and meet the stringent requirements of the standard.

Book a demo